EIA revised down global oil production forecasts for 2023

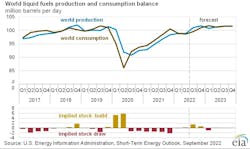

In its October issue Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts global oil production for 2023 to average 100.7 million b/d. The forecast is 600,000 b/d lower than in the September STEO and reflects announced cuts from OPEC+ as well as lower forecast crude oil production in the US.

EIA’s forecast for global oil consumption forecast for 2023 is 101 million b/d, which is 500,000 b/d lower than in the September STEO and reflects Oxford Economics lowering its forecast for global GDP growth in 2023 to 2.2% this month from 2.7% last month.

“September marked the third consecutive month in which the Brent crude oil futures price decreased, bringing the total decrease to $27/bbl in those three months. These decreases in crude oil prices have not affected all countries evenly, however, because Brent crude oil is priced in US dollars. Investors have increasingly purchased US financial assets as a result of the Federal Reserve raising interest rates to curb inflation and because investors seek out US currency as a safe-haven asset during uncertain economic conditions. This trend has led to the U.S. dollar increasing to its highest value since 2002. For countries using other currencies, including many of the globe’s emerging markets, the strengthening US dollar makes it more expensive to convert local currency into the US dollars necessary to import crude oil. A strengthening dollar also creates additional macroeconomic uncertainty by raising debt servicing costs for countries holding US dollar-denominated debt,” EIA said.

EIA also forecasts the Brent crude oil spot price averages $93/bbl in fourth-quarter 2022 and $95/bbl in 2023. Potential petroleum supply disruptions and slower-than-expected crude oil production growth could lead to higher oil prices, while the possibility of slower-than-forecast economic growth may contribute to lower prices.

According to EIA forecasts, US crude oil production will average 12.4 million b/d in 2023, which is down from a forecast of 12.6 million b/d last month. Lower crude oil production in the forecast reflects lower crude oil prices in fourth-quarter 2022 than EIA previously expected.

In the October STEO, EIA forecasts the Henry Hub natural gas spot price will average about $7.4/MMbtu in fourth-quarter 2022, which is about $1.6/MMbtu less than EIA’s forecast in the September STEO. The forecast largely reflects price declines in September that lowered the starting point for the forecast, amid slightly higher expectations for US production in late 2022.

Meantime, in the Winter Fuels Outlook, EIA forecasts that average household expenditures for home heating fuels will increase this winter because of both higher expected fuel costs and higher energy consumption due to colder temperatures. Compared with last winter, in nominal terms, EIA forecasts expenditures for homes that heat with natural gas will rise by 28%, heating oil by 27%, electricity by 10%, and propane 5% from October–March.