OGJ50 firms report lower net income in 2023 on falling commodity prices

The OGJ150 report has long served as a comprehensive benchmark for evaluating the performance of the largest US-based oil and gas companies. Initially covering 150 companies, this report provided valuable insights into the financial, production, and reserves metrics of a broad spectrum of firms.

Over the years, however, the US oil and gas sector has experienced substantial transformations due to mergers and acquisitions (M&A), leading to consolidation of the companies.

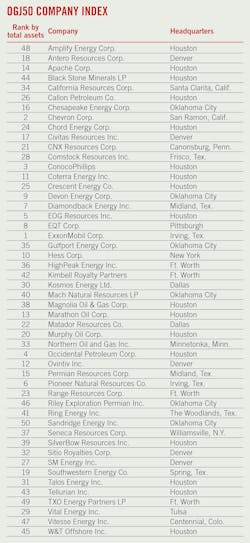

In response to this dramatic reduction in the number of oil and gas companies, the OGJ150 report has evolved into the current OGJ50 report. This change reflects the new reality of the industry, where the top 50 companies dominate the landscape in terms of assets and market influence. The OGJ50 report continues to provide critical insights into the industry’s metrics but with a sharper focus on the most significant firms that shape the market.

As before, to qualify for the OGJ50, oil and gas producers must be US headquartered, publicly traded and hold oil or gas reserves in the US. Companies appearing on the list are ranked by total yearend assets but are also ranked by revenues, earnings, capital expenditures, production, reserves, and US net wells drilled.

As usual, the data for this year’s list reflects the operations of the previous year.

Market snapshots

In 2023, US-based oil and gas producers in the OGJ50 group demonstrated robust yet reduced earnings, mirroring the downward trend in commodity prices throughout the year.

Crude oil prices were lower through 2023 as rising non-OPEC+ supplies and Russia’s ability to redirect crude oil to destinations outside the EU more than offset OPEC+ crude oil supply curbs.

Brent crude oil prices averaged around $83/bbl in 2023, lower than the $101/bbl in 2022, reflecting market normalization after significant volatility. West Texas Intermediate (WTI) averaged $78/bbl, a 17.8% decrease from the previous year.

In 2022, natural gas prices surged due to supply disruptions and high demand as European countries sought alternatives to Russian gas. Henry Hub natural gas spot prices averaged about $6.4/MMbtu in 2022.

In 2023, weaker natural gas demand and high inventories put downward pressure on gas prices in major markets, while the prices remained elevated historically with strong volatility. The average Title Transfer Facility (TTF) spot prices in Europe were $13.15/MMbtu for 2023, a 62% year-on-year decline. The LNG Japan/Korea Marker (JKM) averaged $14/MMbtu, marking a 48% drop from the previous year. Henry Hub gas prices in the US demonstrated relatively stable trends throughout 2023, ranging from $1.77/MMbtu to $3.77/MMbtu with an annual average of $2.54/MMbtu.

Gross refining margins, though lower than the highs of 2022, saw support. European middle distillate shortages due to sanctions on Russian oil products led to high crack spreads. Chinese oil demand growth was limited by an economic slowdown. Low product stocks in the Atlantic basin led to product flows from Asia. Newly operational refineries such as Kuwait’s Al Zour, ExxonMobil’s Beaumont expansion, and Oman’s Duqm contributed to increased product supply, maintaining margins below 2022 levels.

Mergers, acquisitions

During 2023, US oil and gas companies ramped up expenditures on M&A to $234 billion, the highest level since 2012, as reported by the US Energy Information Administration (EIA). This resurgence in dealmaking signals a revival of the consolidation trend within the US oil and gas sector after transactions declined amid significant market volatility between 2020 and 2022.

In October 2023, ExxonMobil Corp. announced the acquisition of Pioneer Natural Resources for about $60 billion. The transaction was completed in May 2024. Chevron Corp. also announced in October 2023 that it would acquire Hess Corp. in an all-stock transaction valued at $53 billion. These two deals are the largest by value in real terms since Occidental Petroleum Corp. acquired Anadarko Petroleum Corp. for a total acquisition cost of $55 billion in 2019.

