EIA: Global liquid fuel production to increase by 1.5 million b/d in 2023

Despite declining production in the Organization of the Petroleum Exporting Countries (OPEC) and Russia, the US Energy Information Administration (EIA) expects global liquids fuel production will increase by 1.5 million b/d in 2023, thanks to strong growth from non-OPEC countries.

In its April issue Short-Term Energy Outlook (STEO), EIA expects strong growth from non-OPEC countries, which (excluding Russia) increase by 2.3 million b/d in the forecast. Non-OPEC production growth is largely driven by countries in North and South America.

OPEC, Russia production

On Apr. 3, OPEC and partner countries announced they would cut crude oil production by 1.2 million b/d through end-2023 (OGJ Online, Apr. 3, 2023). EIA’s March STEO accounted for some declines in OPEC production in the coming months. However, because of the announcement, EIA lowered its forecast for OPEC production for the remainder of 2023 by a further 500,000 b/d. Overall, EIA expects less global liquid fuels production this year than in last month’s STEO.

However, less production from OPEC was partly offset by a 300,000 b/d increase in EIA’s forecast for Russia’s liquid fuels production over the rest of this year.

“These production cuts were in addition to Russia’s 500,000 b/d cut that it previously announced would begin in March. Despite this announcement, the observable impact on Russia’s liquids production and exports in the latest available data has been less significant than expected. Although we still expect Russia’s production to fall this year, Russia’s production outpaced our earlier expectations because its exports have continued to find buyers in markets outside of Europe,” EIA said.

EIA now forecasts Russia’s petroleum and other liquids production will decline from 10.9 million b/d in 2022 to 10.6 million b/d in 2023 and to 10.4 million b/d in 2024, which are both about 300,000 b/d more than the agency forecasted in last month’s STEO.

Global oil demand

EIA forecasts that global liquid fuels consumption will rise by 1.4 million b/d in 2023 and by 1.8 million b/d in 2024.

The forecast for global liquid fuels consumption is unchanged from last month’s outlook. However, increasing risks in the US and global banking sectors increases uncertainty about macroeconomic conditions and their potential effects on liquid fuels consumption, which increases the possibility of liquid fuels consumption being lower than its current forecast, EIA noted.

Market balance, oil price

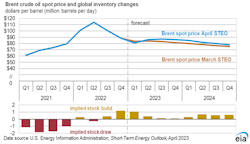

EIA expects global oil markets will be in relative balance over the coming year. Global oil inventories, which increased by 400,000 b/d in 2022 and by 1.1 million b/d in first-quarter 2023, will be mostly unchanged during second-half 2023.

“We expect builds will average about 500,000 b/d beginning in 2024. This forecast assumes the recent OPEC cuts expire at the beginning of 2024. Given our forecast of relatively balanced oil markets in second-half 2023, we expect Brent prices will average $86/bbl for the rest of 2023,” EIA said.

For 2023, the Brent crude oil spot price in EIA’s forecast averages $85/bbl, up $2/bbl from last month’s forecast. The higher price reflects a forecast for less global production in 2023 and a relatively unchanged outlook for global oil consumption, according to EIA.

“In 2023, we assess that the most uncertainty in our oil price forecast comes from less-than-forecast economic and oil demand growth. We forecast Brent prices will average $81/bbl in 2024 with downward price pressures emerging in second-quarter 2024, when we expect global oil inventories will begin to build more significantly. However, because these builds depend on OPEC increasing its crude oil production, uncertainty in the forecast for this period comes from less oil production than we forecast, which could result in higher prices than in our forecast,” EIA said.