Westwood: Offshore investment in 2021 returned to pre-pandemic levels

Year-on-year growth for the global offshore rig market end 2021 was up 200% from 2020, according to Westwood Global Energy Group. The increase was aided by engineering, procurement, and construction (EPC) spend, closing last year at $41.7 billion, close to 2019 levels, it continued.

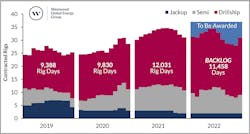

Global rig contract fixtures, including options exercised, totaled 142 in fourth-quarter 2021, representing 54,829 rig days, a 155% increase compared to third-quarter 2021, the energy market research and consultancy firm said.

“Several major drilling regions, including North America, South America, and the Middle East have experienced minimal fall out. In fact, South America has fared particularly well, ending last year in better shape than before the pandemic. Brazil remained particularly buoyant, with high EPC spend coupled with no instances of contract cancellations resulting in continued drilling throughout the period,” said Alex Middleton, senior market analyst.

However, industry growth is globally uneven with Africa, Southeast Asia, and the North Sea falling behind due to the pausing of major drilling projects in response to political and legal uncertainty, the report noted. The Cambo project in the UK West of Shetland that was put on hold in fourth-quarter 2021, after Shell decided to exit development. Operator Siccar Point Energy then decided to pause the project since it couldn’t proceed with the original timescale (OGJ Online, Dec. 3, 3021).

According to Siccar Point, Cambo could deliver 170 million bbl of oil over 25 years, and 53.5 bcf of gas. Exploration licenses date back to 2001 and the current licence is due to expire in March 2022. The UK government is required to approve drilling.

“For these regions, contracted rigs have been on a downward trajectory, hitting rock bottom at the close of 2020. Drilling projects have been halted amidst uncertainty, however there are several major projects on the horizon that, if picked up, could help drive a recovery,” Middleton said.