Haynesville takes Louisiana by storm, Commissioner speaks

Mikaila Adams, Associate Editor, OGFJ

At the Houston, Texas office of Graves & Co., Louisiana’s Commissioner of Conservation, Jim Welsh, spoke both one-on-one to OGFJ, and to a group eager to hear about the state of Louisiana.

Similar to that of the Texas Railroad Commission, the offices of Conservation and Mineral Resources within the Louisiana’s Department of Natural Resources have roles in the exploration and production activity occurring in the state.

The Office of Conservation’s duties lie in the declaration of properties as units for the purpose of oil and gas drilling and production sites, permitting of wells, inspection of wells and audits of well production.

What is different about Commissioner Welsh’s role is that, in Louisiana, there is one appointed commissioner who serves until he is replaced by the seated governor.

Welsh’s service

Welsh began his state service in 1965 as a geologist with the Louisiana Geological Survey, Department of Conservation. In 2001 he retired as Assistant Commissioner of Conservation, and chief administrative assistant to the Commissioner of Conservation.

In 2002, Governor Foster asked him to come out of retirement to serve as the department’s 23rd Commissioner. Upon taking the position, Welsh became the first state employee to move from a classified job into a gubernatorial appointed position.

Pre-Haynesville

As mentioned, Welsh became Commissioner in 2002. Those first years were filled with “business as usual” type dealings. Most times this meant ensuring that oil and gas companies looking to do business in the state were mindful of the interests and concerns of the people of Louisiana. “Our job is to carry out the laws and the rules of the state, and I believe the laws and rules of the state balance out the concerns,” he said.

Most regulations in effect in Louisiana require public hearings. “If a company follows the rules, they are protective of the environment,” he continued. “Many of the rules are subject to a federal oversight.” One of those is the underground injection control program that deals with saltwater disposal and other sometimes controversial issues.

One such controversy pertains to natural gas storage. “There is a lot of activity in natural gas companies wanting to store their product in caverns and salt domes,” said Welsh. Last year a company looked to expand its operations, much to the chagrin of some Louisiana citizens. Legislation was passed that would limit the amount of ground water a company could use to leech a cavern. The law has been contested as being unconstitutional and Commissioner Welsh finds himself a defendant in the ongoing battle.

Haynesville

While Commissioner Welsh finds himself in the middle of a legal battle, he also finds himself with another potential problem – finding enough rigs to develop what is being touted as one of the largest unconventional gas discoveries of our time. “Before the Haynesville we were seeing a rig crunch, and now with what we hear is going to happen, it’s going to compound that, but we hear companies are having new rigs built. That’s something that’s never gone on in Louisiana before,” beamed Welsh.

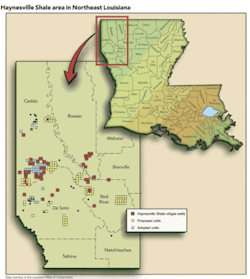

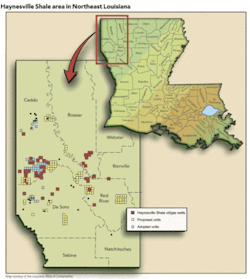

The Haynesville formation is a layer of sedimentary rock more than 10,000 feet below the surface of the Earth in the area of northwestern Louisiana, southwestern Arkansas, and eastern Texas.

The formation is of a type once considered too costly to explore, but rising energy costs and newer technology and processes have changed that, leading to a rush of activity as energy exploration companies have begun to lease property in north Louisiana in preparation for possible drilling and production.

Several companies have begun work in the area to explore and drill for natural gas based on findings indicating a potentially large supply of gas – some are already calling it “the next Barnett shale.”

The most well known and most aggressive player thus far in the Haynesville Shale area is Chesapeake Energy Corp. - a name synonymous with the Barnett shale. The company has partnered with various companies to develop already purchased acreage in the play, with plans to keep adding.

One such joint venture is that one entered into with Goodrich Petroleum Corp. Chesapeake will help develop Goodrich’s Haynesville Shale acreage in the Bethany-Longstreet and Longwood fields of Caddo and DeSoto Parishes.

Chesapeake agreed to pay Goodrich roughly $178 million for the deep rights to roughly 10,250 net acres of leasehold comprised of a 20% working interest the roughly 25,000 net acres in the Bethany-Longstreet field and a 50% working interest in the near 10,500 net acres in the Longwood field.

Chesapeake has also agreed to purchase 7,500 net acres of deep rights in the Bethany-Longstreet field from a third party, bringing the ownership interest in the deep rights in both fields after closing to 50% each for Goodrich and Chesapeake.

In a mid summer update, Chesapeake announced plans to increase its rig counts in the area from five to 12 by year-end 2008, and again to at least 30 by year-end 2009, and up to 60 rigs by year-end 2010.

Another company getting in on the action is Plains Exploration & Production Co. The company will acquire a 20% interest in Chesapeake’s Haynesville leasehold arsenal as of the end of June (roughly 550,000 net acres) for $1.65 billion in cash. PXP agreed to fund 50% of Chesapeake’s 80% share of drilling and completion costs for future Haynesville Shale JV wells over a several year period until an additional $1.65 billion has been paid.

The companies currently plan to develop the Haynesville Shale using 80 acre spacing, which could support the drilling of up to 6,875 horizontal wells on the leasehold.

On the flipside, it seems you don’t have to be an exceptionally large company to get in on the action. OMNI Energy Services Corp. has been awarded a contract with a seismic data acquisition company to perform a seismic drilling project in the area. The project is slated to begin 1Q09 and is expected to generate roughly $5 million for the company.

Brian J. Recatto, president and CEO of OMNI, stated, “This is a sizable contract that will enhance our presence in this prolific play.”

Implications for Louisiana

Since Chesapeake’s announcement earlier this year regarding the discovery of perhaps the largest natural gas field in the US and perhaps the 4th largest field in the world, many around the state are shrouded in excitement.

The excitement is turning into potential big dollars for the state and its residents. The August 2008 state mineral leasing sale netted $93.8 million, the second highest collection on record (the highest sale was $157.7 million in May of 1980 and the previous second highest lease sale was $57.1 million in April 1978).

According to Mineral Board Secretary Marjorie McKeithen, $92.2 million of the bonus money was generated from leases granted within the Haynesville Shale play. The Haynesville leases covered approximately 4,070 acres in Caddo, Bossier, DeSoto, Bienville, and Red River Parishes.

The lease sale pays dividends not only in the direct dollars to state and local government in lease bonuses and possible future royalty and tax dollars, but by continuing to draw interest to the state and boosting economic development.

“I’ve been around a long time and I can’t think of any play that has had this much excitement,” beamed Commissioner Welsh.