Rystad: Southeast Asia's offshore gas boom to hit $100 billion by 2028

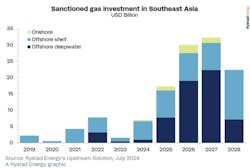

Offshore natural gas production in Southeast Asia is poised to unlock $100 billion of potential, thanks to a wave of planned final investment decisions (FIDs) expected to materialize by 2028, according to Rystad Energy’s latest analysis. This marks a significant increase from the $45-billion worth of projects that reached FID between 2014 and 2023 and signals a surge for the region’s offshore gas industry.

The imminent phase of rapid growth is supported by deepwater projects, recent successful discoveries in Indonesia and Malaysia, and advancements in carbon capture and storage (CCS). These factors will be essential for meeting the region’s sanctioning agenda in the coming years.

“Oil and gas majors are expected to drive 25% of these planned investments through 2028, while national oil companies (NOCs) will account for a 31% share. Notably, East Asia's upstream companies are emerging with a 15% share and show potential for growth through their focus on mergers and acquisition (M&A) opportunities and upcoming exploration ventures. The role of majors could further expand to 27% following TotalEnergies' substantial acquisition efforts in Malaysia,” said Prateek Pandey, Vice President of upstream research at Rystad Energy.

“Discussions among Southeast Asian countries have focused on the future of domestic developments and limiting their dependence on gas imports. Energy security and the transition to gas as a fuel have become growing concerns for governments in the region. To address the energy trilemma— balancing energy security, energy equity, and environmental sustainability—countries can prioritize utilizing domestic resources for gas development while crafting policies and incentives that promote sustainable practices and enhance regional energy security,” said Pandey.

CCS hubs

Despite the region’s promising future for offshore gas development, persistent project delays remain a concern. Deepwater and sour-gas economics, infrastructure readiness, and regional politics have caused widespread delays, some of which have been in place for more than 20 years.

The emergence of CCS hubs in Malaysia and Indonesia, however, could be a game-changer, according to Rystad Energy. The high carbon dioxide (CO2) content in upcoming offshore projects necessitates CCS for financing and regulatory compliance. Furthermore, both countries are exploring depleted reservoirs from mature fields as potential CO2 storage sites. The growing recognition of these reservoirs' potential, combined with the pressing need for emissions reductions, is significantly boosting demand for CO2 storage and fueling a surge in offshore gas development expected from 2025 onwards.

Major projects

“We recognize the potential of new project investments and capital commitments in the region, which surged from $9.5 billion in 2022-23 to approximately $30 billion in 2024-25. As we delve deeper into the data, it becomes increasingly clear that this upward trajectory is projected to continue until 2028. Recent discoveries and the involvement of NOCs will play a vital role in this growth, particularly in deepwater developments, which are pivotal in determining how much of this anticipated $100 billion boom can be realized,” said Pandey.

In forecasts for sanctioned investments between two leading nations in the region, Indonesia and Malaysia, the former stands out with expectations to accelerate its offshore gas activities. This acceleration is driven by major projects such as the Inpex-operated Abadi LNG, Eni’s Indonesia Deepwater Development (IDD), and bp’s Tangguh Ubadari Carbon Capture (UCC). These initiatives, along with recent discoveries in East Kalimantan and Andaman provinces, are projected to account for 75% of Indonesia's total offshore gas investments slated for FID. This significant increase positions Indonesia as a formidable contender to Malaysia's established dominance, although Malaysia continues to maintain robust activity levels with recent FIDs, exploration successes, and planned exploration efforts.

Indonesia anticipates increased FID activity starting in 2025, bolstered by major projects spearheaded by global players like bp and Eni. Malaysia's upcoming FID projects underscore significant discoveries made since 2020, primarily managed by Petronas, PTTEP, and Shell, Rystad said. Across Southeast Asia, more than half of planned gas projects contain CO2 content exceeding 5% and are predominantly managed by NOCs and major international companies, with a notable trend towards cluster-development strategies for deepwater projects.

Economic difficulties

Southeast Asia's gas sector is poised for significant growth, with gas resources from FIDs expected to reach 58 tcf by 2028, a three-fold increase from the levels seen in the past 5 years, 2019-24, according to Rystad. This growth depends on effectively monetizing recent discoveries and progressing delayed developments. Despite a favorable investment climate, operators face economic difficulties, especially in deepwater and sour-gas ventures.

Rystad Energy’s analysis indicates that many projects require gas prices above historical averages of $4/Mcf to achieve profitability, with an optimal threshold closer to $6/Mcf.

These economic realities have sparked discussions on revising domestic gas pricing policies across the region. Notably, a gas price of $7.5/Mcf could potentially make up to 95% of planned developments economically viable, especially those associated with LNG projects in Indonesia and domestic supply initiatives in Vietnam. Supply-chain companies could also see increased value for floater-based projects and deepwater drilling, adding motivation for them to facilitate the offshore gas renaissance that is on the cards for the region, according to Rystad Energy.