Permian Resources inks Delaware basin deal with Occidental

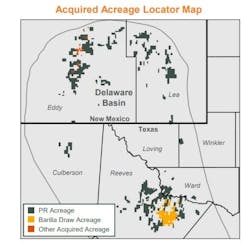

Permian Resources Corp. agreed to acquire certain Delaware basin assets in Texas and New Mexico from Occidental for about $818 million through a combination of equity and debt.

Permian Resources will acquire about 27,500 net acres in Barilla Draw Field of the Texas Delaware basin and about 2,000 net acres in the New Mexico Delaware basin, with combined net production for fourth-quarter 2024 estimated at about 15,000 boe/d (55% oil), the companies reported July 29. The assets are 96% operated and 99% held by production.

As part of the agreement, Permian Resources is expected to add over 200 gross locations at an average lateral length of 10,000 ft that are expected to immediately compete for capital with development beginning as soon as fourth-quarter 2024, TD Cowen analysts said in a note July 29.

The assets include over 100 miles of operated oil and gas gathering systems to fully accommodate Barilla Draw volumes with incremental capacity for growth, according to Permian Resources. The assets currently service Oxy development and multiple third parties.

Current oil gathering capacity is about 70,000 b/d with 10 saltwater disposal wells. The current gas gathering capacity is about 190 MMcfd with water recycling capacity of 25,000 b/d.

The deal is expected to close in this year’s third quarter, subject to customary closing conditions.

For Occidental, the deal adds to its planned divestment program. In separate deals, Occidental completed several sales totaling about $152 million in 2024. The company had previously announced a $4.5-6 billion divestiture program to be completed within 18 months of closing the acquisition of CrownRock LP, which is expected to occur in August (OGJ Online, Dec. 11, 2023).

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.