WoodMac: Iraq aims to ramp up oil, gas output

Iraq’s upstream sector is undergoing rapid change, characterized by a growingly diverse corporate ecosystem and substantial investment directed towards boosting oil and gas production, but critical infrastructure challenges and the lack of exploration activity remain hurdles, according to a Wood Mackenzie report.

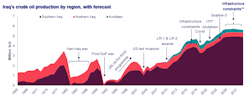

By 2030, Iraq’s gas output could more than double to 4.4 bcfd, while oil output could hit 5.5 million b/d, Wood Mackenzie said.

That potential growth stems largely from oil fields in the south, such as Rumaila, West Qurna, Zubair, and Majnoon, the report indicated, but many challenges remain.

“Operators must overcome several roadblocks right now if production is to be increased, most notably with infrastructure, as export pipelines and terminals, and water injection capacity is currently insufficient,” said Araman. “There are also fiscal issues, as creating value from barrels is difficult.”

The harsh fiscal terms have discouraged both foreign investment and exploration activity. Despite more than 150 billion bbl of oil resources, only five exploration wells have been drilled in Federal Iraq since 2013, Wood Mackenzie said.

However, recent licensing rounds in 2024 showed considerable interest from Chinese firms, demonstrating the growing interest from Asian-based investors. This also highlights how Iraq’s corporate ecosystem has evolved and expanded over time, as more players from more diverse geographies, but Asia in particular, have been attracted to Iraqi upstream opportunities. However, more of this attention has been to discovered resources than exploration potential.

“Iraq’s fiscal terms are still among the least competitive in the Middle East and much more has to be done to increase exploration interest,” said Araman. “If that is addressed, it is likely we will see more activity from Asian players as the corporate landscape in Iraq is shifting from West to East. With improvements in fiscal terms and critical infrastructure, there should be a window of opportunity for more M&A activity and future production growth.”

Continued Araman, “The country’s ambitious target of doubling gas production, eliminating flaring and ending import reliance is backed by 100 tcf of resources and political will, which also presents new investment opportunities. Due to the nature of the fiscal terms, these gas opportunities are in some cases more commercially attractive than developing oil. As such, we now see some of the major players turning more of their attention to gas-focused opportunities.”