In addition, ExxonMobil completed the acquisition of Denbury Inc. in November 2023, for a total acquisition cost of $4.9 billion. The deal provided ExxonMobil with the largest CO2 pipeline network in the US and 10 onshore sequestration sites used for carbon capture and storage (CCS).

Chevron also completed the acquisition of PDC Energy Inc. in August 2023, for a total cost of $7.6 billion.

In December 2023, Occidental Petroleum Corp. announced its acquisition of CrownRock LP for an estimated $12 billion to strengthen its US onshore portfolio, with premier Permian basin assets. The deal could close by August 2024.

APA Corp. acquired Callon Petroleum for a total acquisition cost of $4.5 billion and the deal was closed in April 2024. The acquisition brought APA’s reported production to around 500,000 boe/d.

The consolidation trend has continued in 2024. In January 2024, Chesapeake Energy Corp. and Southwestern Energy Co. announced that they had entered into an agreement to merge in an all-stock transaction valued at $7.4 billion. Upon completion, the merged company, which will assume a new name, could become the largest natural gas producer in the US.

In February 2024, Diamondback Energy announced its purchase of the largest privately held Permian basin oil and gas producer, Endeavor Energy Partners, in a cash-and-stock deal valued at about $26 billion. The deal is expected to close fourth-quarter 2024.

In May 2024, ConocoPhillips announced the acquisition of Marathon Oil in an all-stock transaction for $22.5 billion to expand its operations in the US. ConocoPhillips expects to complete the deal in fourth-quarter 2024.

Group financial performance

The 2023 financial performance of the OGJ50 group indicates an expansion in assets and higher capital expenditures, contrasted with declining revenues and earnings. Overall, however, the group’s financial performance for 2023 remains quite robust historically.

The combined assets of the top 50 companies increased by 5% to $1.26 trillion from $1.2 trillion in 2022. This growth was driven by acquisitions, investments in infrastructure, and improved valuations of existing assets.

ExxonMobil Corp. retained its position as the largest energy company by total assets, increasing from $369 billion at yearend 2022 to $376.3 billion at yearend 2023. Following ExxonMobil are Chevron Corp., ConocoPhillips, Occidental Petroleum Corp., and EOG Resources Inc.

Chevron held onto its second-place position, with a rise in total assets from $257.7 billion at the end of 2022 to $261.6 billion by the close of 2023, with the majority of this growth stemming from its US upstream assets.

ConocoPhillips maintained its third-place position, as total assets rose from $93.8 billion at yearend 2022 to $95.9 billion at yearend 2023, primarily driven by increases in Canada and Alaska, which surpassed a decline in its Asia-Pacific holding.

Notably, Ovintiv Inc. advanced two positions to twelfth place, as assets surged from $15.5 billion in 2022 to about $20 billion in 2023, driven by the increased value of its assets in the US, increasing to $13 billion in 2023 from $8.3 billion in 2022.

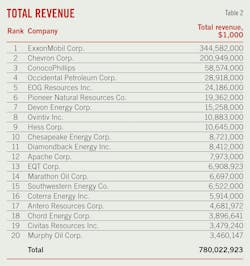

Due to lower commodity prices, the OGJ50 group’s collective revenues in 2023 were $821.6 billion, down 18.5% from a year ago. The group’s aggregate net income stood at $120.3 billion in 2023, a 38% decrease from the combined net income of $192.7 billion in 2022, also impacted by reduced commodity prices.

Capital and exploration expenditures of the group rose by 23.5%, from $94 billion in 2022 to $116.2 billion in 2023. This increase highlights the companies’ strategic focus on future growth, with substantial investments in exploration and capital projects to boost production capabilities and expand reserves.

Furthermore, 46 companies within the OGJ50 reported profits in 2023, with forty-two companies achieving net incomes surpassing $100 million.

The total stockholders’ equity of the group rose by 7.6% from the previous year, reaching $699.2 billion in 2023.

Group operations

The group’s worldwide liquids production increased by 8.56%, from 3,744 million bbl in 2022 to 4,064 million bbl in 2023. The group’s worldwide natural gas production saw a modest rise of 2.6%, from 19,020 bcf in 2022 to 19,512 bcf in 2023.

