Privatization could be the key to unlocking Mexico’s reserves

The oil and gas industry in Mexico is at a crossroads. Declining production, operational difficulties, and inadequate governmental polices are inhibiting the continued development of the country’s much needed reserves. All of these issues are at least partially the result of a state-owned industry. Currently, there is talk of privatizing Mexico’s oil sector to attract foreign investment, but could this be the answer?

Mexico is the fourth-largest importer of crude to the United States, but total oil production in Mexico has been in decline since 2004. One of the primary factors of this drop in production is the decline of the giant Cantarell field, which has been producing for more than 25 years. After three consecutive years of production declines ranging from 13% to 15%, it appears that the Cantarell Complex has peaked in production. Unfortunately, the further development of Mexico’s untapped reserves is being slowed by political policies that do not advance exploration initiatives.

Although Mexico’s national oil company, PEMEX, ranked number 34 on the Fortune 500 list in 2007, much of the company’s revenue is supporting the nation’s annual budget. However, the outflow of cash is not the only factor obstructing future prosperity. The bureaucratic structure of the Mexican NOC is also adversely affecting progress. In 2007, PEMEX generated revenues of approximately $97.5 billion with a workforce of 142,000 employees. In contrast, ExxonMobil generated revenues of approximately $347 billion with 106,000 employees. This is nearly 3.6 times the revenue of PEMEX with only 75% of the workforce.

The director general of PEMEX, Jesus Reyes Heroles, has spoken out in support of regulatory changes that would help alleviate operational inefficiencies and attract investment from the private sector. Additionally, Mexico’s President Felipe Calderon supports a restructuring of the capital budget that would enable PEMEX to adopt advanced technology and a more aggressive exploration strategy.

Unfortunately, these ideas have failed to advance beyond rhetoric because of the question of capital. The nation is reluctant to reallocate needed funds to PEMEX, but this funding is critical in order to employ new exploration programs. One option, and perhaps the best, is to acquire this capital from the private sector.

In 2000, India introduced the New Exploration Licensing Policy (NELP) in an attempt to utilize foreign investment dollars to develop the country’s reserves. NELP revolutionized India’s oil and gas industry by allowing foreign oil companies to participate with India in equitable ventures. The state-owned oil companies of India were facing many of the same challenges as PEMEX, but to support continued economic growth, the country needed to accelerate the development of their domestic reserves—and with the introduction of NELP, it’s working.

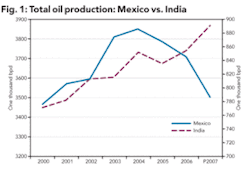

As illustrated in the chart that accompanies this column, India has increased total oil production by 15.6% since NELP began in 2000. However, Mexico’s production has grown by only 1% for the same time period.

India’s performance is indicative of progress that can be motivated by private investment, and a similar change in policy could also work for India.

Declining production and inadequate political policies are hindering Mexico’s ability to remain as one of the world’s leading oil-producing nations. Regrettably, this is happening at a time when the need for oil has never been greater.

It would be in Mexico’s best interest to adopt a business friendly policy to help unleash their untapped reserves. Although privatization in Mexico’s oil and gas sector may not solve all of the difficulties PEMEX is facing, it could play a vital role in the continued development of that country’s much-needed reserves.

About the author

Jason Reimbold is vice president of The Theseus Group (www.thetheseusgroup.com), an energy M&A consulting firm based in Tulsa, Okla. In 2005, Reimbold founded www.Global-OilWatch.com, an energy research portal for industry analysts and investors. In 2007, he co-authored The Braking Point: America’s Energy Dreams and Global Economic Realities (www.thebrakingpoint.com) with Mark A. Stansberry.