EIA: Global public company proved reserves mostly stable in 2023

Global proved crude oil and natural gas reserves of 175 publicly traded exploration and production (E&P) companies rose by 2 billion boe in 2023, or about 1%, according to analysis from the US Energy Information Administration (EIA).

According to EIA estimates, the 175 companies included in this analysis accounted for about half of the petroleum production by non-OPEC sources in 2023. While many of these companies have global operations, some are state-affiliated national oil companies with reserves and operations concentrated in their home countries, including Mexico, China, and Brazil. The top 20 companies accounted for 67% of the 237 billion boe in proved oil and natural gas reserves held at end-2023.

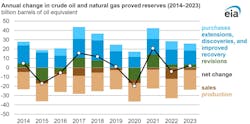

The companies added 14.9 billion boe from improved recovery, extensions, and discoveries. They also added 7.6 billion boe via purchases of proved reserves and 3.4 billion boe from upward revisions. Combined, these increases were enough to cover decreases from property sales and the 21.2 billion boe used for production. Sales of 2.5 billion boe in 2023 were about 50% less than the 10-year (2013–22) average and well below increased sales in 2022 caused by some companies divesting from assets in Russia.

Costs for reserves additions

Costs incurred for organic proved reserve additions in 2023 increased 15% in real terms year over year because of higher development costs, according to EIA. EIA defines costs incurred for organic proved reserve additions to be exploration costs, development costs, and unproved reserve acquisitions.

Broken down regionally, 38% of costs incurred for organic proved reserve additions were spent by the companies on operations in the US; 20% in the Asia Pacific, Russia, and Central Asia region; 15% in Latin America; and 10% in Canada.

Year-over-year changes in costs incurred varied across regions, increasing around 20% in the US and Latin America and increasing around 10% in Canada. Costs incurred remained flat in the Asia Pacific, Russia, and Central Asia region. Overall, costs incurred in developing assets accounted for nearly 90% of the total increase in these companies’ exploration and development costs incurred to add proved reserves.

Purchases of unproved reserves, which are included in exploration and development spending, made by the companies were over 60% below the 10-year (2013–22) average, which helped to offset higher development costs.

Despite increased spending in 2023, organic proved reserve additions by these companies declined 8% compared with 2022, indicating an increase in the cost per barrel.

Finding cost

EIA defines the cost incurred for each additional boe of organic proved reserves as the finding cost. According to EIA, the 2023 world weighted average shows finding costs for these companies increased 24% in real terms from 2022 to $20.06/boe. Despite the increase, finding costs remained less than the 2014–22 average of $22.50/boe and 45% less than the finding costs of 2014.

To examine regional finding costs, EIA averaged results from these companies over 3 years because the timing of expenditures and the formal reporting of changes to proved reserves can differ.

From 2021 to 2023, compared with 2018 to 2020 and 2015 to 2017, 3-year average real finding costs decreased in the US, Canada, the Asia Pacific, Russia, and Central Asia region. These regions also have the lowest finding costs per barrel compared with Latin America, the Middle East, Africa, and Europe.

Finding costs in Latin America increased on average compared with the 2018–20 average but remained lower in real terms than the 2015–17 average. Average finding costs for operations in Europe, the Middle East, and Africa increased markedly, although these regions only account for a small share of the proved reserve additions by these companies. In the Middle East, many assets are held by state-owned companies and are not included in this analysis, EIA said.