Aberdeen: a global center of excellence for oil and gas

»Part 1 – Life after forty: a second wind for the UKCS?

The discovery of significant oil deposits in the North Sea during the 1960s and 1970s marked the beginning of a new era and a definitive turning point in the modern history of Aberdeen, Scotland’s third largest city. Not only did the city (and, more broadly, the Northeast of Scotland) become the UK’s main base for oil and gas operations in the North Sea, it also established itself over the years as – arguably – Europe’s oil capital and one of the industry’s most important global hubs. “Although Aberdeen is a provincial city of only 220,000 people, it is the base of one of the UK’s only two truly global economic sectors, oil and gas, the other being financial services,” underlines Geoff Runcie, Chief Executive of the Aberdeen and Grampian Chamber of Commerce (AGCC).

Over the last four decades, Aberdeen has experienced the ups and downs of the oil and gas industry first-hand and matured alongside the UK’s Continental Shelf (UKCS). After the early years in which foreign players dominated almost entirely the services market for the industry, a myriad of local companies slowly emerged and joined the international firms, consolidating a highly diversified and integrated supply chain concentrated in Aberdeen. Today, despite a widely unexpected revival of the ageing oil province thanks to the effects of sustained high oil prices, everyone in Aberdeen and the UK can’t help but wonder just how much longer it can maintain its position as a global centre of excellence for oil and gas, even as the UKCS moves well into a period of long-term decline.

Source: Aberdeen City Council

Not that you would be likely to get any type of ‘decline’ sensation while driving down the Bentley-filled streets of the Granite City, checking out property prices or trying to get a table at one of the city’s many high-end restaurants. Indeed, in just one generation the oil and gas industry has catapulted a once economically stagnant region towards having one of the highest GDP (Gross Domestic Product) per capita in all of the UK, and an unemployment rate of less than 2%. If anything, the number one challenge for companies – from the supermajors to the small suppliers – is the lack of available skilled workforce in Aberdeen to keep up with demand deriving not only from the North Sea, but also from oil provinces around the world.

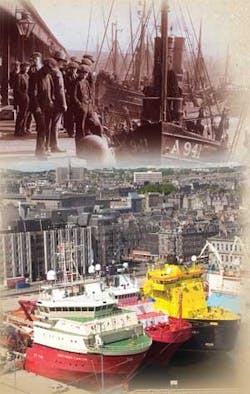

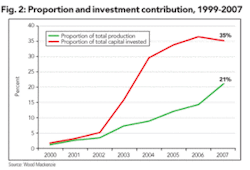

Still, numbers don’t lie and what is clear is that the main source of Aberdeen’s wealth and prosperity, the UKCS, is dwindling. After attaining a production peak of 4.5 million barrels of oil equivalent per day (boepd) in 1999, daily production in 2008 has averaged only about 2.7 million boepd, with most producing fields in their decline phase. How these figures are likely to evolve and exactly how much oil and gas can still be recovered from the UKCS is a matter for debate and the estimations vary. Professor Alex Kemp from Aberdeen University, one of the most prominent analysts on the issue, has elaborated models which indicate that between 2008 and 2035 total oil and gas output from the UKCS will amount to somewhere between 17 and 20 billion boe, depending on variables like price fluctuations and exploration activity.

Kemp’s calculations are slightly more conservative than the figure of 21 billion put forward by the government (with a potential upside of up to 30 billion) and the estimates of 25 billion used by the trade association Oil & Gas UK. However, unlike Kemp’s model, both the government and industry numbers consider production will go on beyond 2035. “We also consider that production is likely to continue towards 2040, though at very small amounts,” says Kemp. Future projections aside, all agree that ultimately the continuity of production from the UKCS will depend on a combination of optimizing existing production, bringing on stream undeveloped fields, and continuing the exploration effort so as to add reserves.

Maturity has also meant that the average size of new discoveries has decreased considerably in the UKCS. Adding this to the fact that many of these discoveries tend to be geologically complex fields and far from existing infrastructure, it is no wonder that the average cost per barrel in the UKCS is notably higher than in other oil provinces. The high oil price environment of recent years has managed to encourage established players in the UKCS to continue investing in existing fields and rekindled the interest of new companies to enter the region, but many of the challenges facing the industry have yet to be tackled.

