EIA: Brent crude prices to stay near $90/bbl to end-2024

The US Energy Information Administration (EIA) expects that voluntary OPEC+ crude oil production cuts and ongoing geopolitical risks will maintain Brent crude oil prices near $90/bbl for the remainder of 2024 before falling to an average of $85/bbl in 2025 as global oil production growth picks up. EIA noted the forecast in its May Short-Term Energy Outlook (STEO).

“The spot price of Brent crude oil averaged $90/bbl in April, up $5/bbl from March and the fourth consecutive monthly increase. However, daily crude oil spot prices have since fallen, and the Brent spot price settled at $84/bbl on May 2. Prices increased in April due to falling global oil inventories. Geopolitical tensions also supported crude oil prices amid conflict between Iran and Israel, which added uncertainty to already heightened tensions in the Middle East,” EIA said.

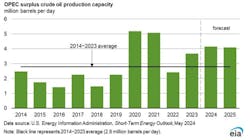

However, EIA noted: “Despite these tensions, crude oil price volatility has been subdued for much of this year by significant spare crude oil production capacity. If holders of spare production capacity choose to deploy it, supply can be available to the oil market in the event of any short-term supply disruption. We estimate OPEC spare production capacity will be around 4 million b/d through 2025.”

EIA assesses that voluntary OPEC+ production cuts are reducing global oil inventories in first-half 2024. “We estimate that global oil inventories are decreasing by an average of 300,000 b/d in first-half 2024. We anticipate some OPEC+ producers will continue to limit production after current voluntary OPEC+ cuts expire at the end of June. Our expectation of ongoing production restraint leads to our forecast of a relatively balanced oil market in second-half 24, which we expect will keep oil prices near $90/bbl for the remainder of 2024, before stronger supply growth contributes to global oil inventory builds of 400,000 b/d in 2025, causing prices to fall to an average of $85/bbl next year. However, there remains significant uncertainty centered around ongoing developments in the Middle East, which have the potential to increase oil price volatility and lead to sharp increases in oil prices.”

Beginning with this month’s STEO, EIA will include new streamlined global oil data tables. These tables provide a more complete breakout of OPEC+ production data and provide a new breakout of world crude oil production that is separate from other liquid fuels production. EIA also includes liquid fuels and crude oil production breakouts for OPEC+ members.

“Given the large role OPEC+ plays in global oil markets, this new layout will allow stakeholders to more easily find relevant OPEC+ production data in our tables while also accurately summarizing the role that the OPEC+ agreement plays in our STEO forecast,” EIA said.

EIA expects that global production of petroleum and other liquid fuels will increase by 1 million b/d in 2024, slowing from growth of 1.8 million b/d in 2023. Although OPEC+ liquid fuels production decreases by 800,000 b/d in 2024, production outside of OPEC+ increases by 1.8 million b/d, led by growth in the US, Canada, Brazil, and Guyana.

In Canada, EIA expects the startup of the Trans Mountain pipeline expansion (TMX) on May 1 will alleviate existing distribution bottlenecks and allow for gradual increases in crude oil production. EIA forecast liquid fuels production will increase in Canada by 500,000 b/d over the forecast period, which is more than 200,000 b/d above the forecast in last month’s STEO prior to the announcement of the pipeline’s startup. Global liquid fuels production is expected to increase by 1.9 million b/d in 2025 as the OPEC+ production cuts expire and production outside of OPEC+ continues to grow.

Meantime, EIA forecasts that retail gasoline prices across the US will average near $3.70/gal from April through September, which is similar to prices during the same period last year. Refinery operations are a source of uncertainty for gasoline markets this summer.

US dry natural gas production is forecasted to fall by 2% from first-quarter 2024 to second-quarter 2024 as a result of low natural gas prices. EIA expects 1% less natural gas will be produced in the US in 2024 than last year before production increases by 2% in 2025 to a record of almost 105 bcfd.