Chief sells to Devon, Crosstex; transactions total over $2.5 billion

Devon Energy will acquire the oil and gas properties of privately-owned Chief Holdings for $2.2 billion in cash, including assumed liabilities. Crosstex Energy Services will acquire Chief’s natural gas gathering pipeline systems and related facilities for $480 million in cash. The bids were made jointly.

Devon estimates the properties it will acquire include proved reserves of 617 bcfe and leasehold totaling 169,000 net acres. The company plans to drill about 800 wells over the next 5 years. Upon close of the acquisition, Devon anticipates its daily production from the Barnett Shale to increase by about 55 MMcfe per day.

“This was a unique opportunity to add to Devon’s position in the hottest natural gas play in North America where Devon is already the largest and most active producer,” said J. Larry Nichols, Devon’s chairman and CEO.

The Chief gathering systems link Crosstex’s existing facilities and other pipelines with the 328 existing producing wells and thousands of new wells expected to be drilled in the future across nine North Texas counties.

The systems acquired by Crosstex consist of about 250 miles of existing pipeline with an additional 400 planned. The current systems have a throughput of about 125 MMcfd with an additional 44MMcfd awaiting pipeline connections.

Petrie Parkman & Co. advised Chief Holdings on both transactions. - Mikaila Adams

Marathon and LUKOIL enter $787 million agreement for Russian businesses

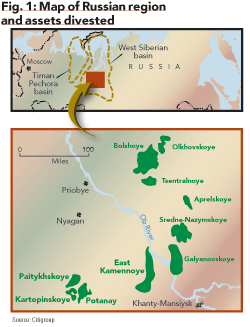

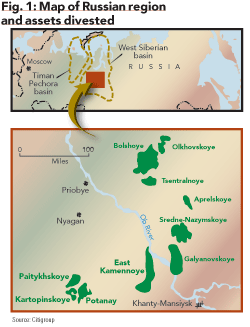

Marathon Oil Corp. has entered into a definitive agreement with OAO LUKOIL, acting through its subsidiary OOO LUKOIL Western Siberia, under which Marathon will sell its oil exploration and production businesses in the Khanty Mansiysk region of western Siberia to LUKOIL.

Under the terms of the agreement, LUKOIL will pay approximately $787 million plus working capital and other closing adjustments. The transaction is subject to government approvals and other closing conditions. Assuming a mid-July closing of this transaction, Marathon estimates its production available for sale during 2006 will average approximately 360,000 to 380,000 boe/d, excluding the effects of any further acquisitions or dispositions, compared to the earlier estimate of 365,000 to 395,000 boe/d.

LUKOIL has paid Marathon $787 million for these businesses, plus preliminary working capital and other closing adjustments of approximately $66 million, for a total transaction value of $853 million.

Proceeds from the sale will be available to help fund Marathon’s aggressive growth initiatives in coming years, including a possible $2 billion plus expansion of its Garyville, La. refinery.

Doug Leggate, a research analyst at Citigroup, said that the sale of Russian businesses comes as no surprise “as [Marathon] has maintained that they would divest the assets if management perceived growth opportunities through strategic partnerships did not materialize in the region.”

He continues to say that the company has “optimized the value of the asset in our view, with oil production having doubled to 30 MMb/d since 2003 when these assets were acquired.”

Citigroup rates Marathon a “medium commodity risk due to sensitivity to a change in oil price, a medium financial risk being highly leveraged in the sector, and a low management risk with a strong executive team.”

Standard & Poor’s Rating Services said that the company’s announcement favors the company’s credit quality, but does not affect its ratings. - Mikaila Adams

Privately-held Coldren pays $625 M for Noble Energy’s GoM assets

Noble Energy has agreed to sell essentially all of its Gulf of Mexico (GoM) shelf assets to New Orleans-based Coldren Resources LP for $625 million. Coldren is a subsidiary of Coldren Oil & Gas Co. LP, a First Reserve portfolio company. Noble Energy will retain its interest in the Main Pass area, which is under repair for hurricane damage.

Production from the assets to be sold currently totals approximately 5,000 bo/d and 90 MMcfd of natural gas, net to Noble Energy, for a combined total of approximately 20,000 boe/d.