Keeping the window of opportunity open

It was only in 2007 that the main trade bodies in the UK representing the operators (oil companies), on one side, and the contractors, on the other, decided to come together and form Oil & Gas UK (OGUK) to jointly address the issues affecting the whole industry. Malcolm Webb, Oil & Gas UK’s Chief Executive, explains that “it had become clear that it would be of great interest for all parts of the value chain to have an association which could act as a single – though not exclusive – voice for the industry, particularly in order to raise our profile amongst the government and the general population.”

As the main spokesbody for the industry, OGUK represents the sector and interacts with policy-makers at different levels, from local governments to Brussels. OGUK has been proactive in engaging the British government, at a moment in which it is increasingly under pressure due to concerns about the cost and security of energy supplies. Webb maintains that there is a ‘window of opportunity’ to seize in the North Sea while the existing infrastructure is still operational, but there are many obstacles to overcome in order to ensure that the UKCS remains a dynamic producing region and continues contributing to the country’s energy supply and wealth.

“There is no magic switch that can change the production profile of the UKCS overnight. The only way to achieve this is through sustained capital investment, meaning billions of pounds if we are to recover the full 25 billion barrels of reserves estimated in the basin”, affirms Webb, adding that “to this end, the industry needs to have the right business climate: on one hand fiscal stability and predictability, which as not been the case in recent years. On the other hand, we need specific stimulus to capital investments in order to start seeing a more positive trend in a few years’ time.” For OGUK, the special incentives should focus particularly on promoting investment in marginal field opportunities, unlocking the reservoirs West of Shetlands, and encouraging enhanced oil recovery from existing operations.

Welcoming the new wave

As major oil companies tend to focus their resources and efforts on the big plays in regions like West Africa and the Caspian, new opportunities have been opening up for medium-sized operators in UKCS. These dynamic players have been arriving en masse over the last several years and setting up offices in Aberdeen, an encouraging sign for the city and the mature UKCS. In Prof. Kemp’s view, towards the future, “the UKCS is going to depend more and more on these types of players, so the government has been proactive in trying to attract them to continue coming and investing.”

One of the most notable entries to the UKCS was achieved by Texas-based Apache in 2003, when it acquired BP’s Forties Field – the largest field ever found in the UK North Sea, discovered in 1970 – and has since managed to not only increase production, but also add new reserves to the ageing assets. Talisman Energy, an international oil company from Canada, is another one of the success stories regarding acquisitions and turnarounds of mature fields in the UKCS. As one of the pioneers of this trend, Talisman established a diversified UK portfolio, allowing it to become one of the biggest operators in the UKCS. Aberdeen-based Dana Petroleum and Venture Petroleum have built on their North Sea success to expand their E&P activities abroad.

An interesting aspect of the UKCS’ E&P landscape in recent years is the high number of Canadian companies investing and operating in the area. The Buzzard Field, the UKCS’ largest discovery in over a decade with over 500 million boe, was brought on stream by mid-tier Canadian operator Nexen in early 2007, following the company’s major asset acquisitions in the area in 2004. Fellow Petro-Canada also holds a significant non-operated interest in the Buzzard project. North Sea-focused Oilexco entered in 2002 and has since been one of the most prolific companies in terms of drilling in the UKCS. Yet another Canadian and UKCS-focused company, Ithaca Energy, entered in 2003 through participation in licensing rounds and has made considerable discoveries.

“Canadian oil and gas corporations are entrepreneurial in their outlook and willing to diversify overseas and internationally,” suggests Iain McKendrick, Chief Operations Officer (COO) of Ithaca, adding that in terms of the kind of reservoirs that they have been dealing with, “the North Sea is well suited for Canadian companies’ technical capabilities and risk profile.”

In 2008, Ithaca has been busy raising funds in order to finance its ambitious exploration, development and acquisition plans in the UKCS. The company’s Jacky and Athena discoveries are expected to come into production in late 2008 and 2009 respectively, while the Stella assets bought from Shell and Esso are slated to come on stream in 2010. Ithaca has also spent much of 2008 finalizing the details regarding the acquisition of Talisman’s Beatrice and Nigg facilities, in a transaction that will free Talisman of assets too small for its now larger scale, while giving Ithaca the opportunity to develop infrastructure for neighboring Jacky.

In McKendrick’s view, investors are putting their money into Ithaca for two main reasons. “The first is the quality of our portfolio, and the fact that we take high equity interest in all of our assets. Ithaca has interests of 90% on Jackie, 70% on Athena, 66% on Stella and 100% on Beatrice. The second is the quality of the people who work on our developments, some of which are recognized experts in their fields,” he says.

