OPEC revises down 2020, 2021 oil demand forecast

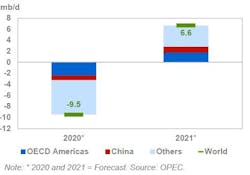

In its monthly report published Sept. 14, the Organization of the Petroleum Exporting Countries (OPEC) revised down its 2020 world oil demand growth forecast by 400,000 b/d, as compared to the August report, to a decline of 9.5 million b/d, leading to total demand of 90.2 million b/d in 2020.

OPEC said that it was revising its projections because of lower demand than expected in countries including India, which has one of the world's worst outbreaks of the COVID-19 disease.

In the OECD, demand is revised higher by around 100,000 b/d due to lesser-than-expected declines in all sub-regions during second-quarter 2020. However, OECD America’s second-half 2020 oil demand forecast was revised lower due to slower than originally assumed recovery in transportation fuels.

In the non-OECD, the 2020 oil demand outlook is revised lower by around 500,000 b/d due to weaker oil demand performance in Other Asia, particularly in India.

Turning to 2021, the negative impact on oil demand in Other Asia is projected to spill over into first-half 2021. At the same time, a slower recovery in transportation fuel requirements in the OECD will limit oil demand growth potential in the region.

Additionally, risks remain elevated and skewed to the downside, particularly in relation to the development of COVID-19 infection cases and potential vaccines. Furthermore, the speed of recovery in economic activities and oil demand growth potential in Other Asian countries, including India, remain uncertain.

As such, 2021 world oil demand is now forecast to grow by 6.6 million b/d, some 400,000 b/d lower compared with the previous month’s assessment to average 96.9 million b/d.

World economy

The global economic growth forecast is revised down to -4.1% for 2020 from -4.0% in the previous month, amid a further slowing momentum in especially emerging and developing economies.

GDP growth in 2021 remains unchanged at 4.7%. The US is revised up slightly and forecast to contract by 5.1% in 2020, followed by growth of 4.1% in 2021. The Euro-zone is revised up as well and forecast to contract by 7.7% in 2020 but grow by 4.3% in 2021. Japan is revised down and forecast to contract by 5.5% in 2020 and recover to 3.2% in 2021. China’s 2020 GDP growth remains at 1.8% followed by growth of 6.9% in 2021. India’s 2020 growth forecast is revised down further to -6.2% from -4.6%, followed by growth of 6.8% in 2021. Brazil’s 2020 GDP growth is revised up to -6.5%, before rebounding to 2.4% in 2021. Russia’s 2020 forecast is revised down to -4.9%, while it is expected to recover in 2021 with a level of 2.9%.

In addition to COVID-19-related developments, numerous uncertainties remain, including high debt levels, inflation, ongoing geopolitical risks, trade-related challenges, as well as the possibility of a hard Brexit.

Supply

The non-OPEC liquids production forecast in 2020 is revised up by 360,000 b/d due to a higher-than-expected recovery in the US in June, which added 1.0 million b/d m-o-m, and now contracting by 2.7 million b/d, y-o-y.

A production recovery has begun in the US, Canada, and Latin America in third-quarter 2020, although Hurricane Laura partially impacted production in the US Gulf of Mexico.

The main declines in 2020 are expected to be in the US with 1.0 million b/d, Russia with 1.1 million b/d, and Canada. The non-OPEC liquids production forecast for 2021 is adjusted up by 371,000 b/d and now is expected to grow by 1.0 million b/d. The US with 400,000 b/d, Canada, Brazil, and Norway will be the main drivers of growth.

OPEC NGLs are estimated to decline by 100,000 b/d, y-o-y, in 2020, with the preliminary 2021 forecast indicating growth of 100,000 b/d, averaging 5.2 million b/d. OPEC crude oil production in August increased by 760,000 b/d m-o-m to average 24.05 million b/d, according to secondary sources.