EIA: US to remain net exporter of petroleum products through 2050

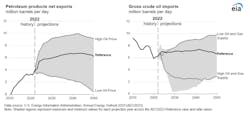

The US will remain a net exporter of petroleum products through 2050, according to the 2023 Annual Energy Outlook (AEO2023) from the US Energy Information Administration (EIA).

Although domestic consumption of petroleum and other liquids does not increase through 2040 across most cases, US petroleum and other liquids production remains high because of increased exports of finished products in response to growing international demand, according to EIA’s analysis.

Because international demand for finished petroleum products keeps exports high, US refinery runs remain strong as the US refinery sector remains competitive in the global market through 2050. Refinery capacity remains relatively constant through 2050, and refinery capacity utilization remains high, at around 90% or higher, under favorable economic conditions, EIA forecasts.

Meantime, in the High Oil Price case, increased production leads to the most exports among all cases over the projection period. The Low Oil Price case shows the opposite: decreased production along with the lowest export volumes.

“In the High Oil Price case, US crude oil imports initially decline but begin to increase starting in 2030 because of changing trends in domestic crude oil production. In the early years, domestic crude oil production increases rapidly due to high prices. However, crude oil production begins to fall after 2030 because wells are drilled increasingly close to one another, resulting in well productivity declines. As wells are drilled closer together, they produce less crude oil and eventually become unprofitable, at which point new drilling stops,” EIA said.

Natural gas

EIA’s analysis shows electrification is displacing combustion fuels in the demand sectors. As electricity generation shifts to renewable sources, domestic natural gas consumption for electricity generation is likely to decrease by 2050 relative to 2022, which contrasts with relatively stable growth over the past decade.

“More natural gas is consumed in the industrial or electric power sectors than in any other sectors of the US economy. Projected consumption in both sectors is very sensitive to changes in our side-case assumptions, particularly in the Oil and Gas Supply cases. These cases, which result in the most and the least natural gas consumption in the industrial sector, vary widely due to differences in resource extraction assumptions. By 2050, natural gas consumption in the industrial sector diverges from the Reference case by 14% in the Low Oil and Gas Supply case and 18% in the High Oil and Gas Supply case,” EIA said.

In AEO2023, shale gas and associated dissolved natural gas from oil formations are the primary sources of long-term growth of domestic natural gas production through 2050. Increased-production wells in the Permian basin (Southwest region) is the primary driver behind associated natural gas growth. Increases in shale gas production mainly come from the Texas-Louisiana Salt basin (Gulf Coast Region) and the Appalachian basin (East Region).

A significant portion of natural gas production growth is due to LNG export demand, which drives the overall increase in natural gas exports.

“With growth in more market based-LNG, the strength of the relationship between international natural gas prices and oil prices has eroded. However, we expect that future oil prices will still affect additional LNG export capacity and overall export levels. When the Brent price is high relative to the US Henry Hub price, like in the High Oil Price case, building more LNG export capacity and exporting LNG are more economical than when the Brent price is lower relative to Henry Hub. In the Low Oil Price case, the Brent price is lower, and the Henry Hub price is higher, which curtails LNG exports to below current volumes in the near term and causes LNG capacity to be underutilized near the end of the projection period,” EIA said.

International demand for LNG exports favors areas that have better access to terminals. In AEO2023, dry natural gas production grows in the Southwest, which has easy pipeline transport to the Gulf Coast, where LNG is exported. Production in the Gulf Coast also generally increases across the projection period, in all cases except the Low Oil and Gas Supply case, due to its proximity to LNG export terminals.