IEA: Russian oil exports fall as trade flow reallocation slows

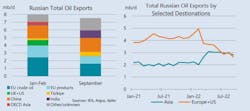

Russian oil exports fell 230,000 b/d in September to 7.5 million b/d, with crude down 260,000 b/d and products up by 30,000 b/d, according to data from the International Energy Agency (IEA). Revenues were down $3.2 billion to $15.3 billion on both lower volumes and prices but were still higher than the average monthly revenue in 2021.

Shipments to European Union countries fell by 390,000 b/d month-on-month (m-o-m) to 2.6 million b/d, with its share down to just 35% in Russia’s total oil exports, compared to 50% at the start of the year.

Exports to India were stable m-o-m at just under 1 million b/d, while loadings to China and Turkey were down by 115,000 b/d and 50,000 b/d, respectively. However, with close to 500,000 b/d of oil going to yet unidentified destinations, final numbers for each importing region may result in significant revisions to preliminary figures.

Nevertheless, the share of Russian oil exports to western markets fell, while Asian buyers gained in importance. In September, declared shipments to China and India combined were 160,000 b/d higher than those to Europe, including EU and non-EU countries. The US stopped importing Russian oil in April.

Since June, China has been the largest importer of Russian crude oil, ahead of the combined EU countries. EU crude oil imports from Russia fell to just 1.6 million b/d in September. While it has taken 7 months for them to replace 800,000 b/d of Russian crude oil imports, they will need to switch an additional 1.3 million b/d of seaborne and pipeline volumes in the 2 months remaining until the EU ban on Russian oil kicks in.

Oil product loadings to EU countries fell 130,000 b/d m-o-m to 965,000 b/d, bringing the cumulative post-Ukraine-invasion loss to 550,000 b/d. Diesel shipments were down by 70,000 b/d m-o-m to just 510,000 b/d.