Oil market tightens amid continued OPEC+ production cuts

Despite the prevailing macroeconomic headwinds, global oil demand is set to rise by 2.4 million b/d in 2023, with China and India leading the increase. China’s rebound continues, with its oil demand setting an all-time high of 16.3 million b/d in April. The annual demand growth in 2023 is expected to accelerate throughout the year, largely due to a weak baseline from China’s 2022 lockdown. However, as the recovery phase following the COVID-19 pandemic is mostly complete, global oil demand growth is expected to slow down in 2024.

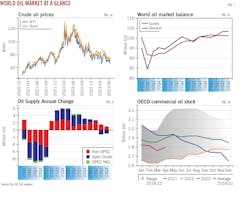

Meantime, substantial reduction in oil production from the Organization of the Petroleum Exporting Countries and its allies (OPEC+) symbolizes a bullish development propelling the oil market and prices upward. As announced during the meeting held on June 4, the formal production reductions by OPEC+ are slated to continue until end-2024. Moreover, voluntary production cuts of 1.66 million b/d from some OPEC+ countries, including Russia, will be extended through 2024. Additionally, Saudi Arabia on June 4 announced a further voluntary July production cut of 1 million b/d with a high possibility of extension. The decision by OPEC+ and Saudi Arabia to curtail production is expected to enlarge the anticipated supply deficit in the rest of 2023.

Despite production cuts made by OPEC+ and Saudi Arabia, global oil production is set to continue its growth, increasing by 1.3 million b/d in 2023 and 1 million b/d in 2024, largely due to robust output from non-OPEC+ producers such as the US, Brazil, Guyana, Norway, and Canada. Non-OPEC+ production will also be positively impacted by higher crude oil prices triggered by OPEC+ and Saudi Arabia’s production cuts. Nevertheless, the forecast for global oil production growth has been revised down from previous assessments following the June 4 announcements.

Russian oil supply has been resilient following Russia’s invasion of Ukraine as crude exports have been successfully redirected to new markets at deep price discounts.

Oil prices have retreated from their mid-2022 peak. Brent crude prices have averaged $80/bbl in 2023 to date. Current demand and supply projections suggest that global oil inventories will decline in the latter half of the year and throughout 2024, gradually pushing oil prices upward. As a result, Brent oil prices in 2024 are expected to exceed those of 2023.

However, considerable uncertainty persists regarding global economic growth and its potential impact on oil demand throughout the forecast period. Issues with US banking, high-interest rates, and other macroeconomic factors represent downside risks to oil demand growth and prices. Moreover, recent economic indicators, such as declining exports and high unemployment, suggest an uneven recovery for China’s economy. Should China’s oil demand growth decelerate, it could pose a major challenge for the oil market and oil prices.

Global economy

In its Global Economic Prospects report released in June 2023, the World Bank predicts a sharp deceleration global economy growth to 2.1% from 3.1% in 2022. This slowdown is largely attributed to ongoing efforts to tighten monetary policy in response to high inflation rates. However, a slight rebound to 2.4% is projected for 2024.

According to the World Bank, the global economic expansion might even underperform expectations if the banking sector faces broader distress, or if persistent inflationary pressures instigate stricter monetary policies than anticipated.

Growth in advanced economies is projected to slow to 0.7% in 2023 from 2.6% in 2022, largely reflecting considerable central bank policy rate hikes since early 2022. Growth is expected to accelerate modestly to 1.2% in 2024 due to a pickup in the Euro area. Growth in Emerging Market and Developing Economics (EMDE) is projected to edge up to 4% in 2023 from 3.7% in 2022, which almost entirely reflects the rebound in China.

Following a 2.1% expansion in 2022, the US economy is projected to grow 1.1% in 2023. The US economic growth is expected to further slow to 0.8% in 2024, largely due to the delayed impact of the significant increase in policy rates.

In the Euro area, growth is forecast to slow to 0.4% in 2023 from 3.5% in 2022, owing mainly to the lagged effects of monetary policy tightening. After bottoming out in 2023, growth is expected to firm to 1.3% in 2024, supported by reforms and investments funded by the Recovery and Resilience Facility.

