IEA reduces 2020 global oil demand growth forecast to 825,000 b/d

Global oil demand has been hit hard by the novel coronavirus (COVID-19) and the widespread shutdown of China’s economy.

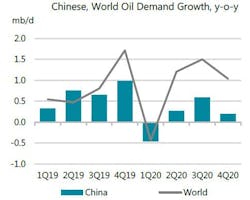

Demand is now expected to contract by 435,000 b/d in the first quarter of 2020, the first quarterly decrease in more than a decade, according to the latest monthly Oil Market Report of the International Energy Agency (IEA).

For 2020 as a whole, IEA has reduced its global growth forecast by 365,000 b/d to 825,000 b/d, the lowest since 2011. Meantime, growth in 2019 has been trimmed by 80,000 b/d to 885,000 b/d on lower-than-expected consumption in the OECD.

“The crisis is ongoing and at this stage it is hard to be precise about the impact. Our initial view is based on an assumption that economic activity returns progressively to normal in the second quarter of 2020,” IEA said.

“The impact of Covid-19 for oil prices have been sharp: Brent values fell by about $10/bbl, or 20%, to below $55/bbl. Before Covid-19 came along, the market was already nervous in anticipation of a supply overhang of 1 million b/d in the first half of 2020 due to continued expansion in the US, Brazil, Canada, and Norway. Even threats to security of supply, e.g. tension in Iraq, a 1 million b/d fall in Libyan oil production, and force majeure declared for some Nigerian cargoes, had little impact on prices. Now that the demand outlook has weakened, prices have moved significantly down,” IEA said.

“From the point of view of the producers, before the Covid-19 crisis the market was expected to move towards balance in the second half of 2020 due to a combination of the production cuts implemented at the start of the year, stronger demand and a tailing off of non-OPEC supply growth. Now, the risk posed by the Covid-19 crisis has prompted the OPEC+ countries to consider an additional cut to oil production of 600,000 b/d as an emergency measure on top of the 1.7 million b/d already pledged. Lower oil prices, if sustained, are also bad news for highly responsive US oil companies, but we are unlikely to see an impact on output growth until later in the year. The effect of the Covid-19 crisis on the wider economy means that it will be difficult for consumers to feel the benefit of lower oil prices,” IEA said.

Supply

Global oil supply tumbled in January after a blockade in Libya virtually halted production and the UAE reduced output. At 100.5 million b/d, production fell 815,000 b/d month-on-month (m-o-m) and was flat versus a year ago. While non-OPEC output stood 2.1 million b/d above January 2019, OPEC production contracted by a similar amount.

January marked the first month of deeper supply curbs from OPEC+ countries. Compliance by the 20 producers taking part in the 1.7 million b/d reduction was 123%, with Saudi Arabia continuing to cut more than required. However, the threat to demand posed by the novel coronavirus (Covid-19) has led OPEC+ to consider a further 600,000 b/d cut. The next ministerial meeting is due to take place March 5-6.

“With China buying over 70% of its crude oil from the OPEC+ bloc, some producers are already feeling the impact of China’s sharp run cuts. The price of spot market barrels from Angola, Oman and Congo – which ship around 70% of their crude to China - has collapsed,” IEA said.

Outside of OPEC+, Brazil is also feeling the pain, as 60% of its exports are destined for China. In terms of volume, Saudi Arabia and Russia are by far the biggest suppliers, although they are comparatively less dependent on China as an export outlet.

IEA’s balance has shown for several months that there could be a major supply surplus in the first half of 2020, with rising non-OPEC supply a major factor. Now, demand growth is expected to fall sharply due to Covid-19, so the call on OPEC crude plunges from 29.4 million b/d in fourth quarter 2019 to 27.2 million b/d in 2020 first quarter. That is 1.7 million b/d below the group’s January production of 28.86 million b/d. For the whole year, the call on OPEC crude oil is 28.4 million b/d, down 1.3 million b/d from 2019. IEA’s forecast for non-OPEC supply growth in 2020 is steady at 2 million b/d.

OECD stocks, oil futures

OECD industry stocks held largely steady in December at 2,915 million bbl as a build in product inventories more than offset lower crude holdings. Total oil stocks stood 26.4 million bbl above the 5-year average and covered 61 days of forward demand.

Preliminary data for January show inventories building in the US and Japan while falling in Europe. Short-term floating storage of crude oil built 7.7 million bbl in January to 76.2 million bbl, most of which is Iranian oil.

Crude oil futures tumbled by $10/bbl during January in anticipation of a negative impact on demand from Covid-19. The price of grades from the Middle East, North Sea, and West Africa, popular with Chinese refiners, fell while the Libyan outage was supportive for alternative crudes from Algeria and Azerbaijan. The coronavirus also weighed on product cracks, in particular jet/kerosene, although reports of Chinese run cuts provided support.

Refining

The coronavirus outbreak has also led IEA to revise down the outlook for global refinery runs. Chinese crude throughputs for the first quarter of 2020 have been cut by 1.1 million b/d and are now expected to contract by 500,000 b/d year-on-year. As a result, global runs are forecast to expand by just 700,000 b/d in 2020. The launch of IMO’s new bunker fuel regulations in January boosted simple refining margins based on sweet crudes.