Rystad: COVID-19 downturn cut Australia’s oil and gas workforce by one-quarter

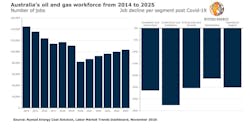

Already in decline, Australia’s oil and gas workforce saw a loss of over 28,000 jobs—one quarter of the country’s total count—due to the COVID-19 pandemic this year, according to Rystad Energy.

While some of the jobs will be restored from 2021 onwards, Australia’s oil and gas workforce will struggle to recover to pre-pandemic levels for at least 5 years, if ever, Rystad said.

In 2019, Australian oil and gas jobs numbered just over 110,000, a tally cut by the current downturn to just over 82,000, Rystad Energy said. The industry’s workforce had been declining steadily even before the present downturn, shrinking by nearly 24% in 2019 from 2014 levels due, in part, to lagging growth in operators’ spending in the country.

In the current downturn, over 8,000 jobs have been lost across the engineering and construction segments, representing nearly 29% of all industry job cuts this year. With the combined spending expected to further decline by almost 17% by end-2021, the segments are not expected to see a strong resurgence in short-term hiring levels.

Maintenance has been one of the best performing segments historically, and contrary to the performance of other segments, it witnessed a net addition in jobs in 2014-2019. As operators curtail discretionary spending and prioritize maintenance activities, the segment may remain resilient and avoid steep job cuts compared to the rest of the industry.

In line with the global trend, drilling is one of most affected segments, with over 1,100 drilling jobs cut in Australia, per Rystad estimates. However, starting in 2021, rig demand across the country is expected to rise and average 6.5 rig years in 2021-2025, offering a respite to workers across the drilling segment.

On an overall basis, Rystad expects the labor market will rebound starting in late 2021, adding a minimum of 20,000 jobs by 2025.

“In the future, the growth in labor demand will not only be driven by oil and gas projects that are under development, but also to a great extent by the infrastructure initiatives undertaken by the Australian government to bring gas prices down across the country,” said Sumit Yadav, energy service research analyst at Rystad Energy.

The government is expected to focus the bulk of its efforts on the country’s east coast, where residents pay gas prices that are double international prices, as most of the gas produced in the eastern region is exported.

To alleviate price issues, the government is planning the $1-billion Amadeus-to-Moomba gas pipeline, which will connect the east coast to Beetaloo shale assets, which have lower gas breakeven prices. The Port Kembla LNG import terminal expansion and the Hunter Gas Pipeline also will likely lower gas prices and lift labor demand in the coming years, Rystad said.

Despite these developments, hiring is not expected to replicate the historic highs of 2014 as the present downturn has adversely impacted the ability of major operators to accept the large-scale risks seen before the 2014 downturn—risks which helped Australia become the largest LNG exporter in the world.

With high breakeven prices for Australian gas assets, existing LNG terminals failing to run at nameplate capacity, and other concerns, operators are taking a more cautious approach to new investments, Rystad said. These factors, combined with the operational complications of COVID-19, mean operators are unlikely to make large-scale investments, thus directly impacting the labor requirement in the industry, Rystad Energy said.

The industry’s troubles could be slightly mitigated by government support, Rystad said. For example, in Southern Australia, the government has deferred all costs associated with exploration and licensing fees for the petroleum sector until end-2020. Similarly, the national government is actively championing a gas-led recovery from the pandemic, bringing hope for the oil industry which is now competing with the renewables industry in the increasingly low oil price environment.

When compared to labor demand, wages have fared relatively better, Rystad said. The industry’s workforce, on average, makes 50% more than the national average, with wages for industry-specific jobs such as petroleum engineers registering a compound annual growth rate of 3.38% over the past decade. However, this could soon change; the industry’s workforce may have to contend with lower wage growth in the coming years if the revenue prospects of industry players do not take a turn for the better, Rystad said.