US natural gas storage 19% above average as of March

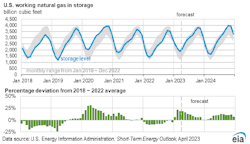

Working natural gas in storage in the US at end-March—generally considered the end of the US storage withdrawal season (November-March)—reached 1,856 bcf, 19% above the 5-year (2018-2022) average, according to estimates from the US Energy Information Administration (EIA).

Higher US natural gas storage reflects below-average natural gas withdrawals from storage during first-quarter 2023, which also leads to lower natural gas prices. Henry Hub natural gas spot prices averaged $5.45 per MMbtu in November 2022, falling to an average of $2.31/MMbtu in March.

Assuming summer injections are similar to the 5-year average, this year's end-October natural gas inventories would sit 8% above last year's end-October inventories and 6% above the 5-year average.

According to EIA data, US dry natural gas production averaged 101.6 bcfd in first-quarter 2023, up 1.4% from fourth-quarter 2022, thanks to mild weather and the absence of major interruptions. Associated natural gas production in the Permian basin and production in the Haynesville region set new records in early 2023, driving growth in US natural gas production in the quarter. However, US natural gas production would decline slightly in April and May due to pipeline maintenance in West Texas and the Northeast.

Over the summer, as Freeport LNG resumes full operations, power sector gas consumption increases, combined with relatively flat US gas production, natural gas prices could rise slightly above $3/MMbtu.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.