IEA: 2020 global gas demand to post largest drop on record

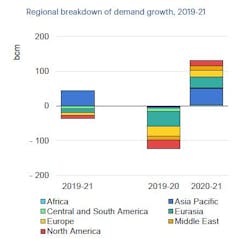

Global natural gas demand is forecast to fall 3% year-on-year (y-o-y) or about 120 bcm in 2020, according to the International Energy Agency (IEA)’s new report, Global Gas Security Review 2020. The decline in demand has been revised from IEA’s previous June forecast, which was projecting a 4% fall for this year. Despite the revision, 2020 is still assumed to experience the largest recorded drop in global natural gas demand.

Most declines in gas consumption have been observed in mature markets across Europe, Eurasia, North America, and Asia. Taken together these markets account for over 80% of the expected drop in global natural gas demand for 2020.

Natural gas demand is forecast to increase by 3% y-o-y in 2021 or about 130 bcm. The resurgence of COVID-19 cases and the prospect of a prolonged pandemic brings further uncertainty to the pace of recovery in 2021, which has led to a downward adjustment from the previous report.

The recovery of global gas demand in 2021 is likely to be supported by fast-growing markets in Asia, Africa, and the Middle East. More mature markets should see gradual recovery, and some may not reach their 2019 level in 2021.

Supply flexibility

With an unprecedented fall in global gas demand in the first half of the year, the whole natural gas value chain has had to provide flexibility to adjust supply, including production shut-ins, contractual flexibility mechanisms to reduce LNG and pipeline gas volumes or optimizing storage utilization onshore as well as at sea.

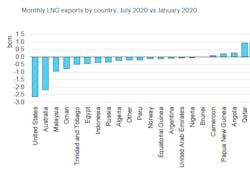

Although pipeline gas exporters bore the brunt of the supply-side adjustment to the demand drop caused by COVID-19, the majority of LNG exporting countries also experienced varying degrees of supply curtailment over first-half 2020. The US accounted for the biggest share of the downward adjustment in global LNG supply, underscoring the outsized role of US LNG in market balancing at a time of a historic oversupply.

According to IEA, without the flexibility of global LNG supply, the adjustment to the 2020 demand shock would have been less orderly and could potentially have had a damaging effect on the commercial and contractual structures underpinning global gas trade.

LNG contracting

After a wave of strong contracting activity culminating in 2018 with 95 bcm signed, LNG contracting slowed down in 2019 with a total volume of 74 bcm. Activity collapsed in 2020 with only 35 bcm signed to date - with no further contracting activity, this would mark a y-o-y decrease of over 50%.

Although COVID-19 is contributing to a historic demand shock, a well-supplied market since 2019 is a larger driving factor behind this decreased activity, IEA said. From 2015-2019, the share of total contracts with fixed destination clauses decreased as new flexible-destination volumes entered the market. By contrast, despite the decline in total volumes, fixed-destination contracts have grown to date in 2020.

About 190 bcm of legacy contracts are due to expire in the next 5 years, accounting for about one-third of current active volumes. Over the same period global liquefaction capacity is to increase by 20% from projects currently under development. These two factors will strongly impact the structure of LNG supply, and create new opportunities for buyers and challenges for marketers in a context of demand uncertainty.