EIA: US petroleum product exports rise for 13th consecutive year

US exports of petroleum products averaged a record 3.8 million b/d in 2014—an increase of 347,000 b/d from 2013—based on data from the US Energy Information Administration’s Petroleum Supply Monthly.

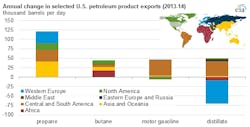

In particular, exports of motor gasoline, propane, and butane increased, offsetting a decrease in exports of distillate, EIA said.

EIA noted that the combination of record-high US refinery runs, which averaged 16.1 million b/d in 2014, and increased global product demand allowed US product exports to rise for the 13th consecutive year.

Most of these exports were sent to Central and South America, followed by exports to Canada and Mexico. In fact, product exports from the US increased in every region except the Middle East, which declined to 47,000 b/d in 2014 from 55,000 b/d in 2013, EIA said.

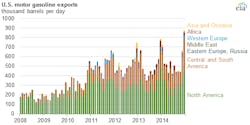

Exports of motor gasoline (including finished gasoline and blending components) in December 2014 set a monthly record of 875,000 b/d, the administration said.

“For the past several years, monthly exports of gasoline have been highest in November and December, as low seasonal US gasoline demand in December creates a larger surplus of gasoline, particularly on the US Gulf Coast (as defined by Petroleum Administration for Defense District 3), resulting in increased exports to relatively farther destinations in Africa and Asia,” EIA said.

“Increased US production and capacity to export hydrocarbon gas liquids (HGL), particularly on the US Gulf Coast, allowed exports of propane and butane in 2014 to increase by 121,000 b/d (40%) and 44,000 bbl/d (149%), respectively, over 2013 levels,” EIA noted. While exports of propane to Asia—particularly Japan and China—nearly doubled in 2014 from 2013, increasing by 40,000 b/d (95%).

Exports of distillate, meanwhile, declined for the first time since 2004, EIA said. “Almost all of this decrease is attributable to declines in exports to Western Europe and Africa, where distillate exports fell by 61,000 bbl/d (15%) and 8,700 bbl/d (35%), respectively, in 2014,” it said.

“In the second half of the year, increased European refinery runs, exports from recently upgraded Russian refineries, and new refinery capacity in the Middle East increased supply to European distillate markets, reducing the need for distillate from the US,” EIA said.