US LNG exports in May hit record high for the month

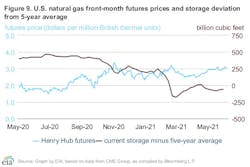

Every month since November 2020 has been among the 10 highest months for US LNG exports on record. Stable US production during this period in combination with high exports reduced storage levels below their previous 5-year average. Although natural gas stocks were 191 bcf higher than the 5-year (2016–20) average at the start of the year, they were 61 bcf lower than the 5-year average as of the week ending May 28.

Front-month natural gas futures prices have increased as stocks have decreased, starting the year at $2.58/MMbtu and closing at $3.04/MMbtu on June 3. Although US natural gas futures prices have risen, futures price volatility has declined to low levels.

Historical volatility measures the magnitude of daily changes in closing prices for a commodity during a given time in the past. Based on rolling front-month contracts, the 30-day historical volatility of US natural gas futures prices was 27.9% on June 3, a significant decrease from 73.5% a year ago.

However, the May 2020 historical volatility was unusually high due to of pandemic-related disruptions. Historical volatility tends to be low in May because of less demand for natural gas as a fuel for heating or cooling. The previous 5-year (2015–19) average historical volatility for the first trading day of June was 35.7%.

This year, historical volatility has been even lower than the seasonal average. Prices have hovered within a somewhat narrow range around $3/MMbtu, likely because of stable US production and relatively stable US consumption stemming from slightly below-average cooling demand during May.

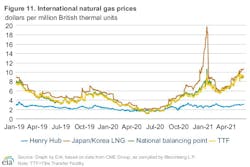

International natural gas prices

International LNG spot prices often reach yearly lows in May, but this year they have climbed to the high prices typically seen in winter months. The Japan-Korea Marker (JKM) price exceeded $10/MMbtu this May, compared with May 2019 and 2020 averages near $5/MMbtu and $2/MMbtu, respectively. The Title Transfer Facility (TTF) and National Balancing Point (NBP) prices in Europe have shown similar trends.

In Asia, efforts to build stocks in anticipation of demand for summer electricity and to prepare for heating demand next winter has increased demand for LNG imports and supported high prices. Because LNG stocks in Asia have been lower than usual this year due to significant draws during the extremely cold winter, demand in Asia for LNG imports has been much greater than usual.

In Europe, the coldest April in nearly a century and low inventories also supported higher demand and higher prices for LNG.

Because of this strong global demand for LNG, EIA forecasts that US LNG exports will continue to be high and average more than 9 bcfd for the remainder of 2021.