The World Bank projects China growth to rebound to 5.6% in 2023 from 3% in 2022, as the economic reopening drives consumer spending, particularly on domestic services. Key downside risks include ongoing turbulence in the real estate industry, a steeper-than-expected deceleration in international trade, high unemployment, and the persistent threat of unsettling waves of COVID-19.

World oil demand

Amid the persisting macroeconomic challenges, global oil demand continues to show robustness. The International Energy Agency’s (IEA) most recent data indicates that for the first two quarters of 2023, worldwide oil demand is estimated to have risen by 2.1 million b/d year-on-year (y-o-y) with China accounting for a substantial 67% of this growth.

For the entirety of 2023, IEA projects the global oil demand to increase by 2.4 million b/d y-o-y, reaching 102.3 million b/d. Non-OECD countries are expected to account for 2.1 million b/d of this growth.

In first-half 2023, China’s oil demand is estimated to have increased by 1.4 million b/d y-o-y. This surge exemplifies the swift revival of personal activity and travel as restrictions were eased. As per data from IEA, China’s transport and petrochemical consumption has skyrocketed, leading to an unprecedented high apparent demand of 16.3 million b/d in April.

However, recent economic data indicates that China’s economic revival is losing some momentum. In May, China’s Manufacturing Purchasing Managers’ Index (PMI) stood at 48.8, marking a drop of 0.4 percentage points from the preceding month, indicating a decline in the vitality of the manufacturing sector. For two consecutive months, manufacturing activity has been below 50. Exports fell 7.5% in May from a year earlier, bucking an 8.5% rise the previous month and adding to pressure on China’s factory workforce. Government surveys also found about 20% of potential workers in cities aged 16-24 are unemployed. China’s latest economic data leads to renewed apprehensions about its demand for crude oil and other commodities, which could potentially slow down the anticipated global oil demand growth and weigh on oil prices.

India’s oil demand demonstrates strength, with record-breaking figures reported for both gasoline and diesel consumption in May. For the first two quarters of 2023, Indian oil demand is estimated to have risen by 140,000 b/d y-o-y. For the year, Indian oil demand is expected to increase by 170,000 b/d.

Demand for oil within OECD countries remains stagnant, influenced by a persistent manufacturing downturn and overall tepid economic expansion. Oil demand in OECD Europe declined by 200,000 b/d y-o-y in first-quarter 2023. On a country level, Germany accounted for roughly half the decline. At the product level, decreases in gasoil and naphtha attested to Europe’s persistent manufacturing slump and warm winter. For 2023, OECD Europe oil demand is expected to increase slightly by 75,000 b/d. During first-half 2023, US oil demand also saw a y-o-y decrease of 23,000 b/d. Over the course of 2023, total US oil consumption is expected to rise by less than 1%, compared with 2% y-o-y growth in 2022.

Regardless of whether they are advanced or developing, countries across the globe are seeing a resurgence in air traffic, reinforcing the role of jet fuel as the primary driver of global demand growth in 2023, contributing an increase of 1.1 million b/d.

As the bounce-back effect from the post-COVID-19 period mostly subsides, the increase in worldwide oil demand is projected to slow to around 900,000 b/d next year. The unprecedented tightening of monetary policies could further restrict economic activity and constrain advanced economies to endure another year of below-average growth in 2024. On the global scale, petrochemical feedstocks will assume the role of primary growth driver from jet fuel, accounting for half of the total demand increase in 2024.

Global oil supply

OPEC+ is set to see decreases in total oil output in 2023 and 2024, given that production restrictions are maintained until end-2024. Non-OPEC+ countries are slated to spearhead global supply growth, contributing an increase of 1.9 million b/d in 2023 and 1.2 million b/d in 2024 per IEA forecasts. Overall, oil supply is projected to achieve historic peaks of 101.3 million b/d this year and 102.3 million b/d next year.

OPEC+ resolved June 4 to uphold its production cut objectives for 2023, and agreed to a new, reduced target for 2024. In the meantime, Saudi Arabia announced on the same day its decision to voluntarily reduce its oil production by 1 million b/d in July for a month, with the possibility of extending. As a result, Saudi Arabia crude production in July is expected to fall to just under 9 million b/d, its lowest level since June 2021.