The OGJ50 group’s worldwide liquids (including crude oil, condensate, NGL, and other liquids) reserves grew by 2.8%, from 41,545 million bbl in 2022 to 42,710 million bbl in 2023. However, the group’s worldwide natural gas reserves decreased by 2.85%, from 225,919 bcf in 2022 to 219,478 bcf in 2023.

The group’s US liquids reserves increased by 3.7%, from 29,745 million bbl in 2022 to 30,842 million bbl in 2023. The group’s US natural gas reserves decreased by 2.78%, from 181,334 bcf in 2022 to 176,285 bcf in 2023.

Meantime, the group’s US liquids production increased by 10%, from 2,759 million bbl in 2022 to 3,039 million bbl in 2023. US natural gas production rose by 4%, from 14,682 bcf in 2022 to 15,284 bcf in 2023.

The group’s total US net wells drilled increased strongly by 17%, to 6,600 in 2023 from 5,639 in 2022.

Earnings leaders

ExxonMobil, Chevron, ConocoPhillips, EOG Resources, Pioneer Natural Resources, and Occidental Petroleum are at the forefront of earnings leaders. Yet their profits in 2023 all decreased compared with 2022, attributed to reduced realized natural gas and crude oil prices.

Despite a decline from $55.74 billion in 2022 to $36 billion in 2023, ExxonMobil retained its position as the top earner among the group. The company’s upstream earnings were $23.6 billion in 2023, down from $39.4 billion in 2022. The decrease in upstream earnings was mainly due to lower commodity realizations. Nevertheless, upstream earnings benefited from substantial volume growth in Guyana and the Permian basin, which more than offset the impacts from divestments, the Russia expropriation, and higher government-mandated curtailments. Energy Products earnings were down from $15.65 billion in 2022 to $12 billion in 2023 as industry refining margins declined from 2022 highs.

Chevron also experienced a drop in net income from $35.46 billion in 2022 to $21.37 billion in 2023. Chevron’s US and international upstream earnings declined $8.5 billion and $4.4 billion respectively, primarily driven by lower realizations. The company’s US net oil-equivalent production was up 168,000 b/d, or 14%, thanks to the acquisition of PDC Energy and expansion in the Permian basin. International net oil-equivalent production was down 47,000 b/d, or 3%, primarily due to normal field declines, shutdowns, and lower production following expiration of the Erawan concession in Thailand. US downstream earnings decreased by $1.5 billion primarily due to lower refining margins and higher operating expenses.

ConocoPhillips’ net income decreased from $18.68 billion in 2022 to $10.96 billion in 2023. Earnings were negatively impacted by lower realized commodity prices and higher operating expenses, mainly in the Lower 48 segment, as well as the absence of certain disposition gains and tax-benefits. The company’s total 2023 production was 1.83 MMboe/d, up 5% compared with 2022, primarily due to new wells coming online in the Lower 48, Australia, Canada, China, Norway, and Malaysia. After adjusting for closed acquisitions and dispositions, production increased by 4%.

Occidental Petroleum dropped from fourth to sixth in this year’s top earner list, with net income reduced from $12.5 billion in 2022 to $3.77 billion in 2023, mainly due to lower crude oil prices. Average daily production volumes from ongoing operations increased by 6% in 2023 as compared with 2022, primarily due to increased development activity in the Permian basin, and the completion of its expansion project in Algeria.

Chesapeake Energy dropped from eighth to tenth, with net income decreasing from $4.94 billion in 2022 to $2.42 billion in 2023, due to lower gas prices.

Leaders in capital spending, drilling

ExxonMobil continued to lead the group in capital and exploratory spending, with an expenditure of $26.3 billion in 2023, up from $22.7 billion in 2022. ExxonMobil’s upstream spending of $19.8 billion in 2023 was up 16% from 2022, reflecting higher spend in the Permian basin and on advantaged projects in Guyana. Capital investments in its Product Solutions businesses totaled $5.9 billion in 2023, up $0.3 billion from 2022, reflecting higher global project spending. Key investments in 2023 included the China petrochemical complex and Singapore resid upgrade project. Other expenditures were directed to investments in the Low Carbon Solutions business, which focused on carbon capture and storage, lithium, and hydrogen. The company anticipates total annual capital expenditures of $23-25 billion in 2024.

