IEA: LNG contracting has returned to more traditional terms

Recent global LNG contracting activity has shown a return to traditional destination-fixed terms, while the duration and volume terms are more balanced, the International Energy Agency (IEA) said in its latest quarterly Gas Market Report.

“The observed tightening of the LNG market since late 2020, further exacerbated by a sharp demand recovery and supply outages in 2021, and by extreme market tensions caused by Russia’s invasion of Ukraine, has put sellers in a stronger position to demand more traditional features in newly signed LNG contracts, such as longer durations, fixed destination, and larger quantities. Meanwhile, the opposing trends of short-term scarcity and longer-term uncertainty of natural gas demand have prompted certain buyers to opt for shorter and smaller contracts. In the past, similar gaps between seller preferences and buyer requirements were bridged by portfolio players who contracted primary supplies on a flexible long-term basis and resold these volumes with shorter durations and in smaller volumes to end users at a premium. However, this model requires primary export volumes to remain destination flexible and portfolio players to retain their appetite for such open positions in the future,” IEA said.

Destination-fixed terms

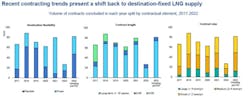

Flexible contracts accounted for almost 80% of the average contracted volumes in 2018-2019, driven by new final investment decisions (FIDs) in the US. Most of these were on free on board (FOB) transport terms, which provides the greatest flexibility to portfolio players to leverage their trading capabilities, IEA said.

However, the share of destination-flexible contracts dropped to 35% in 2020 and 11% in 2021, while the share of destination-fixed contracts rose correspondingly.

“This trend of returning to destination-fixed terms results from a declining share of flexible supply sources in contracting activity (mainly in the US) and a corresponding rise in available supply from Eurasia and the Middle East, with a preference for fixed-destination sales contracts,” said IEA.

The shares of the two terms have been more balanced in the first 8 months of 2022, with destination-fixed contracts accounting for 47% of the total 27 billion cu m (bcm) signed with post-FID projects during this period.

As older fixed-destination contracts expire, almost 60% of primary (sourced directly from export project owners, as opposed to secondary volumes sold by portfolio players) LNG export volumes will come from flexible-destination contracts by 2025, according to current contracts.

Nevertheless, destination fixed contracts may appeal to buyers who would otherwise need to import LNG from the volatile spot market, where they face not only competition between European and Asian buyers, but also the ups and downs of an often-turbulent global LNG market, IEA said.

Long-term contracts

Meantime, long-term contracts (> 10 years) accounted for around 74% of newly signed LNG contract volumes in 2020 and 84% in 2021, a significant increase from an average of 60% in 2015-2019. This high share in 2021 was driven by Asian buyers, which accounted for 84% of contracted long-term volumes. China alone was responsible for 63% of them, in conjunction with a flurry of new investments in LNG receiving terminals.

“Although the import of gas via pipeline is generally cheaper than importing LNG from external supply sources, China nonetheless bought the majority of its gas imports in the form of LNG in 2021,” IEA said.

Size

In terms of size, large contracts (exceeding 4 bcmy) accounted for 22% of contracted volumes in 2021, a sharp increase from only 13% in 2020 and their highest share since 2015. Medium-sized contracts (2-4 bcmy) and small contracts (< 2 bcmy) made up 38% and 40% of the total volume in 2021, respectively. During the first 8 months of 2022, 40% of newly signed contracts had contracted volumes below 4 bcmy. Only two contracts were concluded with large volumes, by portfolio players.

“This reflected some risk aversion on the part of the buyers, which prompted them to sign smaller contracts in the face of the current market tightness and longer-term uncertainties,” IEA said.

On the export side, the US accounts for the bulk of additional contracted volumes, with a tenfold increase between 2017 and 2025 based on contracts concluded with post-FID projects. On the import side, the share of the Asia Pacific region remains broadly stable to 2025, with a significant increase going to China, which reaches almost 160 bcm by 2025, two and a half times higher than in 2017. Contracted volumes going to traditional Asian buyers, including Japan and Korea, by contrast are decreasing gradually. Europe’s contractual position (based on current volumes) is also on course for a nearly 40% decline by 2025 compared to 2021 levels.