AN INTERVIEW WITH ALEXANDER MEDVEDEV: Russia's Gazprom Becoming a Global Player

As international economies signal an increasing demand for cleaner burning natural gas, Russian gas giant Gazprom is stepping up its efforts to serve on a global scale. Sitting on huge reserves in harsh environments and situated with the potential to serve both Atlantic and Pacific basins with natural gas via both pipeline and LNG, Gazprom not only has opportunities that are the envy of the energy industry, but also challenges of daunting proportions. Meanwhile, last fall the company took a big step to becoming an integrated oil and gas company with its purchase of the Russian oil company Sibneft.

Alexander Medvedev, director general of Gazpromexport and deputy chairman of Gazprom’s management committee, recently spoke with Timothy Sutherland, chairman and CEO of Pace Global Energy Services, about global energy market developments, Gazprom’s growing international ambitions, and the company’s efforts to capture new markets.

SUTHERLAND: Alex, 2005 included multiple energy supply shocks, price volatility, and overall rising prices. What is your assessment of Gazprom’s performance in 2005 and how is the company positioned for the challenges and opportunities that lie ahead in this dynamic marketplace?

MEDVEDEV: Tim, the energy supply and price volatility issues really captured the media spotlight this past year. These matters are of utmost concern to Gazprom and to energy consumers at all levels - industrial, commercial, and individual. We know energy prices rise and fall as market and political situations change. At the same time, secure, reliable, and affordable energy is fundamental to economic stability and development. Our companies and states face a tremendous challenge, a challenge that I am optimistic we can address.

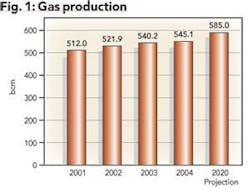

Gazprom achieved many operational and financial milestones during 2005 of which we are proud. Gas production reached 540 billion cubic meters during 2005, which is up approximately 50 billion cubic meters from our late 90’s production levels. In addition, we advanced all of our major initiatives, such as the North European Gas Pipeline. NEGP will be the largest undersea pipeline in the world, increase Europe’s energy security, and provide new supply to serve directly the growing European market. On the financial side, Gazprom’s debt rating was upgraded twice during the past year, reflecting our improved financial position and outstanding prospects. Our market capitalization increased significantly to over $160 billion during 2005, a trend that has continued since the liberalization of our stock this year.

SUTHERLAND: We’ve seen Gazprom’s stock price increase significantly since this stock liberalization, the removal of the so-called “ring fence”, which had formerly limited the foreign ownership of the company. How important is this liberalization of the stock for investors and for Gazprom?

MEDVEDEV: This is big news for the future of our company. As you mentioned, Gazprom shares soared nearly 10% on the first day of liberalized trading, raising our capitalization above companies like Wal-Mart and Procter & Gamble. During the first three trading days, our stock soared 24% on trading volumes which were three times higher than a typical trading day for us last year. We have room to grow here as our stock is trading at only about $2 per barrel of reserves, which is eight to nine times lower than BP or ExxonMobil.

SUTHERLAND: Gazprom has indicated its intention to become a major global energy supplier. Can you comment on the company’s current position and your path forward to achieve this goal?

MEDVEDEV: Yes. Gazprom is currently the world’s largest publicly traded hydrocarbons company in terms of reserves, transportation and production volumes. We’re focused on major initiatives designed to integrate our vast oil and gas resources into the global marketplace for the benefit of our shareholders and our current and future customers. We aim to secure a position as a leading global energy company and this involves many more steps for Gazprom, including growing and diversifying our supply base, expanding our distribution networks, and attracting more capital investment.

SUTHERLAND: Tell us more about the company’s focus on efforts to integrate Gazprom’s resources into the market. Of particular interest would be some examples of the steps underway to achieve the global service model that you envision for Gazprom.

MEDVEDEV: We’re focused on addressing new market challenges and securing opportunities on a global scale. We’ve established long-term gas production goals of 580-590 billion cubic meters per year by 2020, and 610-630 billion cubic meters per year by 2030. Distribution projects and arrangements are under development as well to prepare for efficient delivery of this energy to worldwide demand centers. This includes not only NEGP, but also many other projects such as storage in Europe. Through varied activity, such as by our Gazprom Marketing & Trading unit in London, we’re becoming more active downstream in our leading export markets in Europe, Asia, and North America.

I might add that the recent liberalization of our stock ownership allows investors from these market regions around the world not only to rely on us for energy supplies, but also to rely on us for financial returns by investing in Gazprom stock.

