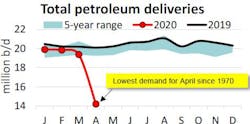

US petroleum demand, as measured by total domestic petroleum deliveries, decreased to 14.2 million b/d in April—a decrease of 26.7% from March and 29.4% compared with April 2019—the lowest for the month of April since 1970, according to the latest monthly statistics report of American Petroleum Institute (API).

The decrease in US petroleum demand reflected the escalation of stay-at-home orders to prevent transmission of COVID-19. Seasonal deliveries of residual fuel oil showed the only increase for the month. Transportation fuel deliveries fell across the board, but fuels were affected to varied extents. Jet fuel was the most adversely affected, followed by gasoline and diesel/distillates. Naphtha/gasoil used in refining and petrochemicals decreased by relatively less. In more than 4 decades of API publishing this report, April 2020 stands out for its singular weaknesses.

Macroeconomy

The Institute for Supply Management’s Purchasing Managers Index (PMI), came in with a reading of 41.5 in April. Index values below 50.0 suggest a contraction. The reading reflected weaker production, new orders, and employment; accelerated slowing of supplier deliveries; pricing weakness; and, contracting international trade. Among 18 manufacturing industries covered, only paper products and food, beverage, and tobacco products expanded in April.

Furthermore, consumer sentiment deteriorated in the University of Michigan’s consumer sentiment index reading. The index readings since February have fallen from 101.1 (Feb.) to 89.1 (Mar.), and 71.8 (April), with the latter cementing the largest monthly decline on record.

The ongoing COVID-19 crisis took a toll on the employment situation in March. According to the Bureau of Labor Statistics (BLS), the unemployment rate rose to 14.7% in April from 4.4% in March, the largest on record since 1948. Non-farm payrolls plummeted by 20,500,000 in April, which was more than 10 times greater than the largest previous monthly payroll decrease.

Demand

Consumer gasoline demand, measured by total motor gasoline deliveries, was 5.7 million b/d in April. This represented decreases of 31.1% from March and 39.6% compared with April 2019 for the largest monthly decrease on record and lowest demand for any month since January 1972. Meanwhile, US average conventional gasoline prices fell by 31.7% y/y or ¢94.3/gal, according to AAA.

Distillate deliveries of 3.2 million b/d in April were down by 22.0% from March and 19.6% compared with April 2019. This too represented the largest monthly decrease on record but compared with that for gasoline was partially cushioned by increased business-to-consumer freight shipments.

Kerosene jet fuel deliveries were 600,000 b/d in April, which was a decrease of 55.9% from March and 64.8% versus April 2019. The International Air Transport Association (IATA) reported that 95% of passenger flights were canceled but partially offset by a 25-30% increase in demand for e-commerce as customers and businesses resorted to online purchasing in response to social distancing restrictions. However, IATA also warned of potential air capacity shortages, especially for mail with the extensive flight cancellations.

Deliveries of residual fuel oil, which is used in electric power production, space heating, industrial applications and as a marine bunker fuel, were 223,000 b/d in April. This was a seasonal increase of 54.9% from March and 32.0% compared with April 2019 – and the only US refined product demand to increase during the month.

Supply

In April, US crude oil production fell to 12.0 million b/d, which was a decrease of 900,000 b/d from March. Due to the tremendous extent to which US crude oil production had recently grown, however, output in April was only 1.2% below that of April 2019. However, April was the 3rd largest monthly decrease in US crude oil production over the past 100 years. The only larger decreases were in September 2008 (Great Financial Crisis) and May 1952 (US refinery workers strike).

Meanwhile, US natural gas liquids (NGL) production of 4.6 million b/d fell by 400,000 b/d from March. When crude oil, NGLs and other liquids (refinery gain) are totaled, US liquids supply fell by a combined 1.6 million b/d in April. These production decreases corresponded with a record decrease in US drilling activity according on Baker Hughes, which reported oil-targeted drill rig activity of 325 rigs for the week ended May 1, down by 52% over the past 2 for the largest decrease in over 30 years.

International trade

All things considered, US petroleum exports held up relatively well in April. The US petroleum exports for the month totaled 8.4 million b/d, of which 3.2 million b/d was crude oil. For total exports, this was a decrease of 500,000 b/d from March, but it was nearly on par with exports in April 2019. By contrast, US petroleum imports of 7.3 million b/d in April fell by 1.8 million b/d between March and April. On net, the US flipped back to being a petroleum net exporter for the month.

Refining

With decreased anticipated petroleum demand and exports, US refinery throughput of 13.3 million b/d fell in April by 2.6 million b/d, the largest decline on record since 1985. This throughput implied a capacity utilization rate of 70.1%, which was a decrease of 14.4 percentage points from March and the lowest monthly rate on record since 1985.

US total petroleum inventories, including crude oil and refined products but excluding the Strategic Petroleum Reserve, were 1.3 billion bbl in April and accumulated year-on-year for the 18th consecutive month. Within the total, as refinery throughput and finished product demand fell, crude oil stocks rose by 10% between March and April to their second highest amount for the month and 20 million bbl below the maximum 538.6 million bbl stored in March 2017.