Going to market

E&P companies that issued equity in the frothy markets

of early 2008 are sitting pretty. However, the current economic climate requires new solutions to capital needs.

Ward Polzin and Mary McCulloch Tudor, Pickering, Holt & Co. Houston

Unprecedented volatility has continued to roil the markets this year in ways that no one could have predicted. Leaving the future up to the macro economists, quant models, and fate, we will instead reflect on what has happened thus far and attempt to understand why.

One thing is clear: energy companies that obtained capital in the first half of 2008, whether they needed it at the time or not, are better off. Those that did not take advantage of the early 2008 financing window and could use a capital infusion now, are looking to asset-based alternatives to help fund their ongoing needs.

It was only a few months ago that energy’s capital markets were outstanding. Commodity prices were rising and stock performance for the sector was strong relative to others. Life was good in the oil patch.

What may come as a surprise to some is that amid all of these positives, significant cash was still needed in the energy industry. E&P companies with strong cash flow also required external capital to fund drilling, while midstream companies required capital to support infrastructure expansions. In fact, many E&P independents have been outspending cash flow as their gains (and then some) are put “back into the ground.”

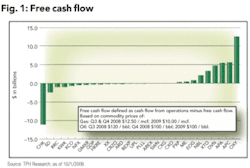

Out of a universe of 28 small-, mid-, and large-cap E&P companies followed by Tudor, Pickering, Holt & Co., only nine have positive cash flow for 2008 and 2009. Fig. 1 highlights some of the companies that stand out at far ends of the spectrum, such as Chesapeake Energy Corp., due to their shale drilling capital program, and Occidental Petroleum Corp. due to their strong oil-based cash flow. Those in negative territory will be thinking about selling assets or cutting drilling programs if raising debt or equity is deemed too expensive.

On the other hand, well-funded companies will be contemplating acquisitions, as Occidental Petroleum Corp. recently proved by purchasing $1.25 billion of assets from Plains Exploration & Production. Similarly, midstream companies need capital to expand infrastructure build-outs and maintenance projects in support of E&P resource play production, which is further exacerbated by rising construction costs. It has been difficult for midstream MLPs to raise capital in 2008 given broader market conditions. If this situation continues for many months, it could delay infrastructure build-outs, and therefore delay production from E&P resource plays.

Reduced risk in resource plays

Unconventional resources have been driving much of the new and more expensive developments. Drilling in shales, or infill drilling in tight sands, is hugely popular, not only within the energy industry, but also with investors. Most investors are better able to analyze these relatively low-risk opportunities much more easily than assessing conventional prospects.

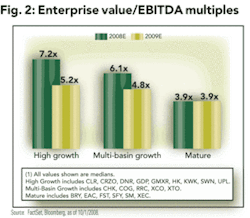

In contrast to a few years ago when individual fields were ostensibly driving a company’s profitability, now the results from a smaller program can be applied to hundreds or thousands of potential wells providing a straightforward company valuation. Fig. 2 highlights that E&P companies achieving high production growth by focusing on resource plays trade at higher Enterprise Value/EBITDA multiples than companies with less growth and resource play exposure.

In many instances, higher commodity prices drove accelerated capital programs in resource plays in 2008. But following the third quarter’s sharp commodity and energy stock price declines and the resulting lack of capital markets access, E&P companies may take a more conservative outlook for 2009 and reduce drilling plans. Capital will be reallocated to less-risky opportunities; therefore, capital spending reductions will probably come first in conventional plays as the unconventional plays (shales, tight gas sands, coal bed methane) have relatively predictable cost and production outcomes, and therefore lower risk. This scenario became true in late September when Chesapeake Energy announced a $1.9 billion reduction in drilling activity through 2010, with the primary capital cuts being made in more conventional plays, while continuing to ramp up spending in their large shale plays.

Volatile markets require new strategies

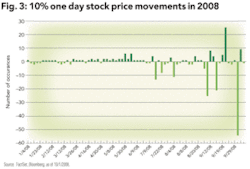

Energy stock performance in 2008 has experienced the same volatility as oil and gas prices, rising through June and dropping off sharply in the third quarter. Year-to-date, about 24 E&P stocks have jumped more than 15% in a single day, generally coinciding with resource play expansion announcements.

Compare this number to the past few years (eight in 2007) and clearly this is a new phenomenon. When using a 10% threshold, volatility in 2008 is incredibly apparent, with 59 E&P stocks gaining over 10% and 95 dropping 10% in a given day during the third quarter. (See Fig. 3). This was even prior to the broad market swings of October 2008.

