IEA continues to increase oil demand forecasts for 2023

In the June edition of its Oil Market Report, the International Energy Agency (IEA) revised its global oil demand forecast upward from the previously predicted growth of 2.2 million b/d to a rise of 2.4 million b/d in 2023. This increase is expected to push global oil demand to a record high of 102.3 million b/d.

China's recovery maintains a steady pace, with its oil demand reaching an all-time high of 16.3 million b/d in April. This year, 90% of the increased consumption is attributed to non-Organization for Economic Cooperation and Development (OECD) countries, while the demand in OECD countries remains subdued due to the ongoing manufacturing downturn, IEA said.

However, a potentially unfavorable economic landscape in 2024 could dampen oil demand growth, especially as the recovery from the pandemic would have mostly run its course. Consequently, the growth of oil demand is expected to decelerate to 860,000 b/d in 2024, according to IEA.

Global oil supply

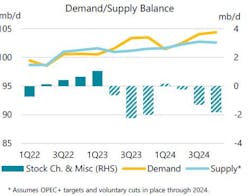

In contrast to the projected continuous surge in oil demand for the rest of 2023, supply is only anticipated to see a slight uptick.

Global oil production experienced a downturn in May, decreasing by 660,000 b/d to a total of 100.6 million b/d. This decline was largely driven by further reductions from certain OPEC+ members, along with the continued halt in production in the Kurdish region of Iraq and some Canadian oil sands. Saudi Arabia, having committed to a voluntary reduction of 500,000 b/d in April, was the principal contributor to this monthly decline in global supply. However, the overall drop was partially offset by a seasonal increase of 330,000 b/d in biofuels, as well as higher output from Nigeria and other countries.

Saudi Arabia has pledged to reduce its output by an additional 1 million b/d in July, reaching a 2-year low of 9 million b/d. This commitment was made during the OPEC+ meeting held on June 4, during which the consortium agreed to extend existing production constraints until 2024 and tweaked some objectives to more accurately reflect actual supply.

According to IEA forecasts, the momentum of global supply growth is set to wane next year, with an increase of 1 million b/d, down from the 1.4 million b/d observed in 2023. The US remains the key driver of non-OPEC+ supply increments, but these gains are projected to reduce to 1.2 million b/d in 2024 from 1.9 million b/d, largely due to the anticipated halving of growth in US shale output. Even though changes in OPEC+ member quotas won't substantially affect production in the current year, their extension through 2024 implies that after this year's decline of 470,000 b/d, OPEC+ production could experience an additional reduction of 200,000 b/d next year. Collectively, this could result in a supply deficit in the oil market in 2024, with the latter half of the year appearing especially tight, IEA said.

Russian oil exports

Russian oil exports dropped by 260,000 b/d in May to 7.8 million b/d, largely unchanged from a year ago. Crude oil exports rose by 90,000 b/d to 5.2 million b/d while product exports slumped by 350,000 b/d to 2.6 million b/d. China and India accounted for at least 56% of total Russian exports, while shipments to Africa, the Middle East, and Latin America made up another 12%. Estimated export revenues fell by $1.4 billion to $13.3 billion, down 36% from a year ago.

Oil inventories

According to IEA data, global observed oil inventories rose by 10 million bbl in April as a 15.9 million bbl decline in oil on water and a 1.1 million bbl drop in non-OECD stocks partly offset a 27 million bbl build in OECD stocks. OECD industry stocks rose by 33.6 million bbl but were still 86.4 million bbl lower than the 5-year average. Preliminary May data show a further stock build in OECD countries of 21.1 million bbl.