US shale growth is likely to remain slow into 2023, investment bank Piper Sandler (PSC) said in a research note.

Citing conversations with operators, PSC said the inversion of economics for the oil industry could not have come at a more inopportune time. “The softness in commodity prices, inflationary service costs, and opaque economic outlook are colliding just as management teams are set to discuss 2023 capital spending. Initial discussions suggest that the pace of activity and price increments could be much lower than what investors had hoped just a few months back,” PSC said.

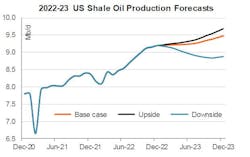

The bank sees risk to lower activity levels in 2023 driving less supply growth for oil and natural gas from US shale. Prospects for a continued shift higher have faded, PSC said. While PSC is still modeling for an increase of 15 rigs into yearend and another 50 throughout 2023, some of its analysts are calling for a decline of 50 rigs through first-half 2023 from the 2022 exit level.

“While we hear the same caution from managements, we would note that such a decline would move our base case production level of production from 300,00 b/d of growth to a decline of 300,000 b/d exiting 2023,” PSC warned.

However, such a swing would have a material impact on OECD inventory levels and would likely push commodity prices high enough to for operators to reconsider their plans, said PSC.

“Commentary out of third-quarter 2022 earnings also suggests a slower pace of spending,” said PSC. While previous consensus forecasts for an around 10% increase in capital spending appeared to only reflect the cost of inflation, the outlook for activity and pricing looks lower than during the summer of 2022.

“Not only our conversations with public and private operators, but also consensus expectations continue to move lower for both 2023 capital spending and the associated growth rates in production. Hold on for third-quarter 2022 earnings, but oil field service (OFS) activity levels and pricing could disappoint. While ESG commitments remain a critical factor in tempering capital budgets, operational issues have not abated and in many cases could actually intensify 2023. Drilling activity appears to have plateaued as fracking capacity, sand availability, infrastructure and labor remain bottlenecks. Production forecasts remain modest,” said PSC.

Meantime, PSC mentioned that “our conversations with both public and private operators continue to suggest a focus on efficiencies and not production growth.”

Many private operators (and some public) are beginning to struggle with inventory depth, according to PSC. With modest drilling inventory of just 2-5 years, private operators are becoming increasingly inquisitive. Opportunities to acquire producing assets to support cash flow or add to drilling location inventory are sought after. Public companies continue to see stronger value propositions to buy back shares in lieu of directing more capital to the drill bit, given the discount their equities represent, the bank said.