IEA trims oil demand prediction due to OECD demand weakness

Global oil demand expansion is slowing, with first-quarter 2024 growth at 1.6 million b/d, 120,000 b/d lower than the International Energy Agency (IEA)’s earlier prediction, mainly because of exceptionally weak OECD deliveries, the agency said in its April issue Oil Market Report (OMR).

“Delivery data for many countries came in on the soft side, as unusually warm late-winter weather curtailed OECD heating fuel use by more than normal. Additionally, the protracted factory slump in advanced economies continued to depress demand for industrial fuels. Further, gasoil and naphtha undershot forecast levels for major non-OECD countries – indicating that the recent uptick in global manufacturing PMIs has yet to manifest itself in oil consumption,” IEA said.

As the post-COVID-19 recovery nears completion and factors like increased vehicle efficiency and a growing electric vehicle (EV) fleet continue to impact oil demand negatively, IEA expects oil demand growth to decrease to 1.2 million b/d in 2024 and further down to 1.1 million b/d in 2025. Non-OECD countries dominate the outlook overall in both 2024 and 2025. Non-OECD oil demand will rise by 1.3 million b/d in 2024 and by 1.2 million b/d in 2025, reaching a record 58.7 million b/d. OECD use will decline by 60,000 b/d in both years.

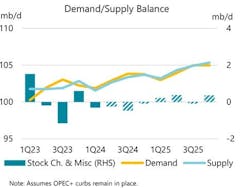

Non-OPEC+, led by the US, is expected to drive global supply growth through 2025. For 2024, worldwide output is projected to increase by 770,000 b/d to 102.9 million b/d. Non-OPEC+ production is set to grow by 1.6 million b/d, while OPEC+ supply could fall 820,000 b/d if voluntary cuts remain in place. In 2025, global growth could rise to 1.6 million b/d. Non-OPEC+ is forecast to lead gains, rising 1.4 million b/d, while OPEC+ output could increase by 220,000 b/d if curbs stay in place.

“In a continuation of last year’s trend, the majority of non-OPEC+ gains are coming from new conventional projects, with US light tight oil (LTO) expected to provide only 20% of the 1.4 million b/d of growth in 2025, down from 25% this year and 40% in 2023. From the start of 2023 through December 2025, selected new non-OPEC+ conventional projects will add just over 3 million b/d in new output. Brazil is the largest source of additional conventional supply, followed by Guyana, the US Gulf of Mexico, Norway, and China,” IEA said.

Global refinery throughputs are forecast to rise by 1 million b/d to 83.3 million b/d in 2024--160,000 b/d less than in last month’s report—on lower Russian runs, unplanned outages in Europe, and still-tepid Chinese activity. Throughputs are projected to increase by 830,000 b/d to 84.2 million b/d in 2025, as non-OECD growth of 1.1 million b/d more than offsets declines in the OECD.

Global observed oil inventories rose by 43.3 million bbl in February to a 7-month apex with oil on water at its highest level in 15 months. By contrast, on land stocks fell to their lowest levels since at least 2016. OECD industry stocks decreased by 7.6 million bbl in February, remaining 65.1 million bbl below the 5-year average. Early data indicate that they increased by 22 million bbl in March.

ICE Brent crude futures hit a 6-month high of $90/bbl in early April amid escalating tensions in the Middle East, attacks on Russian refineries, and an extension of OPEC+ outputs cuts through June. Crude’s price strength was underpinned by bullish investor sentiment, with exchange net fund positions in Brent rising to their highest levels in a year, according to IEA.