Permian gas flaring could increase from 2023 if COVID-19 delays new pipelines

Permian basin gas output is expected to rebound in second-half 2020 and will remain robust for years, but the low-investment environment created by COVID-19 will likely postpone approvals for key pipelines which may necessitate increased flaring from 2023, Rystad Energy projects.

Permian gas output

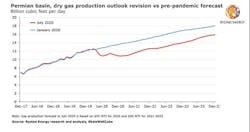

In second-half 2020, and into 2021-2023, Rystad Energy expects Permian gas production will see a rapid increase assuming a $45-50 WTI environment, which is the base case. In the short-term, the reactivation of production is expected to push basin-wide gas output back to 11.4 bcfd in September, although further growth might be delayed until mid-2021 when activity is expected to recover substantially.

Regardless, gas output in the Permian is expected to return to record levels by late-2021, reaching 16 bcfd by yearend 2023. However, this represents a downward revision of 2 bcfd compared to Rystad’s 2023 year-end view prior to the COVID-19 pandemic.

Pipeline development

Despite limited news on development of new gas pipelines in recent months, Rystad Energy remains confident that the Permian Highway Pipeline (PHP), which originally reported an in-service date of first-quarter 2021, and the Whistler project, which reported an in-service date of third-quarter 2021, are both moving ahead.

“Earlier this year, Kinder Morgan faced some regulatory obstacles which have delayed the originally planned in-service date for the PHP. Additionally, in the current environment, the regional supply-demand balance does not require the immediate completion of the pipeline. Even if modest delays occur, Permian’s dry gas production potential will be able to wait for the pipeline to be completed until late-2021. Meanwhile, the Whistler pipeline has recently received new funding, which confirms that project-related work on the pipeline is occurring,” said Artem Abramov, Rystad Energy’s head of shale research.

For other pipelines, however, serious concerns about feasibility remain and many projects have been delayed or put on hold. The Pecos Trail evaluation is on hold and the Permian to Katy (P2K) pipeline also appears inactive. Tellurian has continued to advertise its future global gas market hub around Driftwood LNG, the Permian Global Access pipeline, but the likelihood of any investment decisions in the short-term remains low.

Takeaway capacity

On paper, the nameplate outbound capacity of all takeaway pipelines with local consumption (assuming the completion of the Whistler and PHP) will reach 17.5 bcfd in 2022, enough to accommodate the increasing gas production in the basin through the mid-2020s. However, the future of utilization rates on the Permian-Mexico pipelines (Roadrunner, Comanche Trail, and Trans-Pecos) remains uncertain.

While the Villa de Reyes-Aguascalientes-Guadalajara (VAG) pipeline was completed and started service in June, providing better connectivity between northern Mexico and Guadalajara, it might take several quarters (if not years) to see a significant increase in West Texas-Mexico gas exports, relative to the total capacity of outbound pipelines.

In May 2019 through April 2020, West Texas-Mexico gas exports fluctuated in the narrow range of 0.58-0.67 bcfd. The Trans-Pecos pipeline, specifically, flowed at around 170 MMcfd in the first 4 months of 2020; only in the last few days it has recorded a jump in daily flows towards El Encino, with throughput surpassing 300 MMcfd.

“In the most optimistic scenario, we consider an increase in West Texas-Mexico exports to 1.5 bcfd throughout the second half of 2020 to 2021. However, in our lower case, exports remain flat at 0.7 bcfd. Finally, from second-half 2019 to first-quarter 2020, we frequently observed that pipelines flowed at rates exceeding nameplate capacity by up to 10%. This is considered to be unsustainable in the long-term,” Abramov said.

“Regardless of the state of West Texas-Mexico exports, we conclude that in a $45-50 WTI world, there will be a need for new gas takeaway projects from the Permian as early as 2023-2024. If these projects are not approved early enough, the basin might end up with another period of degradation in local differentials and potentially increased gas flaring.”

Given the conservative investment philosophy of midstream companies and the WTI strip remaining around $40 for the year, it is highly possible that any new pipelines will be approved too late, resulting again in a situation with insufficient infrastructure.