China’s 2022 refinery activity down on domestic policy, geopolitics

In 2022, Chinese refineries processed less crude oil than in 2021, the first year-on-year decline since 2000. The reduction was the result of various factors, including mobility restrictions related to the COVID-19 pandemic and low petroleum product export quotas, according to the US Energy Information Administration (EIA).

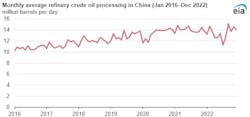

Chinese refineries processed an average of 13.5 million b/d of crude oil in 2022, down 4% from the record high of 14 million b/d set in 2021, according to China's General Administration of Customs. The sharpest reduction in crude oil processing occurred between April and August 2022, when refiners in China processed an average of 12.5 million b/d.

Chinese refineries processed more crude oil at the beginning and end of 2022. In July, refiners processed the lowest volume of crude since January 2018 (11.3 million b/d). Refining in China hit an all-time monthly high of 15.1 million b/d in September 2022, then fell slightly before rising to more than 14 million b/d in November and December.

Demand for petroleum products in China declined in 2022 in response to COVID-19 outbreaks and related mobility restrictions in major cities, including Shanghai. These restrictions significantly slowed China’s economic activity.

Lower petroleum product export quotas also reduced refining activity in China last year. China sets fuel export quotas each year, allocating a fixed amount of exports to a select few refineries, most of them state-owned. China began issuing lower export quotas around second-half 2021, and the low export quotas continued through most of 2022. The quotas kept China's petroleum product exports below 1.5 million b/d between July 2021 and August 2022, subduing refinery demand.

According to EIA, China’s crude oil processing hit a record high in September, most likely because refiners expected China to issue new petroleum product export quotas to promote economic growth, which it did on Sept. 30. China’s petroleum product exports also increased sharply in September, possibly because the expectation of new quotas prompted refiners to use up existing export quota allocations. Once new export quotas were in place, refinery activity rose significantly during the fourth quarter. The increase in China’s refinery activity at end-2022 was partially due to increased exports, which averaged 1.7 million b/d from September through December, up an average 600,000 b/d from the first 8 months of the year.