Ithaca does not rule out potentially making company acquisitions of its own in the future, after having rejected a non-binding offer made public by Endeavour. “The number of independent companies we see in the UKCS is unsustainable,” states McKendrick, adding that “within the current banking situation, many are going to find themselves high on ambition but short on cash.”

Though Petro-Canada is a much larger and internationalized (after the 2002 acquisition of Veba Oil & Gas’ upstream operations) player, the UKCS also represents a large chunk of the company’s overseas production, primarily through its interest in Buzzard, with the remainder coming from the company’s operated assets around Trinity and Scott. Petro-Canada inherited assets scattered over a large swath of territory in the UKCS, which, according to the company’s Northwest Europe Regional Manager, Jim Scrimgeour, required developing a ‘concentric growth approach’, based on core areas with infrastructure to which the other surrounding fields are tied back.

“The key example is the Triton core area, which receives the oil from the Western Extension, Clapham and Pict fields,” states Scrimgeour. “Pict illustrates how Petro-Canada is bringing to development fallow fields discovered almost two decades ago. These are all small fields of between 10 to 20 million barrels of oil, but we are able to make them highly profitable,” he adds, highlighting the company’s contract strategy that has allowed it to sanction first oil in 15 months in some cases, “which is exceptional.”

“The main challenge in the coming years will be to have access to acreage, and we hope that the government keeps delivering. There are licensing rounds coming up and fallow processes which could allow us to invest in exploration ideas developed by smaller companies,” states Scrimgeour, adding that “growth will probably be based more on exploration than on acquisitions, but they are not completely ruled out either.”

All these dynamic Canadian players have had to share the headlines in 2008 with TAQA (Abu Dhabi National Energy Company), a fast-growing energy group based in Abu Dhabi, after acquiring six mature fields in the UKCS in July. TAQA had already set its foot in the UK initially when it acquired Talisman’s non-operating interests in the Brae assets in 2007, afterwards finalizing its ‘Big Bird’ transaction with Shell and ExxonMobil in 2008 for assets currently producing about 40,000 boepd and containing between 200 and 300 million boe in reserves, according to the company’s own numbers.

Peter Barker-Homek, CEO of TAQA worldwide, was recruited in 2006 shortly after an IPO, with the mission to turn a company essentially focused on the power generation business in the UAE into a global energy group. “They basically asked me what I would do if I had the opportunity to build a global energy company. I shared my vision with them, and they said go do it. Needless to say, it was a dream come true,” states Barker-Homek. In record time, he put together a small team to assess different opportunities around the world, and with $4.5 billion in their pockets went on to make acquisitions in Canada, Africa, Northern Europe and the Middle East.

According to Barker-Homek, the UK acquisition “is a defining moment for TAQA’s European business, creating an upstream player of a considerable size. We have gained not only a significant amount of reserves, but also the opportunity to grow them,” states Barker-Homek. “TAQA is dedicated to giving new life to mature assets, which the majors tend to keep in harvest mode. We are playing a key role in reinvigorating those assets in the North Sea, while at the same time helping fuel the prosperity of Aberdeen.” A brand new office building in the Westhill area will house TAQA’s growing staff, which is expected to reach between 400 and 600 people.

TAQA’s Managing Director for the UK, Leo Koot, explains that the company will continue to build around the existing assets as hubs, seek opportunities to acquire other mature assets, and look into the possibilities for corporate acquisitions in the area. “All of this will take us to the next level in which we will be aiming to double production,” states Koot.

Still a majors’ world after all

Major oil companies the likes of BP were the main architects of the huge developments that quickly turned the North Sea into one of the world’s main producing regions in the 1970s. Today, however, the big reservoirs and mega-projects which are material to a supermajor are located in oil provinces in Africa, South America and Asia, while most of the existing UKCS fields are in decline and the possibilities of major discoveries in the region are very slim. So, does this mean the end of the line of the supermajors in the UKCS?

Not so fast, says Roland Festor, Managing Director of Total E&P UK. “There is still a lot of potential in the UKCS, even for the major oil companies,” he affirms, adding that “it is not right to consider that the only dynamic companies are the independents. I can say that Total E&P UK, after 40 years, remains very dynamic; there is a great atmosphere and a desire to stop the decline and get production growing again.”

Although Total’s production in the UKCS is currently declining, recent discoveries are leading the company to believe that it is not only possible to stabilize production – 250,000 boepd, representing 10% of Total worldwide – but that it may actually rise again. “We have had incredible success in exploration, with our last five wells drilled turning into discoveries,” affirms Festor. Total’s achievements are illustrated by its enduring Alwyn development, which came on stream in 1987 with an initial production profile of 10 years yet is still on stream today in 2008 and looking forward to 20 more years of life.

