IEA: Global oil demand falls in July on Delta variant spread

Global oil demand surged by 3.8 million b/d month-on-month (m-o-m) in June, almost three times the seasonal norm, led by increased mobility in North America and Europe, but demand growth abruptly reversed course in July. In its latest Oil Market Report, the International Energy Agency (IEA) estimates that demand fell in July by 120,000 b/d m-o-m, as the rapid spread of the COVID-19 Delta variant undermined deliveries in China (-760,000 b/d m-o-m), Indonesia (-130,000 b/d m-o-m), and other parts of Asia.

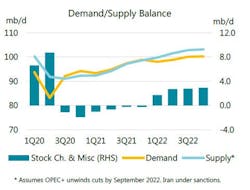

IEA’s outlook for the remainder of the year has been appreciably downgraded due to the worsening of the pandemic and revisions to historical data. Second-half 2021 oil demand has been lowered by over 500,000 b/d since last month’s report. Global oil demand is now seen rising 5.3 million b/d on average, to 96.2 million b/d in 2021, and a further 3.2 million b/d in 2022.

World GDP is expected to expand by 6.2% in 2021 and 4.6% in 2022, but downside risks are increasing. Prompt indicators suggest that the strength of the recovery is slowing, with the IHS Markit Global Composite Output Index falling to 53.4 in July from 56.6 in June. While this was expected as the recovery matured, the upwelling of COVID-19 infections appears to have weighed on the resurgence in some economies, IEA said.

Meanwhile, global oil supply is ramping up fast. In July, producers boosted output by 1.7 million b/d to 96.7 million b/d, as Saudi Arabia ended voluntary curbs and the North Sea bounced back from maintenance. Supply is expected to rise further after the producer bloc agreed to a deal July 18 that aims to raise production by 400,000 b/d a month from August until the remaining cuts are phased out.

Global oil inventories have been falling sharply, and in June, OECD industry stocks plunged by 50 million bbl, or 1.7 million b/d, to stand 131 million bbl below the 5-year average. Stock draws could persist for the remainder of the year assuming sanctions continue to shut in Iranian crude.

According to IEA’s current balances, OPEC and its allies (OPEC+) looks set to pump about 200,000 b/d below the call on its crude during the last quarter of 2021, compared with a deficit of up to 2 million b/d expected earlier.

But the scale could tilt back to surplus in 2022 if OPEC+ continues to undo its cuts and producers not taking part in the deal ramp up in response to higher prices, IEA noted. Following a modest increase of 600,000 b/d on average in 2021, supply from outside the OPEC+ group is forecast to expand by 1.7 million b/d next year, of which the US will account for nearly 60%.

“OPEC+ can still pause, continue, or even reverse its curbs as required by the market and it looks unlikely that the unwinding of cuts will continue on a linear trajectory in 2022,” IEA said.

Meantime, the recovery in global refinery activity slowed in July as new waves of COVID-19 cut into fuel demand while margins remained under pressure. Throughputs are expected to rise marginally in August before seasonal maintenance starts. Runs in third-quarter 2021 were reduced on demand downgrades, narrowing the increase over second-quarter 2021 levels to 2.5 million b/d. Global refinery runs are now forecast to rise by 3.7 million b/d to 77.9 million b/d in 2021 over year ago levels, still 3.7 million b/d below 2019 levels.

The crude price rally in second-quarter 2021 lost steam in July on fears that new COVID-19 Delta cases and weaker economic indicators could slow the oil demand recovery just as more supply hit the market. Despite big swings, North Sea Dated still rose $2.03/bbl to $74.99/bbl but fell to $70.73/bbl in early August. Backwardation only eased in August with the fall in prices.