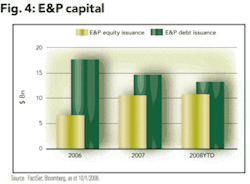

In order to maintain production growth and continue developing unconventional resources, the industry requires external capital. The year 2007 provided strong equity and debt issuance for the energy sector, with E&P and midstream outpacing the equipment and services and refining and marketing sectors.

As of mid-September, E&P equity for 2008 had met the previous year’s benchmark while debt issuance had almost caught up to the total for 2007. (See Fig. 4) However, this strong market eroded quickly after August 1 with the sharp decline in commodity prices and the subsequent negative outlook of investors towards commodity price driven stocks.

The first half of 2008 was the time for energy companies to raise public equity. Since the mid-year change in energy’s equity market environment, only one company has issued significant secondary equity. The cost of debt has also risen throughout 2008 for energy companies, due mainly to general US credit concerns, and to a lesser extent, commodity price volatility. By this measure it is obvious that other alternatives will need to be considered for raising capital.

A&D markets offer capital and control

Difficult and costly equity and debt markets will force E&P companies to turn to the A&D markets as an alternative form of raising capital. By unloading a portion of assets, E&P companies can avoid issuing equity and debt at higher discounts and spreads, but while accomplishing the same capital-raising objectives.

In some cases we have seen selling of non-core assets as in SandRidge Energy’s planned sale of East Texas properties and Chesapeake Energy selling its Woodford shale position. Alternatively, selling down a portion of large core assets allows companies to continue to operate and own a controlling position while sharing future costs and receiving current capital. Chesapeake is utilizing this strategy in its Haynesville, Fayetteville, and Marcellus shale programs, while EXCO Resources desires similar deals in East Texas and Appalachia. It would not be surprising to see other companies utilize this strategy.

Future asset divestitures will continue to focus on long-lived resource plays (East Texas/North Louisiana, Appalachia, etc.), where sellers will continue to receive strong interest and valuations even in a choppy commodity price and capital markets environment.

Majors drive buyside opportunities

Although the drive-for-capital should spawn a number of buyside opportunities, lack of funding for mid-sized public E&P companies, an important buyer set, could dampen overall asset prices. The majors, though, represent a bright spot in the buyers’ market. BP’s recent Woodford and Fayetteville acquisitions, as well as Shell’s joint venture in the Haynesville and ExxonMobil’s expansion in the Piceance, mark the majors’ renewed interest in the North American market with its steadier returns and relatively low political risk.

Following years of analysis, the well-funded majors are making these plays through lease accumulations, asset acquisitions, and corporate transactions. Private buyers (i.e, the private equity firms), cash-rich with the fundraising boom of the mid-2000s, also remain competitive buyers.

In addition to follow-on equity, debt, and selling assets, IPOs are an option that has been almost completely avoided this year by energy companies. No significant E&P or midstream companies have gone public yet in 2008, and only one or two may occur by year end 2008. Instead, rising oil and gas prices in the first half of the year led to a surge in private companies selling to public companies, further increasing the need for capital in the energy industry.

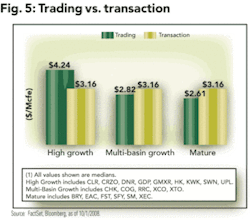

Though public companies have historically received higher trading multiples than a private sale yields, the historical “arbitrage” of an IPO over a sale of the company has not been high enough to tempt many companies to take the public route. By the third quarter of 2008, trading multiples for many public E&P companies were less than the average transaction multiples for the sale of assets, which was not the case in the first half of 2008. (See Fig. 5)

While this environment reduces the motivation for a private company to go public, it does make its assets a more valuable source of capital than today’s capital markets.

About the authors

Ward Polzin [[email protected]] serves as a managing director in investment banking at Tudor, Pickering, Holt & Co. He spearheads the firm’s E&P asset acquisition and divestiture practice. Prior to this, Polzin served as the US country manager at Enerplus Resources in Denver. Polzin has a BS in petroleum engineering from the Colorado School of Mines and an MBA from Rice University. He is a CFA Charterholder.

Mary McCulloch [[email protected]] serves as the technologist in the asset acquisition and divestiture group in the investment banking division. She was previously a product specialist in the marketing and communications department of Jennison Associates LLC in New York. Prior to that, McCulloch worked in market data services at Tudor Investment Corporation in Greenwich, Conn. She has a BS in systems engineering from the School of Engineering and Applied Science at the University of Pennsylvania in Philadelphia.