Total is also set to play a key role in the development of the West of Shetlands, where it is operator of the two largest gas discoveries in the area, Laggan and Tormore. According to Festor, “we are looking to launch a new project there and hoping to move into the development phase in the near term. Our two discoveries are very close to each other and contain enough gas to build a stand-alone project; however, they are not big enough to support the construction of a large regional infrastructure development.”

Indeed, in order to begin developing the considerable amount of reserves sitting in the West of Shetlands to its full potential, brand new infrastructure will have to be built in the area. In order to work together to find infrastructure solutions for the West of Shetlands, government and industry have established a ‘West of Shetland Taskforce.’ Along with Total, other companies with interests in the area such as BP, Chevron, ExxonMobil, and Dong are part of the special taskforce.

For Rick Cohagan, President and Managing Director of Chevron Upstream Europe, the challenge of developing West of Shetlands is a prime example of why the supermajors are still crucial for the UKCS, as smaller players lack the financial strength to carry out large infrastructure projects. “Overall, the industry works very much like an ecosystem,” says Cohagan. “Every company has its place and role to play, each one making an important contribution to the big picture. In the end it is about finding a way to make all of this work for everybody’s benefit, and maximizing production from the UKCS,” he adds.

Chevron has recently contracted a new drill ship with Stena which is set to start drilling wells in the West of Shetlands in late 2008. Though Chevron’s involvement in this area is still in the early stages, and there are major economic and technical challenges to overcome, Cohagan is optimistic about the company’s strong lease position there. “The early indicators we have for our prospects in the West of Shetlands are promising, so we are excited to begin drilling and hopefully have the kind of success that could take us to further development in the coming years.”

In terms of existing production, Chevron Upstream Europe represents around 180,000 boepd, with the UK production accounting for 120,000. “The profiles of the fields vary, with some fairly large oil fields like Captain and Alba, which are in their mid-life phase, and gas developments like Britannia, co-operated with ConocoPhillips.” says Cohagan.

As for its presence in Aberdeen, not only has Chevron chosen the region as its headquarters for all European E&P operations (including the UK, Norway, Denmark, the Netherlands, the Faeroe Islands, and Greenland), but it also established a new Technology Center in 2006. The center, currently employing around 60 people, carries out research, provides technology services for European operations, and supports global operations.

ConocoPhillips’ UK managing director Archie Kennedy shares his peers’ view that there are still good opportunities for the supermajors in the UKCS and that they have a key role to play in the future of the basin. “ConocoPhillips has been one of the most active investors in recent years in the UKCS,” he says, adding that “we have reinvented ourselves several times over the many years of operations in the country. Our portfolio has evolved; we have changed our competencies, developed new technologies and a huge skills base to reflect our current scope of business in the area."

The UK is currently one of ConocoPhillip’s largest business units outside its core area, North America. “The general focus is to attempt to hold the UK’s production roughly flat, which is quite a challenging thing to do in a mature basin. In order to achieve this, we have to grow the base business every year just to keep our production at the same level. This requires considerable investment plus the need for continued success in drilling. We have to ensure that the UK is an attractive place to do business and that our projects remain competitive,” Kennedy says.

The ever-changing Aberdonian entrepreneur

When Sir Ian Wood took over his family’s Aberdeen-based fishing business in 1964, after obtaining a university degree in psychology, few could have imagined that it was the beginning of a career that would lead to the creation of one of the UK’s largest and most successful engineering companies, Wood Group, employing over 26,000 people in 46 countries.

The arrival of the first oil people in Aberdeen in the late 1960s, clad in cowboy boots and hats, was quite a culture shock for the locals, and Wood was no exception. But the young Ian Wood soon perceived the huge potential that this new industry in the North Sea could bring for Aberdeen. “I can’t really say I had a long term vision at that point, but I did have a kind of stubbornness and was able to recognize the opportunities that this new industry could bring,” says Wood.

Much of Wood’s motivation at that point in his life came as a reaction to what he perceived as the newcomers’ patronizing attitude towards Aberdonians. That filled him with “a real hunger and ambition to prove that a Scottish company could do just as well as the Americans or anyone else,” admits Wood, quickly noting that he is much less parochial nowadays and simply considers himself and the Wood Group as global citizens. That initial drive, however, and his strong focus on getting the right people cemented Wood Group’s early success and served as the guiding lines throughout the company’s evolution.

