EIA revised down Russian oil production forecasts

In the March Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) revised down Russian oil production forecasts and noted that market participant trading activity combined with the active war involving Russia create a great deal of uncertainty and risk for global crude oil production and prices.

EIA now forecasts Russia’s liquid fuels production to average 10.8 million b/d in both 2022 and 2023, which is unchanged from 2021, but 700,000 b/d and 1.1 million b/d lower, respectively, than the agency’s forecast in the February STEO. This forecast remains subject to significant revisions because the extent to which sanctions and other private corporate actions will affect production remains unclear, EIA said.

Brent crude oil spot prices averaged $97/bbl in February, an $11/bbl increase from January. Daily spot prices for Brent closed at almost $124/bbl in the first week of March as the further invasion of Ukraine by Russia and subsequent sanctions on Russia and other actions created significant market uncertainties about the potential for oil supply disruptions.

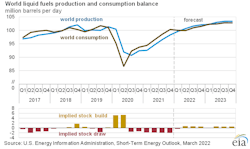

“These events come against a backdrop of low oil inventories and persistent upward oil price pressures,” EIA said. Global oil inventories have fallen steadily since mid-2020, and inventory draws averaged 1.8 million b/d from third-quarter 2020 through end 2021. EIA estimates that oil inventories fell further in the first 2 months of 2022 and that commercial inventories in the OECD ended February at 2.64 billion bbl, which is the lowest level since mid-2014.

EIA expects the Brent price will average $117/bbl in March, $116/bbl in second-quarter 2022, and $102/bbl in second-half 2022. Overall, EIA forecasts the Brent crude oil spot price will average $105/bbl in 2022, which is $22/bbl more than its forecast in the February STEO. And EIA expects the average price to fall to $89/bbl in 2023.

However, EIA noted that this price forecast is highly uncertain. “Actual price outcomes will be dependent on the degree to which existing sanctions imposed on Russia, any potential future sanctions, and independent corporate actions affect Russia’s oil production or the sale of Russia’s oil in the global market. In addition, the degree to which other oil producers respond to current oil prices, as well as the effects macroeconomic developments might have on global oil demand, will be important for oil price formation in the coming months. Although we reduced Russia’s oil production in our forecast, we still expect that global oil inventories will build at an average rate of 500,000 b/d from 2022 second quarter through the end of 2023, which we expect will put downward pressure on crude oil prices. However, if production disruptions—in Russia or elsewhere—are more than we forecast, resulting crude oil prices would be higher than our forecast,” EIA said.

Russia oil production

Several western energy companies, including ExxonMobil, Shell, BP, and Equinor, have said they are stopping operations in Russia and ending partnerships with Russian firms. Some European refiners, shippers, and insurance companies are not purchasing or shipping crude oil from Russia, even without formal energy sanctions. EIA expects that the withdrawal of some firms from Russia, combined with limitations on finance, are likely to contribute to ongoing constraints on Russian new field development and crude oil production with ongoing effects into the medium term.

EIA estimates Russia produced 11.3 million b/d of petroleum and other liquids in February 2022 and expects that production in Russia will fall by 250,000 b/d in March, with an additional decline of 500,000 b/d in April.

“Although Russia’s crude oil production and export capacity will continue to be available, there is considerable uncertainty to which degree countries will continue to import crude oil and petroleum products from Russia. While we recognize that the range of outcomes for Russia’s oil production is wide, we assume that there will be a decrease in Russian crude oil exports, and therefore in production, in the coming months. With crude oil exports decreasing, onshore storage likely will fill up quickly because of limited onshore storage capacity, which will necessitate production shut-ins and the use of floating storage on ships. We assess that most of Russia’s crude oil will find export destinations, but we expect there will be a temporary dislocation of production and exports as new trade routes are established and as Russia finds other crude oil buyers. However, this assessment is based on sanctions as of March 3, 2022, and it is subject to significant uncertainty about the way in which market participants will respond to those sanctions,” EIA said.

EIA expect that Russia’s liquid fuels production will decrease by about 700,000 b/d in second-quarter 2022 compared with first-quarter 2022 and then increase slightly in third-quarter 2022. Overall, EIA expect Russia’s production to be about 500,000 b/d lower in December 2022 compared with February and to remain flat in 2023.

Global oil consumption

EIA forecasts that global consumption of petroleum and liquid fuels will average 100.6 million b/d for all of 2022, up 3.1 million b/d from 2021. EIA also forecasts that consumption will increase by 1.9 million b/d in 2023 to average 102.6 million b/d.

However, as economic forecasts in this outlook were completed before Russia’s further invasion of Ukraine, the outlook for economic growth and oil consumption in Russia and surrounding countries is highly uncertain., EIA said. Oil consumption will depend on how economic activity and travel respond to recent and any potential future events and sanctions.

US crude oil production

US crude oil production fell below 11.6 million b/d in December 2021 (the most recent monthly historical data point), a decline of 200,000 b/d from November 2021. EIA forecasts that production will rise to average 12 million b/d in 2022 and then to record high production on an annual-average basis of 13 million b/d in 2023. The previous annual-average record of 12.3 million b/d was set in 2019.