SUTHERLAND: You referenced the significant Gazprom production growth both achieved to date and targeted for the future. How was this production growth achieved and how will you achieve the higher levels set by the company?

MEDVEDEV: Our systematic production growth plan underway includes enhanced field operations, launching new sites at several existing fields, and new field development. As appropriate, Gazprom collaborates with energy companies and governments to develop energy resources so that we can operate as efficiently as possible. For example, we teamed up with the government of the Yamal-Nenets Autonomous District to organize a comprehensive oil and gas field development program. Concerning the Yamal area, to date 26 fields have been explored, containing approximately 10 triillion cubic meters of prospected gas resources.

SUTHERLAND: It has been reported in the news that Gazprom is targeting the UK natural gas market and other gas markets for business expansion, perhaps through an acquisition. Can you comment?

MEDVEDEV: We have an interest in entering the downstream business of the markets we serve, including the UK, and we are continually closely monitoring acquisition opportunities. With regard to our supply service to the UK, we foresee that eventually the NEGP project will be part of a transport system extending this 1,200 kilometer pipeline to other European countries, including the UK.

SUTHERLAND: This year, the single most prominent Gazprom press coverage has concerned the Russia-Ukraine natural gas matter. Please comment on your ongoing natural gas contract negotiations with Naftogaz, the service interruptions to Europe apparently caused by this dispute, and your impression of the overall situation.

MEDVEDEV: Our negotiations with Naftogaz officials have been consistent, longstanding, frequent, and extensive. Naftogaz is a valued customer and transportation partner, and we understand the difficulties of the transformation from discounted prices to international export prices. We have been working diligently with Naftogaz officials within a structured contract approach consistent with international standards and the export policies of the Russian Federation. The reality is that we have been trying to negotiate more appropriate terms for these supply and transportation transactions for many years and it is reasonable to expect that we would have made much more progress on this business issue by now.

The record cold weather this winter has created peak gas demand stress for Naftogaz and everyone, including Gazprom. However, Gazprom is doing everything possible to ensure meeting our obligations. We expect nothing less from Naftogaz, including delivering all Gazprom volumes designated for transportation through Ukraine to other customers.

SUTHERLAND: Do you have calculations of Gazprom’s annual discount of Naftogaz under the prior methodology?

MEDVEDEV: The Naftogaz discount would amount to a nearly $4 billion annual subsidy by Gazprom. Our global competitors would never be expected to bear such an “out-of-the-market” burden. The barter aspect of the prior arrangements also produced several inappropriate market anomalies and risks out of step with normal commercial practices. I believe this to be the most misunderstood energy issue of the year for the casual observer.

SUTHERLAND: I realize that this is a complex situation, but tell us why you think this situation has been so misunderstood.

MEDVEDEV: First, the fact that it is a significant and complex situation itself can lead to confusion. Second, there are many parties seeking to manipulate the events to further their own agendas, which often have nothing to do with energy. Third, some Western media and politicians have framed the issue in outdated cold war contexts, rather than in terms of consistent national trade policies and international business standards.

The reality is that we are in a competitive global market, and we have an obligation to our shareholders and customers to focus on the responsibilities of the parties under contract. I’ll note that Gazprom has remained in compliance with its contracts throughout all negotiations and that we’ve extended ourselves beyond the contract requirements in order to accommodate the situation.

Our 40-year record of unquestioned international supply reliability should also put this situation into perspective.

SUTHERLAND: What has the world learned about Gazprom from this situation with Naftogaz?

MEDVEDEV: The world has learned that Gazprom is making decisions in the best long-term interest of our shareholders and consistent with our obligations to our customers. We are market driven and we respect our market contracts. We want the freedom to deal with our customers on a commercial and competitive basis, under the same standards as you would apply to other international energy firms. Earlier I noted that our executive teams are focused on developing our vast reserves and efficiently serving international markets. This requires commercial cooperation and diligence between counterparties - and we are committed to both.

SUTHERLAND: What’s your general outlook for this region? Do you envision the broader European market functioning on the commercial basis you mention?

MEDVEDEV: Yes. That is happening already to a great degree. We expect the European market continue a transition to more commercially integrated continental market. This transition will allow more efficient operations and it will support our business growth in Europe. We are adapting now for that marketplace.

SUTHERLAND: How does the Shtokman project in the Barents Sea fit into your plans to provide new long-term supplies to Europe and the United States?