The oil price crash in 1986 and Wood’s own long-term vision drove him to make diversification and international expansion a cornerstone of the company’s strategy, aspects in which Wood Group was also a pioneer among the other Aberdeen-based service providers. The company has since gone public in 2002, and Sir Ian Wood has taken a step back by handing over his position as Chief Executive to Allister Langlands (Wood remains involved as an active Chairman), but Wood Group’s reputation as an icon of Aberdeen and the North Sea is all but secured. Many in the Granite City express regret that more companies did not take Wood Group’s lead early on in order to become major international players in their own right. Nonetheless, examples of Aberdonian entrepreneurship and business-savvy abound since the beginning of the UK’s offshore industry.

One such is Craig Group, a privately-owned company which got started in the North Sea’s shipping business 75 years ago. Douglas Craig, the third generation in the family-run business, led the company’s transformation since the 1970s towards offshore support services for the oil and gas industry. Today it is a company with turnover in excess of $180 million, leader in the supply of stand-by vessels in the North Sea, and growing internationally through its oilfield procurement services division. In a whole different business area there is the telecommunications solution provider Nessco, which was founded by Aberdonian Tom Smith in 1979 to service the offshore industry’s specific needs. Today, on top of Nessco’s established position in the UKCS’ oil and gas market, the company has branched out towards new sectors and expanded abroad.

Another of Aberdeen’s emblematic entrepreneurs is Jim Milne, founder of the diversified Balmoral Group. Through the subsidiary Balmoral Offshore Engineering (BOE), Milne started providing buoyancy and elastomer products and services to the oil and gas industry over two decades ago. However, the industry’s latest downturn in the late 1990s seriously affected the business, to the point that BOE eventually shut down, after an unsuccessful attempt in 2003 to weather the storm through a joint-venture with its main competitor, CRP Group.

Milne was not to remain out for long though, and in 2006 he decided to start Balmoral’s offshore business afresh. Milne and his team moved quickly to design, build, install, and commission a state-of-the-art plant with broad manufacturing facilities. To Milne’s own surprise Balmoral soon secured deepwater contracts for multi-billion dollar projects in places like Brazil, India, the Gulf of Mexico and the China Sea. “Initially we assumed that we would have to start with small jobs and gradually work our way up again. I was humbled by the high opinion that the industry kept of Balmoral and its people through the tough years,” he says.

Another man locally lauded for ‘taking big business back into Scottish hands’ is Bob Keiller. He was responsible for one of the most talked about transactions in recent years: the management buy-out (MBO) of Halliburton’s production services division. Only a few months after joining as managing director in 2004, he realized that the business would be better off alone and soon managed to get Halliburton’s approval to go ahead with the deal. After the long and arduous process of splitting a global business, Production Services Network (PSN) emerged in 2007 as a major contractor with revenues of over $1 billion and strong growth. Though he is reluctant to see himself as an entrepreneur, his actions have won him several prestigious business awards.

Many Englishmen have also arrived in Aberdeen with the oil and gas industry, and ended up making the Northeast of Scotland their home, such as Newcastle-born Kevin Mahoney. After moving up the ranks in Santa Fe to subsea superintendent, he left the company in 1992 and founded Yardbury, a business originally focused on the recertification of drilling equipment. “Over the years I built Yardbury up from very small beginnings, steadily developing a diverse range of services,” says Mahoney.

One of Mahoney’s preferred means of growing the business was through acquisitions, the first being a long established hydraulics company specialized in the repair and manufacture of power units, Glenmac, in 1999. In 2002 Yardbury further expanded its capabilities by acquiring Dee Bridge Electrical Engineers. As a result, “today Yardbury is ready to provide hydraulic, electrical and mechanical services to the oil and gas industry, all in-house and controlled under the same roof,” he states.

Internationally, Yardbury took its first major steps in 2003 when it entered into a co-operation agreement with a Libyan drilling contractor to re-certify equipment in that market. Mahoney admits that it was a challenge, “but today Yardbury has its own state of the art workshop in Libya similar to the one in Aberdeen, smaller in scale but with Yardbury management systems."

Cutting-edge technology for rough seas

With more than 400 fields located around the British Isles, over 40 years the UK’s oil and gas industry has recovered a total of 36 billion boe from beneath the seabed, in one of the world’s most hostile offshore environments. Thanks to its own rough nature, Scotland has become a global centre of excellence in offshore engineering, subsea technology and in the export of offshore goods and services.

