IEA: Unexpected outages extended sharp drawdown in global oil stocks

Unexpected outages during August forced a decline in supply for the first time in 5 months and extended the sharp drawdown in global oil stocks, the International Energy Agency (IEA) said in its latest monthly Oil Market Report (OMR).

The most severe by far was Hurricane Ida, which wreaked havoc on the key US Gulf Coast oil producing region at end August, knocking 1.7 million b/d offline. Overall, world oil supply fell 540,000 b/d month-on-month in August to 96.1 million b/d and is expected to hold steady in September as unplanned outages offset increases from OPEC+. At the same time, concerns over the impact of rising COVID-19 cases on oil demand kept a lid on prices, with benchmark crudes falling month-on-month before edging marginally higher in early September.

“Hurricane Ida is still causing problems for US and global markets. Offshore installations and refineries have been slow to restart due to the severity of the storm, forcing massive stock draws of both crude and products in key markets. The biggest impact on supply will be seen in September, with total supply losses estimated at around 30 million bbl,” IEA said.

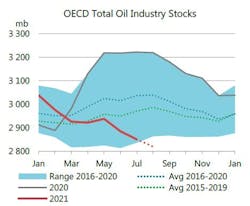

Already in August, production outages led to further sharp declines in inventories. Preliminary data show OECD oil stocks falling by more than 30 million bbl last month, extending steep losses over June and July. By end July, OECD total industry stocks stood 185.7 million bbl below the most recent 5-year average. With nearly 900,000 b/d of crude output and 700,000 b/d of refinery capacity offline at the time of the OMR writing, hefty draws are expected to continue through September, according to IEA.

The US Department of Energy announced Aug. 23 a sale of up to 20 million bbl from its Strategic Petroleum Reserve (SPR) as part of its program to use the SPR to finance spending. The deliveries will take place between Oct. 1 and Dec. 15 and could offset some of the losses from Hurricane Ida. The US government also is loaning barrels from the SPR to the region’s refiners to help offset crude shortfalls.

China, too, is tapping into its strategic reserves. For the first time ever, it will sell oil from state-owned tanks in an effort to dampen domestic oil prices and inflationary pressures. It is unclear how many barrels will be made available to the market.

At the same time, demand growth in China and elsewhere in Asia is under pressure from resurgent COVID cases. IEA has revised down its world oil demand forecast for August and September by nearly 600,000 b/d as China and a number of other Southeast Asian countries enforce more mobility restrictions.

However, strong pent-up demand and continued progress in vaccination programs should underpin a robust rebound from fourth-quarter 2021. IEA’s annual growth forecast is revised marginally lower since last month’s Report for 2021 (-110,000 b/d) to 5.2 million b/d while 2022 growth is slightly higher, at 3.2 million b/d.

“The market should shift closer to balance starting from October if OPEC+ continues to unwind production cuts. Even so, it is only by early 2022 that supply will be high enough to allow oil stocks to be replenished. In the meantime, strategic oil stocks from the US and China may go some way to help plug the gap,” IEA said.