Several OPEC+ members including Saudi Arabia, Iraq, UAE, Kuwait, Algeria, Kazakhstan, Oman, and Gabon announced voluntary production cuts of 1.16 million b/d in April (OGJ Online, July 4, 2023). These reductions began in May and, under the recent agreement, will last until end-2024. Russia’s voluntary cuts of 500,000 b/d (OGJ Online, Mar. 21, 2023), which initially commenced in March, will also be extended until end-2024.

The new OPEC+ production target for 2024 is set at 40.46 million b/d, marking a reduction of 1.4 million b/d compared with this year’s target. The revised 2024 production targets encompass substantial reductions for Russia, Nigeria, and Angola, effectively aligning them with their current actual production levels. In contrast, the new target permits an increase of 200,000 b/d to the UAE’s production output.

In the first half of this year, both Nigeria and Iraq experienced substantial production disruptions. Russian oil supply has demonstrated remarkable resilience, with crude exports effectively redirected to new markets. The substantial price discounts have attracted traders and refiners who are willing to take on the risks.

For OPEC+, additional curbs along with sanctions on Russia will deepen the group’s y-o-y decline to 500,000 b/d, in stark contrast to the substantial 3.1 million b/d increase in 2022 as it phased out record 2020 supply cuts. Total oil output in 2024 is set to decline by an additional 200,000 b/d as production curbs are carried through the year.

Non-OPEC+ oil supply is expected to reach around 49.7 million b/d in 2023, up nearly 1.9 million b/d from 2022, according to IEA. The US is expected to contribute more than 60% of the non-OPEC+ 2023 gain. Growth will also come from Brazil, Norway, Guyana, and Canada, up by 210,000 b/d, 87,500 b/d, 110,000 b/d, and 45,000 b/d, respectively.

OECD oil inventories

In April, OECD oil inventories experienced a significant increase of 33.6 million bbl, reaching 2,794.9 million bbl. However, they were still 86.4 million bbl below the 5-year average. Preliminary data for May suggests an additional rise in stock levels in OECD countries by 21.1 million bbl.

US oil demand

According to data from the US Energy Information Administration (EIA), US consumption of petroleum and other liquid fuels during first-half 2023 was 20.22 million b/d, marking a slight decrease from the 20.25 million b/d consumed during the same period in the previous year.

Amid the general bearish trend, motor gasoline and jet/kerosene were the only products that experienced y-o-y gains over this year’s first half. There was a decrease in demand for distillate and LPG/ethane, resulting in an overall negative growth in the market in the first half of the year.

In first-half 2023, demand for jet fuel rose by 90,000 b/d, or 6%, compared with first-half 2022. Reports from the Airlines Reporting Corp. (ARC) indicate a gradual return of air passenger demand to the seasonal trends observed before the pandemic. OGJ expects jet fuel demand to grow by 110,000 b/d (+7%) y-o-y to 1.67 million b/d in 2023.

Supported by a strong job market, US gasoline consumption remains strong. During first-half 2023, US motor gasoline consumption averaged 8.9 million b/d, reflecting an increase of 1.95% from last year’s levels. OGJ expects US motor gasoline consumption to expand by 113,000 b/d (+1.3%) in 2023, as strong mobility more than offsets vehicle efficiencies. US regular gasoline retail price is expected to average $3.40/gal for 2023, compared with $3.95/gal in 2022.

Deliveries of LPG/ethane remained sluggish. For first-half 2023, average US LPG/ethane consumption was 3.5 million b/d, which was 4.15% less than the same period a year ago. Although there was a slight recovery in ethane usage, this was offset by lackluster demand for LPG. Apart from the ongoing challenges in the petrochemical sector, the unseasonably warm weather also played a role in the weak demand for propane, which is typically used for heating purposes.

US consumption of distillate fuel over first-half 2023 saw an estimated decline of 34,000 b/d (-0.8%) compared with the previous year’s first half amid a general loss of economic momentum. Data from the US Bureau of Transportation Statistics show that trucking freight, as measured by the seasonally adjusted truck tonnage index, decreased by 0.7% year-to-date, in contrast to a 2.43% increase over the same period in 2022. OGJ projects a decline in demand for distillate fuel by 1.4% in 2023.

