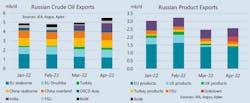

Despite current sanctions and more to come, total Russian oil exports rose by 620,000 b/d in April to 8.1 million b/d, returning to the January-February (Jan-Feb) average, according to the International Energy Agency (IEA). Nonetheless, a reorientation of trade flows is already taking shape, with a notable shift of volumes from Europe and the US to India.

The US was the second country to declare an embargo on Russian oil imports, with no cargoes loaded in Russia in April for delivery to the US. Shipments to the UK, also sanctioned, all but stopped, too. Most product volumes previously going to the US and the UK have yet to find alternative markets, leading to lower refinery throughputs. This has resulted in higher crude oil exports in April despite production cuts, IEA noted.

IEA’s preliminary assessment of Russian oil trade is primarily based Kpler tanker tracking data. “We aggregate loadings by seller and by port to distinguish between Russian and non-Russian origin barrels, as Russian Black and Baltic Sea ports also ship Central Asian and Caspian crude and products for exports. For overland flows we assumed no change in Druzhba deliveries, based on preliminary reports; a 40% reduction in rail exports to the EU countries; a monthly increase in crude deliveries to Belarus and no change in deliveries to China,” IEA said.

Reductions in shipments to the European Union (EU) (-535,000 b/d), the US (-545,000 b/d), and the UK (-160,000 b/d) were primarily offset by increases to India (+730,000 b/d) and Turkey (+180,000 b/d).

“The EU remained the largest market for Russian oil exports in April, with 3.4 million b/d, or 43%. Its share, however, was down from 50% at the start of the year, with volumes falling by 535,00 b/d. The US and the UK together accounted for 9% of Russian exports earlier in the year, but their share went to zero in April. India’s market share was up from zero to 10%,” IEA said.

However, some 430,000 b/d, or 7% of April seaborne volumes were missing destination information. This was mostly the case for fuel oil and naphtha cargoes, likely implying ship-to-ship transfers for subsequent exports to Asia, IEA explained.

Specially, Russia’s crude oil exports increased by 520,000 b/d month-on-month (m-o-m) in April and 630,000 b/d versus the Jan-Feb average. Crude exports to the EU fell by 65,000 b/d m-o-m, and by a total of 330,000 b/d compared to the pre-war average. The EU’s share in total crude exports went down to 37% in April from 49% in Jan-Feb, while India’s share increased from nothing to 14%. China’s share was marginally down to 30% from 33%.

For products, volumes backed out of the US, EU, and the UK (450,000 b/d, 205,000 b/d, and 140,000 b/d, respectively) were only partly offset by an increase in undisclosed destinations (+300,000 b/d). Diesel exports fell by 60,000 b/d m-o-m to 815,000 b/d, and by 155,000 b/d compared to the pre-war average. Volumes to the EU fell by just 43,000 b/d compared to Jan-Feb average, but its share in Russian diesel offtake increased to 69% from 62%.

Despite higher exports, estimated export revenues fell m-o-m by $2.3 billion, due to lower prices. “We assume a 25% discount to European products assessments for the purpose of these calculations. However, total oil export revenues were up by more than 50% y-o-y for the first 4 f months of the year compared to the same period last year,” IEA said.