After-tax cash proceeds from the sale are expected to be approximately $525 million. The company expects to record a pretax gain from the sale of approximately $270 million, which will be more than offset by non-cash items.

Harvey, La.-based Superior Energy Services Inc. has acquired a 40% interest in Coldren in order to give its core businesses the first right to provide services, rental tools, and liftboats required by Coldren and to diversify the property portfolio of its subsidiary SPN Resources LLC.

Randall & Dewey, a division of Jefferies & Co. Inc., and JP Morgan provided advisory services to Noble Energy on this transaction. Credit Suisse and Bank of America NA were advisors to Coldren.

Coldren was formed in August 2005 to pursue low-risk drill-to-earn opportunities on the GoM shelf. Coldren pursues companies operating in the upstream industry that have staffing shortages for their projects in the gulf. - Mikaila Adams

Sempra agrees to $225 M for E&P subsidiary

Sempra Generation, a unit of Sempra Energy has agreed to sell its exploration and production subsidiary, Sempra Energy Production Co. (SEPCO), to PEC Minerals LP for approximately $225 million in cash. Sempra Energy expects to record an after-tax gain of approximately $110 million on the sale as part of discontinued operations. Petrie Parkman & Co. advised Sempra Energy in this transaction.

PEC Minerals LP is owned by a group consisting of Jetta Operating Co., Trevor Rees-Jones, and Providence Energy Corp.

SEPCO’s assets include ownership of mineral rights over 570,000 net acres and executive rights to more than 190,000 net acres in 31 states. In addition to holding non-operated working interests in natural gas and oil wells, the company also owns 6,000 surface acres in five states. The transaction is expected to close next month. - Mikaila Adams

XTO Energy buys privately-held Peak Energy Resources for $105 million

XTO Energy Inc. has agreed to purchase privately-held Peak Energy Resources Inc., a Barnett Shale producer, for equity consideration of 2.555 million shares of XTO common stock, valued at approximately $105 million.

This acquisition increases the company’s reserves and leasehold acreage in the Tier 1 and Tier 2 regions of the Barnett Shale play, predominantly in Hood, Parker, and eastern Erath counties of Texas. XTO Energy’s internal engineers estimate proved reserves to be 64 billion cubic feet (bcf) of natural gas, 14% of which are proved developed.

Bill Pritchard, chairman of Peak Energy Resources, told OGFJ last year that the goal was to “build the company up to the point where it becomes attractive to one of the public upstream oil and gas companies trying to either establish a presence or extend its position in the Barnett.”

Additional potential is more than 200 bcf of natural gas. Proved reserve estimates are based on the ownership of about 37,000 gross acres (33,000 net) with new well locations spaced at 100 acres. Production from the properties is expected to reach 10 million cubic feet per day (MMcf/d) by the end of 2006 and more than 25 MMcf/d in 2007.

Lehman Brothers acted as the financial advisor to Peak Energy. - Mikaila Adams

$85 million NGP financing helps Resaca acquire and develop assets from SDG Resources

NGP Capital Resources Co. has closed an $85 million senior secured credit facility and a $10 million senior subordinated secured convertible term loan with Resaca Exploitation LP, a private Houston-based oil and gas producer affiliated with Torch Energy Advisors Inc.

Initial availability under the facility is approximately $76 million, with about $62 million funded; an additional $10 million was made available and funded under the convertible term loan. NGPC’s portion of the initial funding was $24.6 million under the facility and $4.0 million under the convertible term loan.

Proceeds of the facility and the convertible term loan were used by Resaca to acquire and develop oil and gas assets located in west Texas and New Mexico. These assets were acquired by Resaca from Montrose, Co.-based SDG Resources LP for $83.7 million cash.

Randy King, co-head of investment banking at Petrie Parkman, noted that this was an “opportune time to market assets” and that SDG is a “great fit for Torch and their affiliate.” Sylvia Barnes, also of Petrie Parkman, added that it is a case of a mature property “in the right hands.”

Petrie Parkman & Co. advised SDG on this transaction. The transaction closed May 1, 2006 and was effective January 1, 2006. - Mikaila Adams