In developing its Elgin/Franklin assets, Total has had to overcome serious technological challenges due to extreme high pressure / high temperature (hp/ht) reservoir conditions. For Total’s Roland Festor, Total’s implementation of cutting-edge technology in the UKCS is one of the main elements helping the company attract new talent, at a moment of skill shortages and high turnover in the industry. “Total E&P UK offers both young graduates and experienced people the chance to work on some of the world’s most challenging fields in terms of technology like Elgin/Franklin,” he says. Another heavyweight, Chevron, is looking into opportunities to apply enhanced oil recovery technologies in order to optimize and prolong the production life of its older fields, despite the particularly expensive and technically challenging environment in the North Sea.

For Prof. Kemp, mid-sized and independent oil companies are being successful in “extending the lives of the fields and enhancing recovery through increased drilling and the application of new techniques.” Scrimgeour, points out that Petro-Canada is not just about taking over old fields: “We are more about applying new high-end technologies in order to develop fields of different sizes, which allows us to deliver projects on time and on budget that make commercial returns,” he says.

Balmoral’s Milne also highlights the great technical challenges the company deals with from Aberdeen, as it works in uncharted territory for projects operating at depths exceeding 3,000 meters. “We can be the last link on jobs that are worth many billions of dollars, so it is a big responsibility,” he admits. But Milne seems to crave the challenge and adrenaline of major undertakings, as illustrated by Balmoral’s current development of the world’s largest bend restrictor. “It is often said that Balmoral will not hesitate to go places where others fear; those who say this are right. I’m at my happiest when involved with innovative and revolutionary materials, processes and products,” he says.

Aberdeen has also proved to be a fertile breeding ground for new engineering companies focused on niches within industry. Project Design & Management Services (PD&MS) was created in 2002 by a group of four friends with different backgrounds within the oil and gas sector. Providing primarily engineering and project management support to brownfield developments and rig upgrades, the company went from having just eight employees initially to over 100 in 2008, reaching a turnover in excess of $27 million. Managing director Dave MacKay states that they “saw a niche in the market for smaller types of projects, with quick and cost efficient turnarounds.” After six years of steady growth, he feels that PD&MS is nearing the upper end of its niche and is now looking at “taking things to the next level.”

2006 was a year of particularly meteoric growth for PD&MS, raising its profile and reputation among the UK’s oil and gas industry and making it a prized target for an acquisition. “As it has never been our intention to grow to the size of major companies in our field such as typically Wood Group and PSN, our growth strategy contemplated the possibility of being purchased by another player when the moment was right.” Indeed, that moment came in April 2008 and the buyer was Wilton, a Teesside-based company mainly focused on providing fabrication and offshore mobilization services.

According to MacKay, PD&MS and Wilton’s combined capacity allows them to target EPIC type projects which may have previously been out of their individual reaches. “Our initial philosophy of 'no job is considered too small' can now be expanded to include 'and no job is considered too large' and we can provide clients with a direct one-stop shop solution which will include design engineering, procurement and materials management, fabrication and FAT, construction and commissioning elements.”

A special place for subsea

Of the many areas of expertise which have been developed in and around Aberdeen in support of the UKCS offshore industry for over 30 years, the subsea sector stands out as one of the most cutting-edge and innovative. In fact, the Westhill district just outside of the city center is known as ‘SURF city,’ in reference to the high concentration of subsea-focused and related companies in the area. Major subsea contractors such as Subsea 7, Technip, and Acergy all have large headquarters there, supporting operations well beyond the North Sea.

Many smaller emerging players specialised in the subsea sector have roots in Aberdeen, and are experiencing phenomenal growth as the global demand for subsea services continues strong. A prime example is TSMarine, established in 2004 in response to the growing needs in the field of subsea decommissioning and rigless intervention solutions. According to Alasdair Cowie, CEO of TSMarine, “The vision from the start has been to engage in these specific subsea activities, not to become an EPIC type company or drilling contractor ourselves. The idea was to open up new opportunities, going beyond the traditional thinking in the subsea market.”

After observing several false starts over the last 20 years, Cowie is confident that the subsea well intervention business has finally started to take off, as a more cost effective alternative to drilling rigs. “Operators are now starting to establish long-term subsea field support contracts which include a high level of well intervention, IRM, component installation and indeed decommissioning services. There are only three operators doing subsea well intervention for the moment, but there is no doubt that they are going to be joined by a large number of the other major oil companies over the next five years,” says Cowie.

