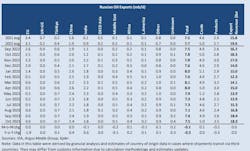

Russian oil export volume, revenues ebb in October

According to the latest estimates from the International Energy Agency, Russian oil export volumes in October experienced a slight decrease of 70,000 b/d compared with the previous month, to total 7.5 million b/d. Associated revenues fell $25 million, to $18.34 billion.

This decrease in revenue can be partly attributed to the initial application of US Treasury sanctions under the G7 price cap. On Oct. 12, 2023, the US Treasury’s Office of Foreign Assets Control (OFAC) imposed the first blocking sanctions on owners of tankers transporting Russian oil priced above the G7's established cap of $60/bbl, one in Türkiye and one in the UAE, in an effort to eliminate loopholes in the mechanism designed to punish Moscow for its war in Ukraine. These sanctions contributed to slightly weaker Russian crude prices in the latter half of the month due to rising shipping costs. Russian crude price discounts versus North Sea Dated continued to narrow into October, but rising freight rates after mid-month reversed the trend, with Russian oil ending the month $2/bbl weaker.

In October, Russian crude oil exports via seaborne routes increased by 110,000 b/d to 5.04 million b/d. This increase in seaborne volumes helped offset the decline in crude oil prices and boosted seaborne crude oil revenues by 3.3%, $280 million month-on-month (m-o-m). Additionally, higher pipeline prices, particularly to the European Union (EU), counteracted a slight decrease in volumes, resulting in an 11% increase ($360 million) in overland revenues. Overall, total crude oil export revenues reached $12.67 billion, an increase of $660 million year-on-year (y-o-y).

Conversely, the decline in product prices exacerbated the impacts of a m-o-m decrease of 150,000 b/d in product exports, resulting in a revenue reduction of $690 million, bringing the total down to $5.67 billion. This represented a y-o-y decrease of $620 million.

Destinations

Crude seaborne cargoes headed for Türkiye rose to 320,000 b/d in October (+40,000 b/d m-o-m). Cargoes destined for India rose 90,000 b/d m-o-m to 1.64 million b/d, offsetting an equivalent drop to China, to 2.1 million b/d. Loadings for other known destinations fell by 200,000 b/d over the month, including 90,000 b/d less to the EU, but volumes heading to unknown destinations (eventually reallocated once ships have discharged) rose by an equivalent amount.

Product exports fell during October. The largest decline impacted cargoes for the Middle East, with volumes falling by more than half (180,000 b/d m-o-m to reach 130,000 b/d). Shipments also eased to India (120,000 b/d m-o-m), China (50,000 b/d m-o-m) and Türkiye (40,000 b/d), according to preliminary data from Kpler.

The decline in product exports was mostly accounted for by fuel and feedstocks (down 110,000 b/d m-o-m to 960,000 b/d) and by gasoline (30,000 b/d m-o-m to 160,000 b/d). Gasoil exports rose by just more than 10,000 b/d, reaching 740,000 b/d. A decline in Russian refinery throughputs and pressure to lift domestic product deliveries likely contributed to exports falling for product but rising for crude.