ConocoPhillips ranks third in terms of 2023 capital spending, with an expenditure of $11.25 billion in 2023, up from $10.16 billion in 2022. In 2023, capital expenditures were mainly directed towards its operations in Alaska concerning the Western North Slope and the Greater Kuparuk Area, as well as activities in the Lower 48 region, Canada, Norway, Malaysia, and China. Additionally, a significant portion of the capital was allocated to investments in Port Arthur LNG (PALNG), and North Field East(NFE) and North Field South(NFS) in the Persian Gulf. The 2024 operating plan capital is expected to total $11-11.5 billion.

In 2023, Occidental Petroleum raised its expenditures to $6.27 billion from $4.5 billion in 2022, whereas EOG Resources augmented its 2023 spending to $5.39 billion from $4.62 billion in the previous year. Devon Energy Corp. and Ovintiv Inc. similarly escalated their capital and exploratory expenditures in 2023.

Chevron emerged as the leader in 2023 in the number of US net wells drilled, drilling 701 net wells, a significant increase from its 2022 count of 456 wells. EOG Resources ranked second with 640 net wells drilled in 2023, up from 533 wells in 2022.

ConocoPhillips and Occidental Petroleum also demonstrated strong drilling activity. ConocoPhillips drilled 547 net wells in 2023, compared with 517 in 2022, while Occidental Petroleum drilled 496 wells in 2023, up from 274 wells in 2022.

ExxonMobil drilled 447 net wells in 2023, down slightly from 474 in 2022, while Pioneer Natural Resources drilled 438 wells, a slight increase from 434 in 2022.

Liquids reserves, production

ExxonMobil, Chevron, and ConocoPhillips top the OGJ50 group in terms of worldwide liquids reserves. EOG Resources and Occidental Petroleum are ranked fourth and fifth.

In 2023, ExxonMobil maintained its position at the top with global liquids reserves totaling 10,056 million bbl, down from 10,234 million bbl in 2022. Extensions and discoveries, primarily in the US and Guyana, resulted in the addition of about 732 million bbl of proved undeveloped liquids reserves for the company, which partly offset declines in reverses from production and downward revisions.

Chevron follows with 4,908 million bbl at yearend 2023, a modest increase from 4,870 million bbl in the previous year. In 2023, extensions and discoveries were primarily due to planned development of new locations in shale and tight assets in Midland and Delaware basins, Denver-Julesburg (DJ) basin, deepwater assets in the Gulf of Mexico, and other Americas. The acquisition of PDC also contributed to increased reserves. The increases were partly offset by some downward revisions.

ConocoPhillips ranked third, with reserves rising to 3,924 million bbl at yearend 2023 from 3,820 million bbl at yearend 2022. In 2023, the company noted upward revisions of 126 million bbl in the Lower 48 region resulting from development drilling and technical revisions. Additionally, there was a 10-million bbl upward revision in Africa, predominantly stemming from development drilling activities in Libya.

Occidental Petroleum increased its reserves from 2,759 million bbl in 2022 to 2,923 million bbl in 2023. Diamondback Energy also experienced substantial growth with reserves, growing to 1,678 million bbl in 2023 from 1,555 million bbl in 2022.

With 784 million bbl of output, ExxonMobil produced the most liquids worldwide during 2023, up from 739 million bbl a year ago. The US and other Americas accounted for the largest portion of the growth. ExxonMobil is followed by Chevron, ConocoPhillips, and Occidental Petroleum.

Chevron’s global liquids production increased from 520 million bbl in 2022 to 558 million bbl in 2023. Liquids production in the US increased to 997,000 b/d in 2023 from 888,000 b/d in 2022, due to the acquisition of PDC and growth in the Permian basin.

ConocoPhillips also saw a significant rise in global liquids production, reaching 429 million bbl in 2023 from 408 million bbl in 2022, primarily due to new wells online in the Lower 48, Australia, Canada, China, Norway, and Malaysia.

ConocoPhillips’ liquids reserve in the US reached 3.4 billion bbl at the end of 2023, topping the group and followed by EOG Resources, Chevron, Occidental Petroleum, and ExxonMobil.