US residual fuel consumption averaged 270,000 b/d in the first half of this year, a significant decrease of 22.6% from the previous year. OGJ expects a decrease of 11% in US residual fuel consumption in 2023.

Overall, OGJ forecasts an average consumption of 20.43 million b/d in 2023 for US petroleum and other liquid fuels, indicating a minor growth of 120,000 b/d (+0.6%) from 2022.

US oil production

US crude oil production is projected to reach record highs annually in 2023 and 2024, with the primary boost coming from the Permian basin. OGJ forecasts that US crude oil production for 2023 will touch 12.6 million b/d, marking a 6% growth, or 700,000 b/d, from 2022 levels. Growth for 2024 is projected to be a more modest increase of around 100,000 b/d. Increased forecast production is supported by crude oil prices and the addition of infrastructure capacity.

Despite higher oil prices, current US crude oil production growth is decelerating compared with the average annual growth of 1.1 million b/d observed from 2017 to 2019, a period when WTI price stood at $58/bbl. The US shale oil industry has fully embraced financial discipline, focusing more on increasing dividends and share buybacks than investing in new production. This approach reduces leverage-based overspending and reduces short-term sensitivity to commodity price fluctuations. Tighter labor markets, higher costs, and increased stress on oilfield supply chains are also contributing to the slowed growth.

According to OGJ’s capital spending outlook (Apr. 3, 2023), a group of 26 US-listed E&P companies plan to spend about $63.7 billion in total capital expenditures in 2023, up 21% from a year ago. This however compares with a 48% growth in capital spending last year.

The US oil rig count is declining as oil prices retreat from last year’s highs. The rig count report by Baker Hughes indicated 552 active US oil rigs as of the week ended June 16, compared with 584 active oil rigs recorded during the same week in 2022. EIA’s Drilling Productivity Report showed the recent DUC well count stood at 4,834 in May 2023, compared with 4,523 in May 2022.

The first half of 2023 saw Permian’s crude oil production hit 5.67 million b/d, a rise of 10.53% from the same period a year ago. The rig count in the play averaged 347 during first-half 2023, up from 322 over the same period a year ago. Recent data from the quarterly Dallas Fed Energy Survey indicate that average breakeven prices in the region range from $50/bbl to $54/bbl. Rising crude oil production in the Permian basin is also partially the result of the expected completion of new natural gas pipelines in the region.

Benefited from new projects coming online, the Gulf of Mexico’s crude oil production averaged 1.74 million b/d in 2022, up 2.1% from the previous year. The Gulf of Mexico’s crude oil production is expected to increase 9% in 2023 to 1.89 million b/d. In response to weather uncertainties, operators in the Gulf of Mexico have focused on short-cycle and low-cost recompletions, infills, and tiebacks.

Production growth in other regions will remain essentially flat in 2023. According to EIA’s Drilling Productivity Report, crude oil production in the Bakken region increased to 1.18 million b/d in first-half 2023 from 1.1 million b/d in first-half 2022. For the Eagle Ford region, crude oil production saw a slight growth to 1.09 million b/d in first-half 2023 from 1.08 million b/d in first-half 2022.

Production of US natural gas liquids (NGL) escalated by 8.56% in 2022, reaching 5.88 million b/d, and is expected to increase by another 5% to 6.18 million b/d in 2023, according to OGJ forecasts. In total, OGJ expects US total domestic oil production to rise by 5.7% from the previous year, reaching 18.79 million b/d in 2023.

US refining

ExxonMobil said on Mar. 16 that its expansion of the Beaumont refinery had commenced operations, resulting in an additional capacity of 250,000 b/d. With this expansion, the refinery has become one of the largest in the US in terms of crude oil distillation capacity. Total capacity of the Beaumont refinery, as stated by ExxonMobil, now stands at 630,000 b/d.

The expansion marks the first significant increase in refinery capacity since the onset of the COVID-19 pandemic, which led to the closure of several refineries throughout 2020 and 2021. Refinery distillation capacity in the US decreased to 17.9 million b/d at the beginning of 2022 from 19 million b/d at the beginning of 2020. With the Beaumont expansion, US refining capacity increased to 18.2 million b/d.

