Crescent to pay over $900 million for Eagle Ford assets

Crescent Energy Co., Houston, has agreed to pay $905 million for a set of Eagle Ford assets that will grow its count of gross locations by about 13%.

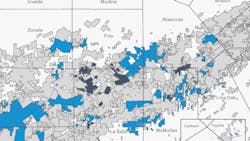

The planned cash-and-stock transaction between Crescent and Ridgemar Energy covers roughly 80,000 net acres in four counties south of San Antonio, Tex., that produce about 20,000 boe/d (90% liquids) from about 140 gross locations. Completing the deal, which is expected early next year, will grow Crescent’s footprint to about 540,000 net acres and 177,000 boe/d. Crescent chief executive officer David Rockecharlie and his team expect the deal to grow the company’s inventory of low-risk production by about a year.

“These assets contribute meaningful scale, enhance Crescent’s cash margins, increase our oil weighting and extend our low-risk inventory life, all at an attractive and highly accretive valuation,” Rockecharlie said in a statement. “I remain confident in our ability to capitalize on our strong momentum and continue our profitable growth trajectory towards our investment grade ambitions.”

The Crescent team has been on a buying spree in the Eagle Ford. Since the spring of 2023, they have committed more than $3.1 billion to four deals in the basin, the most notable among them for SilverBow Resources (OGJ Online, May 16, 2024). Most recently, the company paid $168 million to an unnamed private operator for about 4,000 boe/d of production in Atascosa, Frio, LaSalle, and McMullen counties, the same four counties that hold the Ridgemar assets (OGJ Online, Sept. 4, 2024).

The acquisition push has grown Crescent into the Eagle Ford’s No. 3 oil producer behind ConocoPhillips and EOG Resources.

Shares of Crescent (Ticker: CRGY) fell more than 4% to roughly $14.50 on Dec. 4. Shares are, however, still up more than 15% over the past 6 months. That move has grown the company’s market capitalization to about $3.3 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.