IEA: Global oil demand will surpass pre-COVID levels by end-2022

In its latest monthly Oil Market Report, the International Energy Agency (IEA) forecasts that, following a record decline of 8.6 million b/d in 2020, global oil demand will rebound by 5.4 million b/d in 2021 and a further 3.1 million b/d next year, to average 99.5 million b/d. By end-2022, demand should reach 100.6 million b/d, surpassing pre-COVID levels.

“The recovery will be uneven not only amongst regions but across sectors and products. While the end of the pandemic is in sight in advanced economies, slow vaccine distribution could still jeopardize the recovery in non-OECD countries,” IEA said.

“The aviation sector will be the slowest to recover as some travel restrictions are likely to stay in place until the pandemic is brought firmly under control. Gasoline demand is also expected to lag pre-COVID levels, as continued teleworking practices and a rising share of electric and more efficient vehicles provide an offset to increased mobility. Petrochemicals will be boosted by robust demand for plastics, while global trade supports bunker demand.”

According to IEA’s forecast, the OECD accounts for 1.3 million b/d of 2022 growth while non-OECD countries contribute 1.8 million b/d. Jet and kerosene demand will see the largest increase (+1.5 million b/d y-o-y), followed by gasoline (+660,000 b/d y-o-y) and gasoil-diesel (+520,000 b/d y-o-y).

The forecast also highlights the challenges outlined in the IEA’s recently released ‘Net Zero by 2050 - A Roadmap for the Global Energy Sector,’ which notes that most pledges by countries are not yet underpinned by near-term policies and measures. In the meantime, oil demand looks set to continue to rise, underlining the effort required to get on track to reach stated ambitions.

Oil prices

Crude prices rose during May on bullish oil fundamentals and financial markets, while backwardation steepened on both benchmark crude futures contracts, reflecting anticipation of tighter markets ahead. North Sea Dated Brent rose $3.95/bbl in May to $68.54/bbl and reached $69.84/bbl in the first week of June. Tanker freight costs remained weak overall during May.

Oil supply

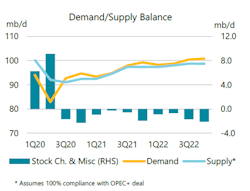

IEA’s first detailed look at 2022 balances confirms earlier expectations that OPEC and its allies (OPEC+) need to open the taps to keep world oil markets adequately supplied.

According to IEA forecasts, world oil supply is expected to grow at a faster rate in 2022, with the US driving gains of 1.6 million b/d from producers outside the OPEC+ alliance. That leaves room for OPEC+ to boost crude oil production by 1.4 million b/d above its July 2021-March 2022 target to meet demand growth. In 2021, oil output from non-OPEC+ is set to rise 710,000 b/d, while total oil supply from OPEC+ could increase by 800,000 b/d if the bloc sticks with its existing policy.

“Meeting the expected demand growth is unlikely to be a problem. Even after boosting oil production by around 2 million b/d over the May-July period, OPEC+ will have 6.9 million b/d of effective spare capacity. If sanctions on Iran are lifted, an additional 1.4 million b/d could be brought to market in relatively short order. As for those producers outside the alliance, output growth is set to accelerate from 700,000 b/d in 2021 to 1.6 million b/d next year. The US leads 2022 gains, adding more than 900,000 b/d to total supply, followed by Canada, Brazil, and Norway. That leaves non-OPEC+ output well above 2019 levels. By contrast, even if OPEC+ producers were to fill the gap created by demand growth, the bloc’s output would still be more than 2 million b/d below the 2019 average,” IEA said.

Refining

The refining sector, meanwhile, is expected to remain under pressure, according to IEA. In 2022, demand for refined products will still be below 2017 levels. Following net capacity additions of 3.3 million b/d over the 2017-20 period, a further 1.5 million b/d of new net crude distillation capacity will come online in 2021-22. This means that global average utilization rates reach 78%, limiting any rebound in refinery margins from the depressed 2020-21 levels.

Global refinery throughput in 2021 is expected to recover half of the 7.4 million b/d fall in 2020, lagging demand growth for refined products as surplus inventories are drawn down. In 2022, refining activity is forecast to increase by 2.4 million b/d. The 3.8 million b/d of new capacity coming online over 2021-22 will be partially offset by 2.3 million b/d of announced closures or conversions to biorefineries.

Oil stocks

OECD industry stocks held relatively steady in April at 2.926 million bbl but fell 1.6 million bbl below the pre-COVID 2015-19 average for the first time in more than a year.

May preliminary data for the US, Europe, and Japan show that industry stocks rose by a combined 17.2 million bbl. Crude oil held in short-term floating storage declined by 6.8 million bbl to 99.4 million bbl in May, its lowest since February 2020.