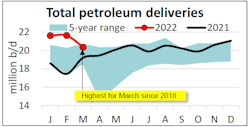

US petroleum demand, as measured by total domestic petroleum deliveries, was 20.4 million b/d in March—a 5.9% decrease from February but the highest demand for the month of March since 2018, according to a recent American Petroleum Institute report.

However, the monthly percentage decrease was its second largest for March in a decade and about 70% as strong as that of March 2020, with the onset of the COVID-19 pandemic.

“Other oils” (naphtha, gasoil, propane, propylene) that feed refinery and petrochemical operations, including packaging, films, and medical plastics, dropped the most.

As urban commuting resumed, consumer gasoline demand, measured by motor gasoline deliveries, was 8.7 million b/d in March. This reflected an increase of 0.1% month-on-month from February and 1.8% year-on-year compared with March 2021.

Distillate deliveries of 4 million b/d decreased by 8.8% month-on-month from February to their lowest for the month of March since 2016. DAT iQ industry trendlines showed that spot trucks available in March increased by 29% month-on-month, while the number of available loads rose by only 2.2% month-on-month, which appeared to be consistent with the possibility that the trucking activity and freight demand slowed.

Kerosene-type jet fuel deliveries of 1.5 million b/d in March—their highest so far in 2022—increased by 4.2% month-on-month from February and 29.6% year-on-year compared with March 2021. High-frequency data from Flightradar24 and TSA showed that the numbers of flights and air passenger volumes also rose by 8% month-on-month and 18.5% month-on-month, respectively. The International Air Transport Association indicated that air passenger and cargo volumes have picked up despite Russia’s war on Ukraine and “challenges in the trading environment.”

Deliveries of residual fuel oil, which is used as a marine bunker fuel and internationally in electric power production, space heating, and industrial applications, were 400,000 b/d in March, which reflected increases of 21.1% month-on-month and 26.1% year-on-year. The increases occurred despite reports of a drop in marine shipping activity but could have reflected shipping fuel substitution towards relatively less expensive residual fuel oil in lieu of distillates.

Deliveries of refinery and petrochemical liquid feedstocks—naphtha, gasoil, and propane/propylene (“other oils”)—were 5.9 million b/d in March, down by 1 million b/d month-on-month from February, but up by 22.4% year-on-year compared to March 2021. The monthly drop likely reflected lower demand for medical plastics, films, and packaging as the global numbers of Omicron COVID cases decreased.

US oil supply

US crude oil production of 11.7 million b/d in March increased by 0.4% month-on-month and 4.7% year-on-year. Despite the increase, however, crude oil production remained 33,000 b/d lower than it was in December 2021. Baker Hughes reported 533 active oil-directed rigs in March, a 2.2% month-on-month increase from February but 36.3% less than the 828 rigs that ran in March 2019, which as a benchmark preceded the strongest US crude oil production later that year. US NGL production increased by 2.6% month-on-month to 5.7 million b/d, its highest level on record since 1973.

International trade, refining, stocks

The US returned to being a net exporter of total petroleum—crude oil and refined products—of 500,000 b/d in March. The return was driven by a 1.5 million b/d monthly increase in US exports, including an increase of more than 1 million b/d of refined product exports helping to meet global demand at an uncertain time when international petroleum prices rose by relatively more than US ones.

In March, US refinery throughput was 16.2 million b/d and implied a capacity utilization rate of 90.5%. This was highest throughput for any month since July 2021—and the highest capacity utilization rate for the month of March since 2018.

Total petroleum inventories, including crude oil and refined products (but excluding the Strategic Petroleum Reserve), of 1.2 billion bbl increased by 0.2% month-on-month from February and 8.5% year-on-year compared to March 2021. US crude oil inventories fell by 0.3% month-on-month to 411.4 million bbl, their lowest for any month since August 2018.