WoodMac: US could see $100 billion in new LNG projects over next 5 years

High prices and the demand for energy security will drive US to be the leading exporter of LNG in 2023 and potentially pave the way for $100 billion in new developments to support long-term growth, according to Wood Mackenzie.

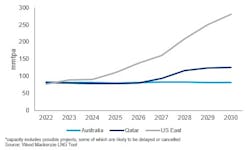

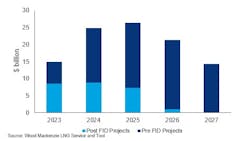

In 2022, the US was the third-largest exporter of LNG at 76.4 million tonnes/year (tpy). With the resumption of the Freeport plant, the US will surpass Qatar and Australia this year to export 89 million tpy. Wood Mackenzie predicts that based on the combination of projects already under construction and momentum of potential projects, US LNG capacity could grow between 70 million tpy and 190 million tpy before the end of the decade, potentially more than doubling current exports. To achieve this, a slew of new projects will have to launch, which could lead to as much as $100 billion in new projects in the next 5 years, Wood Mackenzie reported.

“Record-high prices and the need for energy security drove buyers, which included portfolio players and US producers and infrastructure companies, to seek long-term US LNG deals in 2022 and created huge contracting momentum for projects,” said Giles Farrer, head of gas and LNG asset research for Wood Mackenzie. “Last year alone, 65 million tpy of long-term US deals were signed, dwarfing the 18.5 million tpy we saw in 2021. This activity has pushed a host of pre-final investment decision (FID) US projects forward and we could see a wave of FIDs this year and next.”

According to Farrer, projects will be undertaken by both privately and publicly owned developers and most pre-FID projects are currently seeking external financing for this investment. “In most cases, project financing will support between 60-80% of the required capital, with the remainder either financed via equity raises and/or balance sheet,” he added.

Risks to capacity growth

The potential for cost increases is challenging developers as they move forward, particularly through supply-chain-triggered inflation and competition for resources, the report said.

“Our benchmarking analysis indicates we have already seen inflation of over 20% on the US Gulf Coast, compared to projects which were built in the last 5 years,” said Sean Harrison, research analyst, gas and LNG for Wood Mackenzie. “As developers continue to push more projects forward, competition for service contracts will rise, creating a squeeze on both work force and material prices. This could cause further cost inflation, along with delays to some projects.”

Harrison added that despite rising costs, competition for customers is keeping liquefaction fees low, potentially between $2-2.5/MMbtu for fixed price long-term agreements, challenging profitability.

“The combination of low fees and increasing costs mean we estimate unlevered internal rates of return (IRRs) as low as 5-6% for some projects. Based on these returns, some projects are finding it challenging to secure finance, particularly via equity raises,” said Harrison. “Projects are looking for ways to create additional value for developers and equity investors. Ways they might find upside include procuring feed-gas efficiently, securing good prices for uncontracted LNG sales, debottlenecking and re-rating of trains and the sale of pre-commercial volumes. Charging customers for additional services to reduce project emissions could also deliver additional returns.”