The downturn brought by the COVID-19 pandemic and the accelerating energy transition has created a new reality for the world’s oil and gas industry, whose production will peak lower and earlier than expected, according to Rystad Energy. The five integrated supermajors – ExxonMobil, BP, Shell, Chevron, and Total – posted a combined record loss of $76 billion in 2020.

The major chunk of this loss, $69 billion, can be attributed to asset impairments and write-offs as the supermajors re-evaluated strategy to become less dependent on petroleum. Their combined oil and gas output dropped by nearly 5%, or 900,000 boe/d, in 2020 from the year before.

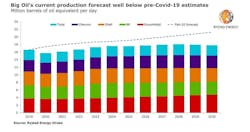

Lower emission targets and demand for cleaner energy have significantly impacted the long-term production outlook for the majors. Rystad Energy forecasts that the majors’ net production will be around 17.5 million boe/d in 2025 and peak at around 18 million boe/d in 2028, based on latest revisions. For context, internal forecast in February 2020—before shockwaves from COVID-19–stood at 19 million boe/d for 2025 and 20 million boe/d in 2028.

“Last year has certainly tested oil and gas majors like never before. Some recovery can be expected in the near future as demand rebounds and oil prices cross the $60 mark. However, the key to success for the five majors over the next decade will be to strengthen their business in more resilient regions, restructure and resize to match the market needs, and pay back their high debt levels,” said Rahul Choudhary, upstream analyst at Rystad Energy.

The majors’ net income declined sharply last year as low oil prices, OPEC production cuts, collapsing refining margins and weak chemical margins left no business segments unscathed. The five majors reported net losses in 2020 with ExxonMobil reporting the largest at $22.4 billion, followed by Shell and BP which also incurred losses of more than $20 billion. Total and Chevron fared better, relatively speaking, reporting net losses of $5-6 billion.

Before COVID-19 and the price crash, most companies assumed an oil price of $70-80/bbl, which allowed them to pursue higher-cost projects. After the price slump and with continued uncertainty around future oil demand, companies have reduced price assumptions to $55-70/bbl, making high-cost projects unviable.

European majors Shell and BP accounted for the largest year-on-year drop in production with about 300,000 boe/d each, while ExxonMobil and Total cut production by 200,000 boe/d and 150,000 boe/d, respectively. Chevron was the only major to increase its production in 2020, largely due to its $13 billion acquisition of Noble Energy that partially offset the production curtailments.

At the end of the year, total spending cuts stood at $26 billion, or 32% of the five majors’ initially announced guidance. Most of the capex cuts relate to greenfield development projects as the majors wait for a recovery in prices and demand before moving ahead with new projects.

Rystad Energy estimates that the five majors approved $30 billion less in greenfield investment in 2020 than they did the year before—a decline of 90%.

US majors ExxonMobil and Chevron raised a record amount of debt during the year, adding $19 billion and $18 billion respectively to net debt. As a result, both majors increased gearing ratio by 10% in 2020. Chevron’s gearing ratio remains below 25%. ExxonMobil’s gearing ratio is now close to 30%, and the company plans to avoid any additional debt in the near future. Due to the heavy debt burdens, both majors had their S&P credit ratings lowered a notch to AA- from AA.

European majors BP and Shell raised cash in hand by around 50%, thus reducing overall net debt for the year. However, all the majors had their gearing ratio raised in 2020, with BP and Shell both ending the year with a gearing above the 30% mark.