XTO appears ever-expanding with acquisitions, increased production

Mikaila Adams, Associate Editor, OGFJ

While Fort Worth-based XTO Energy Inc. has been steadily expanding its holdings across the country for the past few years, the company has been particularly aggressive in the last six months.

The large-cap growth company has made multiple million-dollar acquisitions, particularly in areas where new technology has enabled the production of gas and oil from shale formations.

Hunt Petroleum

Most recently, XTO entered a merger agreement with privately-held Hunt Petroleum Corp. and other associated entities for $4.186 billion. Consideration includes $2.6 billion in cash and common stock valued at roughly $1.6 billion.

XTO Energy’s internal engineers estimate proved reserves on the properties to be 1.052 trillion cubic feet of natural gas equivalent (Tcfe), of which 62% are proved developed. Daily production of 197 million cubic feet (MMcf) of natural gas, 8,500 barrels of oil (bbls) and 2,300 barrels of natural gas liquids (bbls) will be added to XTO’s production base upon closing.

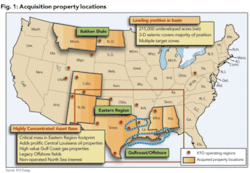

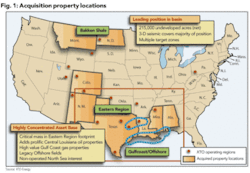

The acquired properties are primarily concentrated in XTO’s Eastern Region including East Texas, central and northern Louisiana, where 70% of the reserves are located. Another 28% of the reserves, both onshore and offshore, are along the Gulf Coast.

Non-operating interests, reflecting more than 300,000 net acres of potential in the North Sea and the balance of proved reserves, will also be conveyed in the deal. The company will also gain an additional 15,000 net acres of leasehold in the Bakken Shale region of North Dakota.

Bob R. Simpson, XTO chairman and CEO stated, “They are a natural complement to our operations. With the current outlook for commodity prices and our development plan, we have facilitated a history-making deal for XTO which should generate over $1.2 billion in cash flow next year.”

“Over the past decade, our team has aggressively developed the tight-gas sands and carbonates of our Eastern Region. The Hunt assets overlap and align with our substantial operated positions. Going into this deal, we have identified hundreds of locations to expand recovery and access the multi-pay targets,” noted Keith A. Hutton, XTO president.

Hutton expects XTO to grow the Eastern Region production by 15% per year with 35% of its cash flow and hold the Gulf Coast and offshore production volumes flat with about 30% of its respective cash flow.

In conjunction with the transaction, XTO initially hedged 100 MMcf/d of natural gas production, for 28 months, at a NYMEX price of $11.08 per Mcf.

Goldman Sachs acted as financial advisor to Hunt Petroleum. Hunt’s legal counsel was Jones Day, and Tristone Capital LLC provided advisory and technical assistance.

Following the news, Moody’s Investors Service affirmed XTO’s ‘Baa2’ senior unsecured note ratings and ‘P-2’ commercial paper ratings with a stable outlook.

The stable outlook assumes XTO will fund the cash portion of the acquisition price with sufficient long-term funding or internal funds to retain ample unused availability under its commercial paper back-up lines upon closing the acquisition.

Shares of XTO rose $2.96, or 4.5% to $70.02 in midday trading the day after the deal was disclosed.

Most onlookers expect a target closing date on or before September 3, 2008. However, a potential kink lies within the Hunt family.

A June 11th New York Times article pointed to the underlying family feud plaguing the dynasty founded by the legendary oilman H. L. Hunt.

It seems that Albert Hill III, a great-grandson of H. L. Hunt, is considering ways to stop the sale. Late last year Hill filed a lawsuit claiming various family members mismanaged up to $4 billion in assets, including Hunt Petroleum. In his opinion, the proposed sale price is too low.

Hill contends that his relatives plotted to remove him and his family from two family trust funds because he opposed their plan to sell Hunt Petroleum and divide the proceeds.

Those involved in the deal say they are not overly concerned about the challenge.

“I don’t believe there will be any delay,” said George Bramblett, a lawyer for Thomas Hunt, who oversees the two trusts.

Headington Oil

In another, less controversy-ridden deal, XTO has agreed to purchase producing properties and undeveloped acreage from privately-held Headington Oil Co. for $1.85 billion. Consideration includes $1.06 billion of cash and common stock valued at roughly $790 million.

The purchase includes 352,000 net acres of Bakken Shale leasehold in Montana and North Dakota. XTO’s internal engineers estimate proved reserves on the properties to be 68 MMboe, of which 60% are proved developed. Upon closing, the acquisition will add about 10,000 boe/d to the company’s production base.

In a new assessment of the Bakken Shale play of North Dakota and Montana, the US Geological Survey estimates 3 billion to 4.3 billion barrels of undiscovered oil are technically recoverable with current technology and industry practices. This estimate makes the Bakken Shale the largest continuous oil accumulation in the lower 48 states.

Early year ‘bolt on’ acquisitions

Before signing the aforementioned ‘monster deals’, XTO was busy buying ‘bolt-on’ assets to build its existing portfolio.

In February, the company purchased acreage positions in the Woodford, Fayetteville, and Barnett Shales.

From those transactions, the company’s internal engineers estimated proved reserves to be 212 bcfe, of which approximately 60% are proved developed. These early-year acquisitions have added about 35 MMcfe/d to the company’s production base and 76,000 net acres of expanded drilling inventory in the emerging shale plays

In April, the company made two transactions totaling $1.12 billion. First, the company bought 55,631 net acres in the Fayettville Shale leasehold from Southwestern Energy Co. for about $520 million. The purchase expanded XTO’s position in the play to more than 300,000 net acres.

Later that same month, XTO acquired assets from Linn Energy LLC for $600 million. The purchase included 152,000 net acres of Marcellus Shale leasehold in western Pennsylvania and West Virginia and added 25 MMcfe/d to the company’s production base.

Going forward

Given the recent property additions, the company has increased its 2008 production growth target to 28%-30%. Based on volume projections for next year, the company has also established an annual production growth target of 20% for 2009.

In order to achieve this production growth, a preliminary 2009 development budget of $4.0-$4.5 billion utilizing 110 to 120 operated drilling rigs is anticipated.

The company has targeted a production volume increase in 2009 of about 450 MMcfe above the average rate in 2008 and expects the growth can be delivered with about 50% to 55% of the estimated cash flow at the current commodity price outlook.

XTO Energy is expected to maintain its impressive production-growth momentum in 2008. Simpson stated, “Given XTO’s significant acquisitions and expanding shale basin presence, we have now assimilated the best property base for growth in the company’s history.”