Gross inputs to US petroleum refineries, or refinery runs, averaged 16.25 million b/d in first-half 2023, down from 16.33 million b/d over the same period a year ago, reflecting increased maintenance activity. With increased refining capacity, US refiners ran at an average utilization rate of 89.3% in this year’s first half, compared with 91% the same period a year ago. For 2023, OGJ forecasts an average utilization rate of 89.5%, down from 91.6% a year ago.

US refining margins during first-half 2023 have eased from highs seen in second-half 2022. Materially lower distillate crack spreads were the key driver of this apparent margins normalization. The distillate crack spread jumped to an unprecedented high in October 2022, quadrupling the average of the previous 5 years (2017-2021). Since then, US distillate crack spreads have decreased as new trading patterns alleviated supply worries and milder winter temperatures curtailed distillate usage. US distillate crack spreads this May have reverted to levels seen in February 2022 before Russia’s invasion of Ukraine.

According to Muse Stancil & Co., the average refining cash margins for the first 5 months of 2023, which is the most recent data available, stood at $29.02/bbl in the Midwest, $23.88/bbl on the West Coast, $26.86/bbl on the Gulf Coast, and $15.60/bbl on the East Coast. For comparison, these averages were respectively $23.11/bbl, $26.67/bbl, $23.94/bbl, and $19.71/bbl in 2022. Further back, in the same period of 2021, the average refining margins for these regions were considerably lower, at $13.95/bbl, $10.88/bbl, $5.78/bbl, and $4.68/bbl, respectively.

US oil trade

Over the first half of this year, the average US petroleum trade balance amounted to net exports of 1.58 million b/d, compared with net exports of 960,000 b/d over the corresponding period in 2022. Specifically, crude oil net imports averaged 2.4 million b/d during the period, down from 2.9 million b/d a year ago. On the other hand, estimated net exports of petroleum products averaged 3.98 million b/d year-to-date, up from 3.86 million b/d over the same period last year.

According to the latest EIA data, the US exported 4.1 million b/d of crude oil in first-quarter 2023, compared with 3.3 million b/d over the same period a year ago. China was the major destination for US crude oil exports over this period, receiving 544,000 b/d, or 13% of total US crude oil exports. This compared with 229,000 b/d in first-half 2022. Aside from China, US crude oil exports went mostly to the Netherlands, Korea, and Canada. US crude exports to India averaged 139,000 b/d in first-quarter 2023, down from 393,000 b/d in last year’s first quarter.

In first-quarter 2023, the US imported 6.39 million b/d of crude oil, up from 6.32 million b/d in the same period a year ago. Crude oil imports from OPEC members averaged 1.04 million b/d, compared with 934,000 b/d in first-quarter 2022. US crude imports from Saudi Arabia for this year’s first quarter decreased to 414,000 b/d from 477,000 b/d in last year’s first quarter. The leading source of US crude imports was Canada, which supplied 3.92 million b/d.

In the first 3 months of 2023, the US exported an average of 6 million b/d of petroleum products, a growth of 4.33% compared with the same period in 2022. The top destination for US petroleum products exports was Mexico. Over the first 3 months of 2023, US petroleum products exports to Mexico averaged 1.24 million b/d, up 10.5% over the same period in 2022. Aside from Mexico, US petroleum products exports went mostly to Japan, China, and Canada.

According to EIA data, the US exported 2.68 million b/d of HGL in first-quarter 2023, compared with 2.35 million b/d over the same period a year ago. Japan received the largest share of US HGL exports at 564,700 b/d, followed by China at 417,000 b/d, and Mexico at 222,000 b/d.

For first-quarter 2023, propane exports averaged 1.57 million b/d, an increase of 216,000 b/d (+16%) compared with the same period of 2022. US propane exports reached a record 1.7 million b/d in March 2023, the highest level since EIA began collecting this data in 1973. Propane is consumed globally for space heating and is used as a petrochemical feedstock. Lower US demand for propane this past winter and higher propane production led to lower US propane prices relative to Northwest Europe and Asia, underpinning the record export levels.