According to him, as some of the major subsea contractors move on with the majors to massive projects in areas like West Africa and Brazil, “a huge gap opens up which companies like TSMarine are in a prime position to fill.” In 2008 about 70% of TSMarine’s revenues came from overseas, but Cowie believes that the UKCS should pick up in 2009, allowing the company to establish a 50/50 split between domestic and international business. TSMarine’s turnover has skyrocketed from $18 million in 2005 to an expected $140 million in 2008, driven by major contracts such as the one awarded by Woodside for rigless intervention in offshore Australia. Fresh new resources from both debt and equity are allowing TSMarine to build its own customized vessels and to accelerate growth.

William Edgar, chairman of industry body Subsea UK, highlights that about 40,000 people are employed in the country’s subsea sector, which was worth about $9 billion in 2007 and growing at double digits. That is a very significant part of the global subsea market, which is estimated at about $25 billion. Well aware of the sector’s potential and growing needs, the founders of DES Operations set out to develop innovative solutions to facilitate companies’ access to subsea wells in terms of processing and production optimization. They eventually came up with several patents for a ‘USB-type port’ which could be retrofitted to the underwater christmas tree, most notably the Multiple Application Reinjection System (MARS) which was filed in 1999.

“The business was set up with the aim of lifting reserves for subsea wells to the same level that can be attained through platform wells,” says Ian Donald, co-founder and current Vice President of DES Operations. “We found that the potential upside recovery that could be achieved through the application of MARS in subsea processing was, in certain cases, up to 20%. MARS also gives companies the ability to carry out well intervention without the need for a new drilling operation, a long term benefit throughout the life of any field,” he adds.

Donald explains that, “BP and Shell were the first to move forward with our technology. While BP decided to use MARS for multiphase pumping in the Gulf of Mexico, Shell focused it on well stimulation in the North Sea.” With the benefits of DES Operations’ solutions proven, the company doubled in size for several years and in 2007 accepted an offer to become a part of the Cameron Group.

In Donald’s view, this move has allowed DES Operations to truly globalize its offer to the industry. “Now we are able to support clients in all of their international markets, all while retaining a distinct identity within the Cameron Group. Their global footprint gives us the opportunity to move from the pilot projects phase to full scale implementation capability,” he says. DES Operations is already supplying operations in the North Sea, West Africa, the Gulf of Mexico, and soon in Brazil.

In with the new…in with the old

While the UK’s North Sea may not be seeing the type of mega-projects taking place in other oil and gas provinces, there is plenty of work to go around for Aberdeen’s offshore contractors as operators seek to get the most out of decades old assets and push back decommissioning as far as possible. As Archie Kennedy points out, “the bulk of new developments in the UKCS will be relatively smaller fields that will be reliant on existing infrastructure for off-take, as opposed to greenfield projects. Much of that infrastructure is quite mature and maintaining asset integrity is a crucial aspect.” Local major engineering groups such as Wood Group and PSN have developed particular brownfield expertise in their North Sea operations, on the back of which they are now supporting production in mature fields around the world.

International oil & gas facilities service provider Petrofac also has Aberdeen as its main hub for its Operations Services division, after the acquisition of Atlantic Power & Gas and PGS Production Services in 2002. Through a combination of organic growth and acquisitions, Petrofac is now pulling together a central capability based in Aberdeen offering a full range of services, from operations, maintenance, brownfield modification, well services, production engineering, specialist consulting and training. The company is in the process of bringing everyone together in its new offices in the city centre, where it already has over 700 people working.

According to Gordon East, Managing Director of Petrofac Facilities Management, “Petrofac has deep roots and heritage in Aberdeen, and our base in the city is symbolic of our long-term commitment to the region and the North Sea. I believe that the oil & gas industry has many more decades of life here”.

In East’s view, one of the keys to Petrofac’s success has long been its ability to generate commercial innovation. The most significant example of this has been the duty-holder model, which Petrofac pioneered over 10 years ago in the North Sea. “Whilst others have followed, Petrofac remains the leading player in this market, and has successfully taken the concept overseas”, he states. One of the company’s main milestones in this regard has been the major contract awarded by Dubai’s government to manage the entirety of its offshore oil and gas assets, which East hopes will open new opportunities in the Middle East and with other National Oil Companies around the world.

