Oil prices fall on bearish sentiment, defying fundamentals while natural gas gets technical boost

Oil, fundamental analysis

Global crude prices tumbled during the holiday-shortened trading week to the lowest levels this year as demand concerns remain. This, despite a large draw in inventories, the shut-in of half of Libya’s oil fields and, an announcement by OPEC+ that it will delay the planned Oct. 1st output increase for 2 additional months.

The high for WTI of $74.40/bbl was set on Tuesday while the low was Friday’s $67.83/bbl, a $6.57/bbl decline from 3 days earlier. The US grade has not been this low since the last week of 2023. Brent crude, which traded all week, fell in a similar fashion with $77.65/bbl as its high on Monday, followed by a precipitous decline on Tuesday leading to the week’s low of $71.35/bbl on Friday.

Both grades of oil look to settle much lower week-on-week. A key technical marker was breached on the low side, but prices have rebounded slightly back above that point. Since both WTI and Brent have moved in sync, the spread has stayed around the -$4.15/bbl area. Tuesday’s dramatic fall in prices was exacerbated by the high-frequency or, “algo-trading” as over 500,000 NYMEX October 2024 WTI futures contracts traded hands–the equivalent of 500 million bbl of oil trading on paper in 1 day for a single delivery month. (The NYMEX WTI delivery point is the Cushing, Okla., hub which, in total, has capacity to hold 76 million bbl in storage, with some of that capacity reserved for blending different grades.)

Talks are under way to resolve political disagreements in Libya that could restore output to normal levels. Meanwhile, ceasefire talks between Israel and Hamas move forward at a snail’s pace, but the ongoing conflict had no impact on oil prices this week.

Another bearish signal came in the form of lower wholesale gasoline prices. NYMEX RBOB futures for October 2024 slipped to levels not seen since October 2021, further crushing crack spreads. Asian refiners have been steadily decreasing runs since May as a result, while China’s product output for July was the lowest level since October 2022. China’s sliding demand for crude has been a major concern for the oil markets as it is down 2% year-to-date. The popularity of EVs in China has led some analysts to predict a peak in gasoline demand in 5 years.

The Energy Information Administration’s Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week decreased by more than expected. Crude production remains at 13.3 million b/d while demand for gasoline slipped post-Labor Day weekend.

The much-anticipated August jobs report indicated 142,000 jobs were added last month while unemployment fell to 4.2%. Both numbers were better than July’s report, however, revised numbers for June and July were lower than first reported, bringing the 3-month average gains down and causing concerns over a possible downward revision for the August numbers next month. All three major US stock indexes are lower week-on-week as a result. The USD is also lower which would normally be supportive of oil prices.

Oil, technical analysis

October 2024 WTI NYMEX futures prices are trading below the 8-, 13- and 21-day moving averages (MA) while the 200-day MA is out of reach. Daily lows have been touching on and below the Lower Bollinger Band which represents 2-Standard Deviations away from the Mean.

Volume has fallen off from Tuesday’s 500,000+ level to less than 300,000. The Relative Strength Indicator (RSI) is 'oversold' at 37 mark. Thirty or below is considered very oversold while 70 or above is considered very overbought. Resistance is now pegged at $70.15 with near-term support at $67.85, the week’s low.

Oil, looking ahead

The tropics has awakened as the National Hurricane Center is now tracking five systems. High pressure fronts moving down from the Rocky Mountains and Canada could steer the systems away from the Gulf of Mexico.

Markets are once again in the 'too far, too fast' price decline area. Along with technical signals, look for buying to increase next week. On the other hand, Labor Day is behind us, and we have seen a decline in gasoline demand. Distillate inventories still bear monitoring. Markets will now await a Fed announcement regarding an interest rate cut which will spur equities and energy prices.

Natural gas, fundamental analysis

Natural gas prices remained north of $2.00/MMbtu this week on a lower-than-forecasted storage injection and on a technical rebound. The week’s high was $2.95/MMbtu on Friday while the low was Tuesday’s $2.075. Supply last week was 108.1 bcfd vs. 108.8 the prior week. Demand was 98.9 bcfd, down from 101.2 bcfd the week prior with lower power demand.

Exports to Mexico were 6.9 bcfd vs. 6.7 the prior week. LNG exports were 13.1 bcfd. vs. 12.7 the prior week. Freeport LNG has been increasing output since its prolonged outage this past year.

The latest European natural gas prices were quoted at $10.75/MMbtu. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 13 bcf vs. a forecast of 29 bcf and the 5-year average of an additional 51 bcf. Total gas in storage is now 3.347 tcf, 6.6% above last year and 10.7% above the 5-year average.

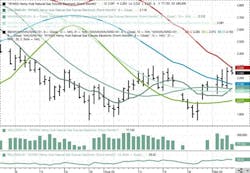

Natural gas, technical analysis

October 2024 NYMEX Henry Hub Natural Gas futures are now trading above the 8-, 13- and 21-day moving averages and have pierced the Upper-Bollinger Band level, a pending sell signal. Volume is below average at about 100,000. The RSI is neutral at 56. Support is pegged at $2.09 with resistance at $2.30.

Natural gas, looking ahead

The Matterhorn natural gas pipeline started moving small amounts of gas out of the heavily-congested Permian basin. As those volumes increase, price differentials for West Texas/SE New Mexico should improve. They have been trading negative for a while now.

The tropics bear watching for the natural gas market as well. This week’s buying was largely technical along with reports of shut-ins which have yet to be quantified. Fall is upon us and temperatures will moderate, lowering demand until cold waves move in. The storage overhang is key as there’s expectation that will grow in the coming weeks. With 8 weeks of the injection period remaining, it would only take an average of 81 bcf/week to hit the rarely seen target of 4.0 tcf at season’s end.

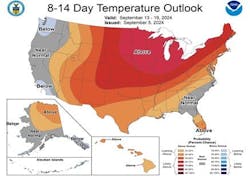

The NOAA 8–14-day outlook indicates above-normal temperatures for the northern 1/3 of the central US with normal to below-normal temperatures elsewhere.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.