The top destination for US propane exports was Japan. Over the first 3 months of 2023, US propane exports to Japan averaged 518,000 b/d, up 29.8% over the same period in 2022. Aside from Japan, US propane exports went mostly to China, Mexico, and Korea.

US ethane exports reached a record high in March 2023, averaging 537,000 b/d. This represents the highest level of ethane exports since the US started exporting this product almost a decade ago. The increased export capacity in recent years has played a significant role in enabling higher volumes of ethane to be exported.

The US also exported 998,000 b/d of distillate in first-quarter 2023, compared with 1.08 million b/d over the same period a year ago. The US exported 843,000 b/d of gasoline in first-quarter 2023, compared with 823,000 b/d over the same period a year ago.

During this year’s first quarter, the US imported 2.12 million b/d of petroleum products, compared with 2.04 million b/d for the same period a year ago.

US oil stocks

Over first-half 2023, higher domestic crude oil production and lower refining inputs resulted in higher commercial crude oil stocks versus the year-ago level. Estimated industry crude oil stocks stood at 442 million bbl at the end of June 2023, up from 417 million bbl at the same time a year ago.

The volume of crude oil in the Strategic Petroleum Reserve (SPR) continues to be low, with the SPR holding 345 million bbl at the end of June, down from 493 million bbl recorded at the same time the previous year.

All product inventories are up from a year ago. As of mid-2023, total product stocks reached 808 million bbl, a significant increase from the 762 million bbl recorded at the same time the previous year. Motor gasoline inventories stood at 223 million bbl at the end of June 2023, compared with 220 million bbl a year ago. Distillate fuel stocks moved to 113 million bbl from 111 million bbl a year ago. Distillate fuel stocks remain well below the 5-year average. Inventories of jet fuel stood at 41 million bbl, up from 39 million bbl a year ago.

US natural gas

The Henry Hub natural gas spot price averaged $2.45 per million British thermal units (MMbtu) in the first half of this year, a significant decrease from $6.07/MMbtu during the same period a year ago. Projections suggest that in 2023, the Henry Hub natural gas spot price will average $2.45/MMbtu, down from $6.42/MMbtu in 2022 and $3.91/MMbtu in 2021.

According to EIA, US natural gas consumption grew by 5.5% in 2022, averaging 88.53 billion cubic feet per day (bcfd). Year-to-date through June, US natural gas consumption averaged 90.2 bcfd, lower than the 90.5 bcfd recorded during the same period a year ago. US gas consumption is expected to see a marginal increase this year, averaging 88.7 bcfd, primarily driven by higher demand from the power sector.

US power plants continue to be encouraged to use natural gas because of its much lower cost compared with coal fuel parity. Gas consumption by the power sector increased by 7.9% y-o-y in 2022, reaching 33.2 bcfd, which represented 37.5% of total US natural gas consumption. In first-half 2023, the power sector’s gas consumption averaged 31.6 bcfd, up from 29.7 bcfd during the equivalent period the previous year. Gas consumption by the power sector is now projected to rise by 3.4% in 2023, reaching 34.3 bcfd.

Industrial natural gas consumption averaged 23.16 bcfd in 2022, reflecting a 1.9% increase compared with 2021. Year-to-date, estimated industrial natural gas consumption averaged 23.22 bcfd, down from 23.87 bcfd during the same period last year, primarily due to subdued economic growth. It is projected that industrial demand for natural gas will decrease by 2% in 2023 to 22.7 bcfd.

During first-half 2023, the commercial sector’s natural gas consumption averaged 10.67 bcfd, a decrease from the 11.16 bcfd observed during the corresponding period in the previous year. Additionally, residential gas consumption averaged 15.59 bcfd over the first 6 months of 2023, compared with a higher average of 17.02 bcfd over the same period a year ago. Consumption was low because of above-average temperatures in early 2023, particularly in the regions where natural gas consumption makes up a large share of fuel used for space heating. OGJ forecasts that commercial and residential demand for natural gas will fall 5% and 1% in 2023, respectively.

In 2022, US marketed gas production and dry gas production reached record peaks of 106.65 bcfd and 98.11 bcfd, respectively. These figures represent growths of 4.35% and 3.81%, respectively,

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.