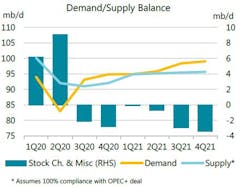

Due to weak historical data and the resurgence of COVID-19 in Europe and the US, the International Energy Agency (IEA) revised down its near-term global demand outlook in its November Oil Market Report, by 400,000 b/d in third-quarter 2020, 1.2 million b/d in fourth-quarter 2020, and 700,000 b/d in first-quarter 2021. IEA now expects demand to decrease by 8.8 million b/d in 2020 (versus 8.4 million b/d in last month’s report) and to rise by 5.8 million b/d in 2021 (versus 5.5 million b/d last month).

Oil prices initially surged at the news that an effective vaccine against COVID-19 might soon be available. The Brent front month futures price bounced back to over $45/bbl, a level not seen since the beginning of September. However, vaccines are unlikely to significantly boost demand until well into next year, according to IEA.

“It is far too early to know how and when vaccines will allow normal life to resume. For now, our forecasts do not anticipate a significant impact in the first half of 2021…The recent announcements of lockdowns and other containment measures in many countries have led us to significantly lower our estimates for global oil demand,” IEA said.

Nearly all of these massive demand reductions are found in Organization for Economic Co-operation and Development (OECD) countries. For the non-OECD world, IEA has raised demand estimates mainly due to improved expectations in China and India.

In 2020, global oil demand will be 91.3 million b/d, which is 8.8 million b/d lower than in 2019 and below the average level for 2013. In 2021, demand will recover by 5.8 million b/d to 97.1 mb/d, about 3 million b/d below the pre-COVID-19 level in 2019.

Supply

Meantime, global oil supply rose by 200,000 b/d m-o-m to 91.2 million b/d in October. Production from countries participating in the OPEC+ agreement held largely steady. Overall compliance was 103%. In November, world oil supply may rise by over 1 million b/d as the US recovers from hurricanes and Libya continues to bounce back, with production increasing to 1 million b/d from only 100,000 b/d in August.

Output from producers outside of OPEC+ is set to fall by 1.3 million b/d in 2020 and rise by 200,000 b/d next year. US supply falls by 600,000 b/d in 2020 and by 655,000 b/d in 2021.

Stocks, refining

OECD industry stocks fell for the second consecutive month by 19.7 million bbl in September to 3,192 million bbl and were 225 million bbl above their 5-year average. OECD industry crude stocks are only 51 million bbl below their peak in May. In third-quarter 2020, observed global stocks fell by 800,000 b/d. Preliminary data for October show crude stocks falling 8.4 million bbl in the US, 8.3 million bbl in Europe, and 1.2 million bbl in Japan. In October, volumes of crude oil held in floating storage decreased by 17.8 million bbl to 156.3 million bbl.

Global refining throughput fell in September as US hurricane shutdowns were not fully offset by higher activity elsewhere. Permanent shutdowns of refinery capacity now amount to 1.7 million b/d, but there remains significant structural overcapacity with more than 20 million b/d of crude distillation capacity idle.

In October, the modest fall in crude prices and tighter product markets contributed to generally stronger cracks, except for gasoline.

Weak fundamentals

According to IEA, in the short term, the poor outlook for demand and rising production in some countries suggest that the current fundamentals are too weak to offer firm support to prices. Physical crude prices remain below futures and this is a signal that markets are well supplied.

“We can see that OECD crude stocks in September are only 51 million barrels (4%) below their high point in May. Product stocks, following six consecutive months of builds, finally fell in September. With a Covid-19 vaccine unlikely to ride to the rescue of the global oil market for some time, the combination of weaker demand and rising oil supply provides a difficult backdrop to the meeting of OPEC+ countries due to take place on 1 December. Our current balances, incorporating the quota increase of 2 million b/d included in the OPEC+ supply agreement, imply almost zero stock change in the first quarter of 2021. Unless the fundamentals change, the task of re-balancing the market will make slow progress,” IEA concluded.