EIA: Publicly traded global oil and natural gas companies added proved reserves in 2021

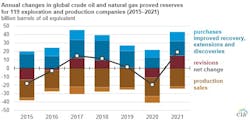

Annual financial reports by 119 publicly traded exploration and production companies show that their proved reserves totaled 293 billion boe at end 2021, 6% higher than end 2020, according to the US Energy Information Administration (EIA)’s 2021 Financial Review. After net purchases and production, the companies added 19.2 billion boe to proved reserves in 2021. Excluding revisions, the companies replaced 77% of their production through organic proved reserve additions.

Proved reserve levels are affected by a number of factors, including the price of crude oil or natural gas, company actions, such as sales, acquisitions, and spending on exploration and development (E&D). Proved reserves are estimated volumes of hydrocarbon resources that an analysis of geologic and engineering data demonstrates with reasonable certainty are recoverable under existing economic and operating conditions.

EIA based its analysis on the published financial reports of 119 domestic and international companies to the Securities and Exchange Commission (SEC) and collected by Evaluate Energy Ltd. EIA’s conclusions do not represent the global exploration and production sector as a whole because its analysis did not include private companies that do not publish financial reports. EIA estimates that the 119 companies in this analysis accounted for about 60% of total non-OPEC liquid fuels production in 2021.

“Although many of these companies have global operations, some are national oil companies with reserves and operations concentrated in their home countries, such as Russia, China, and Brazil. Company assessments of their proved reserves of crude oil and natural gas change from year to year because of revisions to existing reserves resulting from price changes, extensions and discoveries of new resources, purchases and sales of proved reserves, and production,” EIA said.

The 119 companies in this analysis collectively spent $244 billion on E&D in 2021, 28% less than the pre-pandemic 5-year (2015–19) average.