With 364 million bbl of output, Chevron produced the most liquids in the US during 2023, up from 324 million bbl in 2023. Chevron is followed by ConocoPhillips, Occidental Petroleum, EOG Resources, and ExxonMobil in this category.

Global gas reserves, production

Among the OGJ50 group, the company with the most worldwide gas reserves in 2023 is Chevron, followed by EQT, ExxonMobil, Southwestern Energy, and Range Resources.

Chevron retained its position as the top holder of global gas reserves in 2023, despite a slight decrease from 28,765 bcf in 2022 to 28,318 bcf.

EQT demonstrated significant growth in worldwide natural gas reserves, increasing from 23,824 bcf in 2022 to 25,795 bcf in 2023, due to extensions, discoveries, and other development additions of 3,412 bcf and acquisitions of 2,600 bcf from the Tug Hill and XcL Midstream, partly offset by production of 2,016 bcf and revisions to previous estimates of 1,402 bcf.

ExxonMobil’s global gas reserves stood at 21,962 bcf at yearend 2023, a decline from 24,147 bcf in 2022. The decrease was mainly due to production of 2,024 bcf, downward revisions of 1,738 bcf and sales. Meantime, extensions and discoveries in the US added proved gas reserves of 1,997 bcf.

Chevron maintained its position as the top global gas producer of the group in 2023, with gas production increasing slightly to 2,607 bcf from 2,578 bcf in 2022. Following Chevron in worldwide gas production are ExxonMobil, EQT, Southwestern Energy, and Chesapeake Energy.

ExxonMobil posted worldwide gas production of 2,024 bcf in 2023, slightly down from 2,151 bcf in 2022. Chesapeake Energy also saw a minor decline in gas production, from 1,308 bcf in 2022 to 1,266 bcf in 2023. ConocoPhillips maintained stable gas production levels at around 830 bcf in both 2023 and 2022.

EQT leads the group in US gas reserves at 25,795 bcf. EQT is followed by Southwestern Energy, ExxonMobil, Range Resources, and Antero Resources.

Chesapeake Energy’s gas reserves declined to 9,688 bcf at yearend 2023 from 11,369 bcf at yearend 2022, reflecting production and downward revisions due to lower natural gas prices.

EQT produced 1,907 bcf of natural gas in the US in 2023, followed by Southwestern Energy at 1,438 bcf, and Chesapeake Energy at 1,266 bcf.

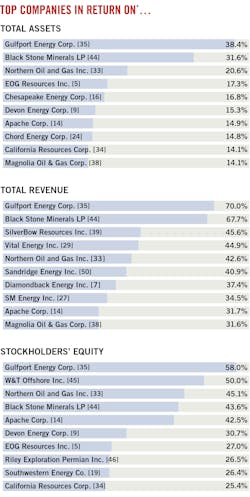

Fast-growing companies

The ranking for the OGJ50 list of the fastest growing companies is based on growth in stockholders’ equity. Other qualifications are that companies are required to have positive net income for 2023 and 2022 and have an increase in net income in 2023. Subsidiary companies, newly public companies, and limited partnerships are not included.

Northern Oil and Gas Inc. experienced a dramatic increase in stockholders’ equity, growing by 174.8% from $745.3 million in 2022 to $2.05 billion in 2023. The company also reported a net income increase of 19.4%, from $773.2 million in 2022 to $923 million in 2023. The company realized a $259 million gain on commodity derivatives, and its annual production surged by 31% compared with 2022.

Gulfport Energy Corp. also demonstrated significant growth in stockholders’ equity, which increased by 160.8% from $828.8 million in 2022 to $2.16 billion in 2023. Gulfport Energy’s net income saw an even more remarkable increase of 203.7%, soaring from $412.9 million in 2022 to $1.25 billion in 2023. Meantime, Gulfport Energy managed to slightly reduce its long-term debt from $694.2 million in 2022 to $667.4 million in 2023. To manage exposure to price volatility, the company entered into natural gas, oil, and NGL price derivative contracts. The company also achieved significant operational efficiencies, with average drilling footage per day and completion hours pumped per day improving by 60% and 30% year-over-year, respectively.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.