Besides the Operations Services and its traditional Engineering & Construction business, Petrofac has introduced another innovative approach to the oil and gas industry with its Energy Development division. Indeed, through this division “Petrofac has provided its own capital for upstream and infrastructure projects and is investing alongside its customers and the services it provides, thereby producing another new concept in the industry”, says East. In the UKCS, Petrofac is keen on investing in the development of stranded, marginalized or non-core assets. The company has recently announced achieving field development approval for the Don area, which Petrofac is particularly proud of as many other companies beforehand had been unable to come up with a development solution for that area.

Further along the value chain, companies specialized on the maintenance side are also keeping busy and focusing on renewing multi-year contracts with key clients. One of the main players is Aberdeen-based BIS Salamis, whose CEO Ian Nickerson explains that there is an increasingly strong demand for its services in the region since “assets that are already nearing the end of their estimated lifespan are being both upgraded and more rigorously inspected and maintained with the aim of remaining operational for another 10 or even 20 years”.

Much like BIS Salamis, Cape Industrial Services has been diversifying from its traditional fabric maintenance and deck operations support offerings towards higher added-value services such as inspection. John Welsh is regional director of Cape’s UK Offshore division running from Aberdeen, which has doubled in turnover in the last five years and now represents 20% of the company’s total revenues. He states that “standing still isn’t an option for Cape and we are constantly looking to further enhance our skills portfolio and capabilities through training and shared knowledge.”

For the North Sea and beyond

Dominion Gas brought George Yule on board in 2006 to prepare the company for sale, culminating in an MBO in May 2007 and with his becoming chief executive subsequently. After climbing up the ranks of the industry, from the workshop floor through several levels of management, he is now ‘living the dream’ as leader of Dominion Gas’ new and ambitious team.

Dominion Gas is a provider of diving and industrial gases and equipment for the offshore sector, and as a complement, also offers engineering solutions. “We are not what some would call a ‘catalogue’ gas company; we are in fact an oilfield services company, focusing on providing total solutions rather than (just) selling gas,” says Yule. Dominion Gas is currently broadening its range of products, services and capabilities; some are being developed organically and others through mergers and acquisitions. Only seven weeks after finalizing the MBO, Dominion Gas bough its closest independent competitor called Global Gas Supplies, making it market leader in UKCS in terms of offshore cylinder gases and giving it new overseas presence in Azerbaijan and Singapore.

The UK currently represents about 70% of Dominion Gas’ business, while the remaining 30% is done overseas, but Yule sees this balance shifting in favor of international operations in the coming years. “Aberdeen is a mature market, but it is important that we retain a critical mass of presence here, because it does represent a ‘supermarket’ for many oil and gas and diving companies for their global activities,” states Yule. “Dominion trades from Aberdeen into 22 different countries, but certain regions require having a physical presence in-country. Our plans are to expand to other areas such as Latin America, Gulf of Mexico, West Africa, and the Middle East but we remain open-minded to other project-led opportunities in other locations too,” he adds.

Though emboldened by the company’s growth, from $9 million turnover in 2006 to about $40 million in 2008, Yule acknowledges that it is important to find the right balance and avoid over-stretching. “In terms of our existing business locations, we believe that Norway is interesting because it offers a sustainable market going forward, with longer-term perspectives than the UK North Sea.” He also sees Norway as a strategic stepping stone towards the countries of the former Soviet Union.

Aberdeen-based environmental services company TWMA, focused on handling and treating waste generated by drilling operations, has also established itself in Norway and is rapidly expanding its international presence well beyond. A significant injection of capital in early 2007, provided by investment partner Lime Rock, has enabled TWMA to make acquisitions, build equipment, and develop new technologies. One of the company’s recently launched innovations, the TCC-RotoTruck, is a compact, mobile, and versatile process equipment which helps overcome the logistic and environmental issues that arise when having to move waste material over long distances.

“TWMA is positioning itself as a provider of total environmental services for the oil and gas industry, both onshore and offshore. We can offer operators in any location to look at the waste generated by their activity, and thereafter provide advice and environmental solutions to safely recycle or dispose of them,” says Ronnie Garrick, TWMA’s managing director. Besides Aberdeen, the company has bases in Norway, Egypt, and Nigeria, plus newly opened sales offices in Houston and Kuala Lumpur. “As a result, TWMA has been experiencing a high level of enquiries and global interest in the services that we provide,” he adds.

The company’s turnover, projected to reach about $48 million in 2008, has doubled over just two years. In Garrick’s view, the environmental services market can only keep growing in the future, and in preparation for the even busier times TWMA is moving to a new and larger location in Aberdeen.