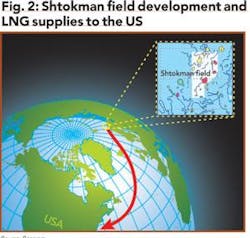

MEDVEDEV: Tim, this is one of Gazprom’s most significant projects over the next decade, and even beyond. Shtokman is set to become the world’s largest offshore gas field with estimates of 3.2 trillion cubic meters of natural gas reserves and 31 million tons of gas condensate. Recent 3-D seismic testing has indicated that the Shtokman resources may be even 10% higher than previously indicated. To put that in perspective, Shtokman represents more than half of the total US reserve volume.

The development plan for Shtokman is another good example of our collaborative approach. We are working now to select our partners from among a “short list” of five other companies (Chevron, ConocoPhillips, Hydro, Statoil, and Total) to complete our plans to make this supply available to serve both European and US markets.

SUTHERLAND: What does Gazprom expect from its Shtokman partners, and when do you expect these reserves to be available for the US market?

MEDVEDEV: This spring Gazprom will select a maximum of three partners for the Shtokman consortium. This group will work in close partnership to develop and position all of the necessary assets required to serve the US market with Shtokman reserves. We are interested in capturing the best long-term value for our company from this project. We are looking for our partners to provide material financial, technical, and market benefits. This includes an opportunity to participate in the midstream and downstream aspects of this business, as we would like to be vested in the international markets that we serve. We are ambitious: We expect Shtokman to begin delivering LNG to US consumers by 2011.

SUTHERLAND: US Federal Reserve chairman Alan Greenspan recently commented on the need to expand America’s ability to import natural gas. Are you surprised to hear that a central banker has gas supply issues on his agenda?

MEDVEDEV: It’s not surprising at all, as natural gas supply has become a major economic issue for Americans and, indeed, worldwide. Natural gas price shocks and price volatility pose risks for economies, businesses, and individual citizens. We understand the impact of these economics and we’re responding to market signals with new supplies and services. We want to serve the North American market and we believe that our service will provide long-term economic and environmental benefits for American consumers and financial rewards for our stockholders.

SUTHERLAND: Gazprom Marketing & Trading and Gazpromexport have already been active in the US market during this past year. Can you tell us more about these market activities and why you’ve “started early” with your US market involvement?

MEDVEDEV: That’s right. Gazprom Marketing & Trading and Gazpromexport are “priming the pump” in advance of our Russian supplies by contracting for LNG from other sources and delivering it into the US market. The first shipment of “Russian-owned gas” was delivered to Cove Point, Maryland last September. It’s interesting to note that this supply was delivered to US consumers during the supply and transportation disruptions throughout the US Gulf Coast brought about by Hurricane Katrina. Because this delivery was provided downstream of the supply disruptions, we were able to help resolve a difficult supply situation - and demonstrate the benefits of supply and deliverability diversity for US consumers.

SUTHERLAND: Gazprom and Gazpromexport also sponsored a Russia-US Energy Symposium last year in Houston. Tell us more about this event and why you sponsored it for the international energy community.

MEDVEDEV: Tim, the Houston symposium in October was a great success for Gazprom and for many international energy interests. We were pleased to host such a prestigious group of global industry leaders and to engage in an open dialogue about the Russia-US energy and trade relationships. We feel that such proactive engagement is an important part of our plan to bring our business to the US. Gazpromexport was soon thereafter recognized by Platts with a Global Energy Award as the “Downstream Business of the Year.” We feel that our open approach to downstream markets was a big part of gaining this recognition.

SUTHERLAND: What else has Gazpromexport been doing to introduce itself to the US market?

MEDVEDEV: Well, last fall we brought our Gazpromexport hockey team to the US to play in a goodwill competition against host NHL alumni clubs of the Washington Capitals, the Detroit Red Wings, and the Boston Bruins. Our common respect and love for the game made for great camaraderie among the players and the fans saw outstanding hockey. Russian greats from the NHL joined us for the festivities and both sides really enjoyed the cultural exchange. There is strong interest in organizing another series this year after the completion of the winter Olympics. In addition to hockey, we’ve become active in the arts, sponsoring Russian artists performing in the US. We have some interesting ideas in mind regarding other philanthropic exchange projects as well.

SUTHERLAND: So we’ll be seeing more of Gazpromexport in the US advancing its international business and cultural agenda?

MEDVEDEV: Yes. We are committed to serving the US market and we like to be involved and active in the downstream markets we serve. I look forward to more regular involvement in the US market. Once our Shtokman partners have been announced, you can expect to see our presence in the US grow both in terms of our commitments to business development and our examples of responsible corporate citizenship.OGFJ