EIA revises down crude oil price forecasts for 2024

In the December issue of Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts the Brent crude oil spot price will increase to an average of $84/bbl in first-half 2024 from an average of $78/bbl in December 2023, partly driven by recently announced OPEC+ production cuts. Nevertheless, despite the announced cuts, EIA lowers its forecast for the Brent price in 2024. EIA expects the Brent spot price will average $83/bbl next year, a decrease from the previous forecast of $93/bbl in last month's STEO.

EIA forecasts global liquid fuels production will increase by 600,000 b/d in 2024, slowing from growth of 1.6 million b/d in 2023. This forecast reflects a reduction of 400,000 b/d in expected growth for 2024 compared with last month’s STEO. The lower forecast is mostly the result of less expected production from OPEC+ and a slight drop in expected production growth in the US.

“Growth in global crude oil supply has been limited in 2023 because of voluntary production cuts from Saudi Arabia and reduced production targets from other OPEC+ countries. We estimate countries within the OPEC+ agreement have lowered crude oil production by 1.4 million b/d in 2023, partly offsetting production growth of 2.4 million b/d by non-OPEC+ producers,” EIA said.

EIA also forecasts OPEC+ crude oil production to fall by an additional 600,000 b/d on average in 2024. This forecast assumes some voluntary production cuts from Saudi Arabia will be extended through 2024 and overall production from OPEC+ countries will remain below targets.

The agency’s current assessment is that global oil inventories have increased by an average of 600,000 b/d in 2023. Inventory draws will materialize in first-quarter 2024, averaging 800,000 b/d, before the oil market returns to balance for the remainder of 2024. However, the potential for OPEC+ production to increase after the voluntary cuts expire in first-quarter 2024 creates some downside risk for expected oil prices, according to EIA.

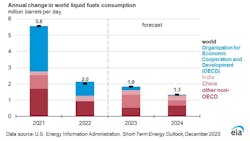

Global liquid fuels consumption in the forecast increases by 1.8 million b/d in 2023 and by 1.3 million b/d in 2024. Most of the expected growth in liquid fuels demand is in non-OECD Asia, led by China and India. EIA expects China’s liquid fuels consumption to rise by 800,000 b/d in 2023 and by 300,000 b/d in 2024. India’s liquid fuels consumption in EIA’s forecast increases by an average of 300,000 b/d in both 2023 and 2024. Outside of China and India, EIA forecasts non-OECD consumption to increase by about 700,000 b/d on average in 2023 and 2024. This growth contrasts with OECD liquid fuels consumption, which is up only slightly over the forecast period.

In the latest outlook, EIA also expects net exports of US crude oil and petroleum products to reach a record high of almost 2 million b/d in 2024, up from around 1.8 million b/d this year and 1.2 million b/d in 2022. This growth is primarily driven by an increase in US crude oil and hydrocarbon gas liquids production. The US will remain a net importer of crude oil next year, averaging about 2.2 million b/d. However, net crude oil imports will decline slightly from 2023, according to EIA.

The Henry Hub spot price in the forecast averages close to $2.8/MMbtu this winter (November—March), down more than 60¢ from the November STEO. The downward revision reflects both a warmer-than-average start to the winter, which has reduced demand for space heating in the residential and commercial sectors, and high natural gas production. These two factors have increased natural gas storage inventories. EIA forecasts US natural gas inventories will end the winter 22% above the 5-year average (2018–2022), with more than 2,000 bcf in storage.