AEO2015: US on track to eliminate net energy imports by 2030

Continued growth in oil and natural gas production, growth in the use of renewables, and the application of demand-side efficiencies show the potential to eliminate net US energy imports in the 2020 to 2030 timeframe, according to projections in the Annual Energy Outlook 2015 (AEO2015), released by the US Energy Information Administration. The US has been a net importer of energy since the 1950s.

AEO2015 presents updated projections for US energy markets through 2040. “The projections provide a basis for examination and discussion of energy market trends and serve as a starting point for analysis of potential changes in US energy policies, rules, and regulations, as well as the potential role of advanced technologies,” EIA said.

EIA’s projections in the outlook are based on six cases (reference, low and high economic growth, low and high oil price, and high oil and gas resource) that reflect updated scenarios for future crude oil prices.

In AEO2015’s reference case, the price of global marker Brent crude oil is $56/bbl (in 2013 dollars) in 2015. Prices rise steadily after 2015 in response to growth in demand; however, downward price pressure from rising US crude oil production keeps the Brent price below $80/bbl through 2020.

US crude oil production starts to decline after 2020, but increased output from non-member nations of the Organization for Economic Cooperation and Development as well as Organization of Petroleum Exporting Countries producers helps to keep the Brent price below $100/bbl through most of the next decade and limits price increases through 2040, when Brent reaches roughly $140/bbl.

There is significant variation in the alternative cases. In the low oil price case, the Brent price is $52/bbl in 2015 and reaches $76/bbl in 2040. In the high oil price case, the Brent price reaches $252/bbl in 2040. In the high oil and gas resource case, with significantly more US production than in the reference case, Brent is under $130/bbl in 2040, more than $10/bbl below its reference case price.

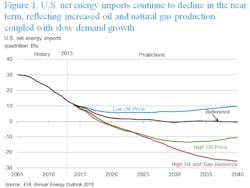

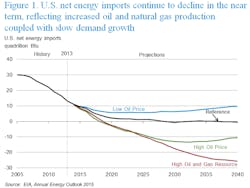

Net energy imports

US net energy imports decline and ultimately end in most AEO2015 cases, driven by a rise in US energy production—led by crude oil and natural gas—increased use of renewables, and only modest growth in demand.

US energy use rises 0.3%/year from 2013 through 2040 in the reference case, far below the rates of economic growth (2.4%/year) and population growth (0.7%/year). Decreases in transportation and residential sector energy consumption partially offset growth in other sectors. Declines in energy use reflect the use of more energy-efficient technologies as well as the effect of existing policies that promote increased energy efficiency. Fuel economy standards and changing driver behavior keep motor gasoline consumption below recent levels through 2040 in the reference case.

Growth in US energy production—led by crude oil and natural gas—and only modest growth in demand reduces US reliance on imported energy supplies. Energy imports and exports come into balance in the US starting in 2028 in the AEO2015 reference case and in 2019 in the high oil price and high oil and gas resource cases.

Natural gas is the dominant US energy export, while liquid fuels continue to be imported.

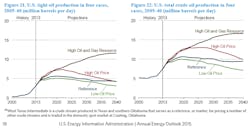

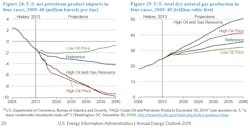

Petroleum and gas

In all AEO2015 cases, through 2020, strong growth in US oil production from tight formations leads to a decline in net petroleum imports and growth in product exports in all AEO2015 cases. The net import share of petroleum and other liquids product supplied falls from 26% in 2014 to 15% in 2025 and then rises slightly to 17% in 2040 in the reference case. With greater US crude oil production in the high oil price and high oil and gas resource cases, the US becomes a net petroleum exporter after 2020.

Net natural gas trade, including LNG exports, depends largely on the effects of resource levels and oil prices. The US transitions from being a net importer of natural gas to a net exporter by 2017 in all cases. US natural gas net export growth continues after 2017, with annual net exports in 2040 ranging from 3 tcf in the low oil price case to 13.1 tcf in the high oil and gas resource case.

Meanwhile, the report notes that regional variations in US crude oil and gas production can force significant shifts in oil and gas flows between US regions, requiring investment in or realignment of pipelines and other midstream systems.