Rystad: Offshore project commitments set to hit record, deepwater to have top growth

Offshore project commitments are expected to not only recover but reach a new record—cumulatively almost 600 projects in the 5-year period toward 2025—according to Rystad Energy. Deepwater commitments will see the largest growth as costs have become much more competitive against greenfield continental shelf reserves.

For this analysis, Rystad defined a project as committed when more than 25% of its overall greenfield capex is awarded through contracts.

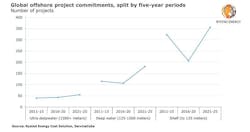

Looking at 5-year intervals, total offshore project commitments declined in 2016-2020 to 355 projects, down from 478 in 2011-2015. From beginning-2021 until end-2025, Rystad Energy forecasts 592 commitments, with growth across all water depth levels – shallow water (0-125 m), deepwater (125-1,500 m), and ultra-deepwater (beyond 1,500 m).

While shallow water commitments account for the largest share of the total offshore project pie, rising to 356 from 206 in the last 5 years, the increase is more modest—about 10% compared to the 2011-2015 count of 323 projects. The most impressive growth is that of deepwater commitments, with the number of projects rising to 181 from 106 in 2016-2020 and 115 in the 5 years before that.

Ultra-deepwater commitments also will pick up, but not by similar margins, as costs still bite. Rystad expects about 55 projects from this year until 2025, up from 43 in the previous 5 years.

"The growth in commitments will stimulate rising demand for floating production, storage and offloading vessels as well as subsea tiebacks. The search for large new fields in deep and remote waters became much more economically viable after dayrates for drilling rigs and offshore supply vessels fell in the wake of the oil price crash in 2014 and 2015. This offers significant support for companies interested in deepwater,” said Rajiv Chandrasekhar, energy service analyst at Rystad Energy.

Rystad Energy’s latest offshore cost benchmarking report notes the difference in the cost of greenfield shelf reserves compared to deepwater has fallen dramatically from the highs of 2014—from over $5/boe to around $1/boe in 2020.

Due to the expected growth in E&P activity over the next 5 years, the number of new offshore facilities is set to increase, meaning floaters and subsea tiebacks are also projected to rise. E&Ps are likely to prefer leased FPSOs over owned units—based on both reported data and the assumptions made by operators. Rystad Energy expects a 50% rise in the number of owned FPSOs expected to be used on upcoming projects until 2025.

Subsea tiebacks are significantly less capital-intensive compared to fixed and floater technologies, and they facilitate quicker turnaround times from the start of field development to first oil. Furthermore, the large number of pre-existing fixed facilities has made it progressively easier to opt for subsea production systems that can be tied back to these platforms. Even in shallow waters below 125 m, subsea and floater commitments will likely see their market share rise considerably over the next 5 years, though fixed platforms will remain the dominant solution for shelf developments.

“In terms of greenfield expenditure, we expect offshore project commitments in 2021-25 to be worth more than $480 billion, eclipsing the 2016-20 tally of around $320 billion by 50%. However, this is still well off the pace set in the 2011-15 period, when around $673 billion worth of commitments were made,” Chandrasekhar said.

“We expect ultra-deepwater activity to be primarily concentrated in South America, with over 50% of the total committed value, while the Middle East is likely to lead shelf developments with 40% of the total value. Deepwater investments are forecast to be less dependent on any particular region, with a quarter of greenfield expenditure expected in Europe,” he continued.