Europe considers supply, storage, price cap as winter approaches

As the heating season approaches, Europe is monitoring natural gas supply and continuing discussions of a price cap, Rystad Energy said in a research note.

After a few volatile months, European natural gas prices have declined in September and October and currently sit at their lowest level since June 2022, reaching $40/MMbtu on the Netherlands-based Title Transfer Facility (TTF) Oct. 17.

Underground storage levels in Europe continue to build alongside policy efforts within the European Union (EU) to stabilize end-user prices. The European Commission (EC) is considering intervening to increase stability and liquidity and ease upward pressure on the European gas market.

“With the gas withdrawal season approaching fast, market participants will be hoping to avoid any major supply outages and abnormally cold weather which would hit certain European nations, such as Germany, at the worst possible time. Asia and the US are presently sitting comfortably when it comes to supply and storage levels, though this could change as winter approaches,” said Rystad analyst Nikoline Bromander.

Alongside LNG imports, Norway is offsetting the latest drop in Russian pipeline gas to keep up supply. In recent weeks, Norwegian gas flows have returned to 330 million cu m/d (MMcmd) following the end of September maintenance. On Oct. 17, exit nominations from the Norwegian Continental Shelf (NCS) totaled 336 MMcmd, their highest level since the end of July.

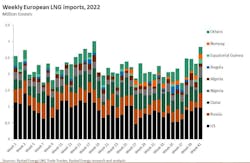

LNG imports have edged up on strong spot purchases in August and September. Major LNG exporters to Europe include the US, Qatar, and Russia. Nigeria LNG has declared force majeure due to flooding in the Niger delta region. With the duration unknown and about 3.8% of global monthly supply potentially impacted, the move is an upward risk on prices.

Meanwhile, European gas demand has continued its year-on-year decline following measures put in place by the EC and demand destruction.

“For the coming week, milder temperatures are expected across Continental Europe, which is expected to further depress demand for gas. Falling demand is enabling Europe to build storage levels ahead of the winter withdrawal season. European storage facilities are now 92% full, well ahead of the EU’s 1 November target, compared to 77% at the same time last year,” said Bromander.

UK storage is 100% full and German storage is 95% full. Austria and Hungary sit at 78% and are on track to meet the EU’s target of 80% by Nov. 1.

The EC has not reached consensus on whether to cap the price of gas for end users, with some countries pushing back on the idea due to the negative impact it could have on the supply-demand balance. Several countries, including Germany, remain fundamentally opposed to a gas price cap on fears it could exacerbate the energy crisis by failing to address the EU’s fundamental supply issues, Rystad Energy said. For major gas suppliers such as Norway, which is currently maximizing production to meet Europe’s needs, a price cap could encourage producers to revert to gas injection for enhanced oil recovery.

The EC will meet in Brussels Oct. 20-21 to discuss various price cap options.

“Firstly, the EC is considering measures to expand the list of assets that companies can use as collateral, boosting their ability to hedge transactions. Secondly, they are considering creating a joint platform for gas purchases, a joint procurement which is key to ensuring that the EU can leverage their market power and avoid competing for a limited pool of volumes. Third, they are planning a new benchmark, with the intention of providing an alternative to the TTF that they feel may better reflect LNG prices,” Bromander said.